On July 26, the U.S. Internal Revenue Service (IRS) revealed that the tax company has actually begun corresponding to American cryptocurrency owners encouraging them to pay their taxes. According to the company, 3 kinds of letters will be sent out to more than 10,000 taxpayers by the end of August. The news follows the current IRS taskforce slide that reveals worrying suggestions on how tax representatives need to examine digital currency users.

Also Read: Another Self-Proclaimed Satoshi Appears in the High Profile Bitcoin Lawsuit

Through Compliance Efforts the Internal Revenue Service Has Collected 10,000 Names

The IRS media space has actually released a news release discussing that the federal government tax company prepares to correspond to Americans who own digital currencies. The company’s statement, released on Friday, states that the letters will be sent out to taxpayers who have actually taken part in virtual currency deals or otherwise did not report previous deals appropriately. The IRS calls the recommendation letters “academic” and began sending out the notifications recently. Through IRS “compliance efforts,” the tax company has actually gotten the names of more than 10,000 Americans who will receive this correspondence.

“Taxpayers need to take these letters really seriously by examining their tax filings and when proper, change previous returns and repay taxes, interest, and charges,” IRS Commissioner Chuck Rettig discussed. “The IRS is broadening our efforts including virtual currency, consisting of increased usage of information analytics. We are concentrated on imposing the law and assisting taxpayers totally comprehend and satisfy their commitments.”

The Virtual Currency Compliance Campaign addresses people and services who wear’t adhere to the U.S. tax code by utilizing “several treatment streams.” The IRS highlights that cryptocurrency compliance follows the “basic tax concepts relevant to all deals in residential or commercial property.” The preliminary screening premises for the project starts with the Withholding & International Individual Compliance system led by Director John Cardone.

Enforcement Campaigns and the Promised Issuance of Guidelines Concerning the Tax Treatment of Digital Assets

The news follows the current enforcement project the tax company began in order to fight noncompliance. Through “outreach” and taxpayer “evaluations” the IRS began the project by releasing academic resources, “audits, and criminal examinations.” The IRS just recently revealed that the tax company would be releasing standards on the tax treatment of digital currencies. “[We] highly desire the IRS to release upgraded assistance, supplying extra clearness for taxpayers looking for to much better comprehend and adhere to their tax commitments when utilizing virtual currencies,” a group of bipartisan congressional leaders composed to the IRS commissioner in September 2018.

“I share your belief that taxpayers are worthy of clearness on fundamental concerns associated with the tax of virtual currency deals and have actually made it a concern of the IRS to release assistance,” Rettig composed reacting to the demand.

News.Bitscoins.net talked with Node40 CTO, Sean Ryan, last June and he stated the issuance of the brand-new assistance is long past due. “New assistance will be upcoming and will deal with particularly the 3 most discussed unpredictabilities: appropriate method for computing expense basis, an appropriate method for project expense basis (FIFO, Specific Identification, etc.), and treatment of forks,” Ryan informed our newsdesk. “I do think it will be this year,” he included.

Cracking Down on Noncompliance and the Tax Agency’s Ongoing Focus

Furthermore, over the last number of years, numerous three-letter firms like the IRS, FBI, and others have actually been prosecuting a multitude of Americans for unlawful cash transmission, especially traders who make use of the Localbitcoins.com exchange. On July 9, a slideshow produced by IRS-CI cyber criminal offenses program supervisor James Daniels was released online, and proposes oppressive strategies to examine crypto users. The slide recommends examining an individual’s social networks accounts and questioning relative. If required the representatives can ask for a Grand Jury Subpoena in order to acquire records from Apple, Microsoft, and Google. When the New York Times (NYT) questioned an IRS representative about the academic letter scenario, the representative decreased to expose where the tax company got the names of the 10,000 people targeted. NYT also asked Coinbase if the IRS letter receivers originate from when the IRS obliged the business to surrender information on 13,000 users. A Coinbase representative decreased to talk about the topic.

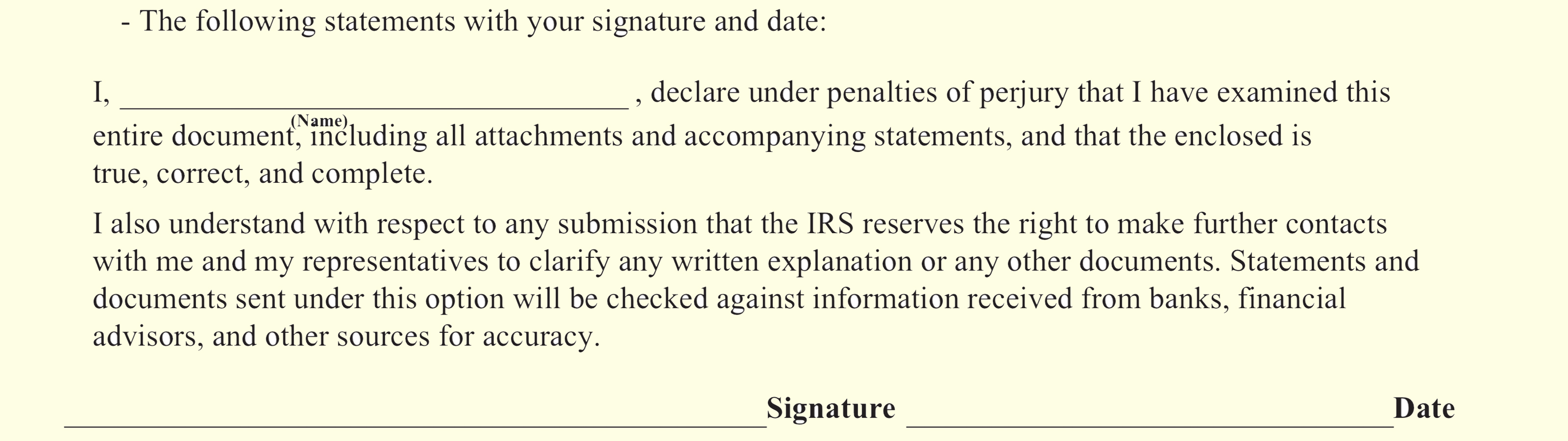

In regard to the letters that will be provided this August, individuals will receive 3 various variations: Letter 6173, 6174 or 6174-A. Of all the notifications, Letter 6173 needs a signature from the recipient under perjury that they are certified with the U.S. tax code. “All 3 variations make every effort to assist taxpayers comprehend their tax and filing commitments and how to fix previous mistakes,” the statement states.

“Taxpayers are pointed to proper info on IRS.gov, consisting of which kinds and schedules to utilize and where to send them,” the news release includes. According to traders on the Reddit online forum r/Bitcoinmarkets, a couple of people have actually currently gotten letters and evaluations. The IRS statement on Friday stressed several times that there will be continued tax enforcement and examinations. During the end of the news release the tax company worried:

Virtual currency is a continuous focus location for IRS Criminal Investigation

The press declaration also describes Notice 2014-21, the just assistance the company has actually ever provided in regard to digital possessions. Essentially the 2014 documents specifies that virtual currencies are thought about a “residential or commercial property for federal tax functions” and those who want to comply need to follow basic practices. Toward the end of the IRS statement, the company kept in mind that it will release “extra legal assistance in this location in the future.” Even though the IRS hasn’t provided assistance in 5 years, the company still alerts that enforcement versus noncompliance will continue to the complete degree of the law.

“Taxpayers who do not appropriately report the earnings tax repercussions of virtual currency deals are, when proper, responsible for tax, charges, and interest,” the IRS news release defines. “In some cases, taxpayers might be based on prosecution.”

What do you think of the IRS sending out “academic” letters to more than 10,000 American taxpayers this August? Do you believe it’s ok that the IRS implements the law while the company still hasn’t provided clarified assistance given that 2014? Let us understand what you think of this topic in the comments area below.

Image credits: Shutterstock, Getty Images, Wiki Commons, Pixabay, and IRS Notice 2014-21.

How could our Bitcoin Block Explorer tool aid you? Use the useful Bitcoin address search bar to locate deals on both the BCH and BTC blockchain and, for much more market insights, visit our thorough Bitcoin Charts.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.