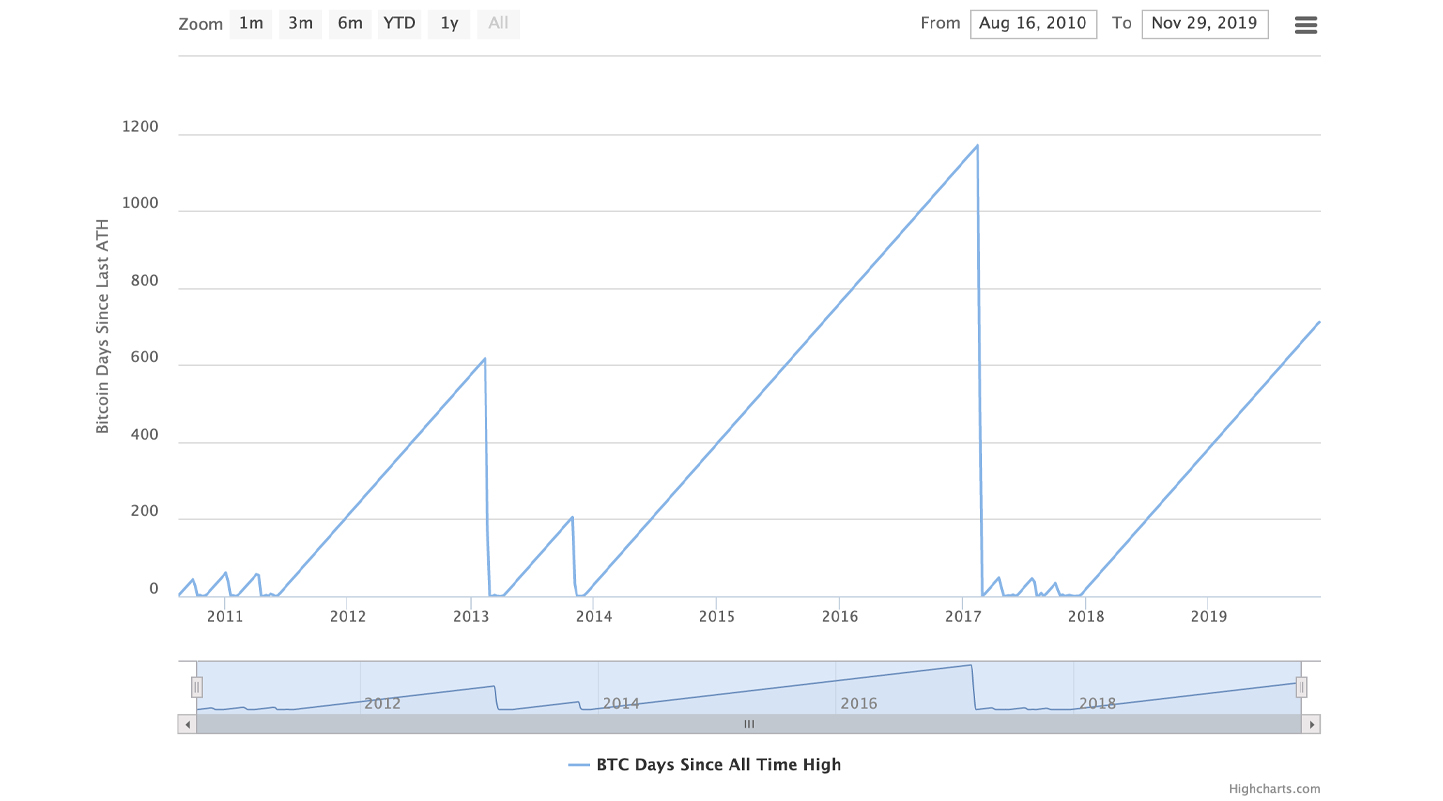

Since bitcoin struck its all-time high (ATH) in December 2017, crypto lovers have actually questioned if BTC will touch or exceed it once again. After the ATH in November 2013 at $1,156 per BTC, it took 1,170 days to touch the next ATH at $19,891 per coin. To lots of observers, the downtime has actually been long after the rough crypto winter season of 2018, however up until now it’s just been 711 days because the last cost high.

Also Read: Bakkt’s Bitcoin Futures Shatters Records Amid Spot Market Turmoil

BTC Traders Patiently Wait for the Next Bull Run

Digital currency and BTC rates rebounded after the fall in 2018 however not everybody is persuaded the bearish belief is over. Optimism exists due to the fact that on December 7 at around 8: 05 EST, BTC rates dropped to a low of $3,306 per coin however ever since BTC has actually gained back a minimum of half of the portion losses. Positivity leapt back in the summertime when BTC increased 320% from the December 2018 low to a high of $13,311 on June 27. But after that, expectations dropped when BTC rates moved to the $7K area throughout the recently of October. The dip made individuals question if the crypto winter season was still alive and well. However, on October 24 BTC rates popped once again from a low of $7,446 to a high of $10,021 on October 26. Since then BTC rates have actually been dragging low once again and 27 days later on the worth dropped under $7K to a low of $6,400.

BTC has actually gotten 5-7% in the last 7 days and a lot of digital possession markets appear to be in a healing stage after the drops in worth. One method to find out just how much longer it will be until the next ATH is by determining for how long it’s been because the last BTC cost high. Historical information reveals that in between November 30, 2013 when BTC went beyond $1,100 per coin it took 1,170 days to go beyond the 2013 ATH on February 13, 2017. Various elements drove the cost up in 2013 like Mt Gox bots, the Cyprus banking crisis, and Chinese need. Similarly, feverish retail need, enjoyment for controlled BTC futures, financial difficulties in Greece and Venezuela, South Korean need, and the preliminary coin offering (ICO) boom assisted strengthen the 2017 ATH. When the Chicago Board Options Exchange (CBOE) started its BTC futures markets and CME Group (Chicago Mercantile Exchange) followed with its BTC derivatives items, area markets were on fire. From February 13 to December 17, 2017, BTC leapt 1,629% to its existing ATH of $19,891 per coin.

711 Days Since the December 17 All-Time High

Another set of elements assisted the cost slide after touching near $20K per BTC. Crypto lovers saw the regulative crackdown in South Korea, increased regulative standards in the U.S., EU and other areas worldwide, and the ICO market got knocked with policies and criminal enforcement. Still, there are 459 days left if we take a look at the days in between the 2013 ATH to when it touched once again in 2017. So far there’s just been 711 days in between the ATH of $19,891 per BTC. Since the network launch on January 3, 2009 up until November 30, there’s been around 3,983 days in between.

Data also reveals that BTC has actually been on the up approximately 3,573 days of its presence which ends up being 89% of its life process. During the downtimes, nevertheless, crypto lovers grow really restless and this is rather common on social networks and online forums at the end of 2019. Investing in cryptos is truly bad for health, years of bearishness followed by a couple of days of bull run hysteria — And FUD the whole time,” someone remarked on Twitter today. “707 days of bearish market — I believe we require a break please,” another crypto supporter said on Sunday. On November 25 after BTC rates were wandering down another trader on Twitter mentioned:

In regards to [percentages], we’re practically precisely where we were this lots of days after the bottom in 2014. The surge out of the bearish market was too fast and too unreasonable. This extended correction is regular. Markets never ever repeat, however they rhyme. This is simply the 3rd verse.

The wait has actually been long and lots of people think that being client will gain the most benefits as the total worth of cryptocurrencies, in basic, is headed northbound. As news.Bitscoins.net’s Graham Smith reported on November 24, information programs that in spite of the marketplace turbulence, BTC’s support lines stay undamaged. Just as nobody was particular when the bearish market would end after the 2013 ATH, this time around lovers and traders are still thinking extremely. Analysts can log trendlines and trace historic patterns and we can determine days in between ATHs too, however we are mainly based on guesstimates and faith.

What do you consider the days in between the 2013 ATH and the existing days in between the $19K BTC ATH and now? Let us understand what you consider this topic in the comments area below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.