Originally released on Unchained.com.

Unchained is the main United States Collaborative Custody partner of Bitcoin Magazine and an important sponsor of associated material released through Bitcoin Magazine. For more details on services used, custody items, and the relationship in between Unchained and Bitcoin Magazine, please visit our site.

You don’t frequently see the term “Roth IRA” trending online, however in 2021, tech financier Peter Thiel made headings for his $5 billion tax-free Roth individual retirement account piggy bank. How did he do it? The response is alternative financial investments. He utilized a self-directed individual retirement account to buy early-stage tech business several times over. Is it a loophole? Possibly. But it occurred, it got attention, and the individual retirement account structure in concern might come under more examination.

“Thiel has taken a retirement account worth less than $2,000 in 1999 and spun it into a $5 billion windfall.” – ProPublica (2021)

Let’s take a look at 6 common threats related to self-directed and checkbook IRAs, how they might use in the context of bitcoin, and why there might be increased guideline being available in the future. But initially, we require to specify our terms and separate in between individual retirement account structures.

The various individual retirement account structures

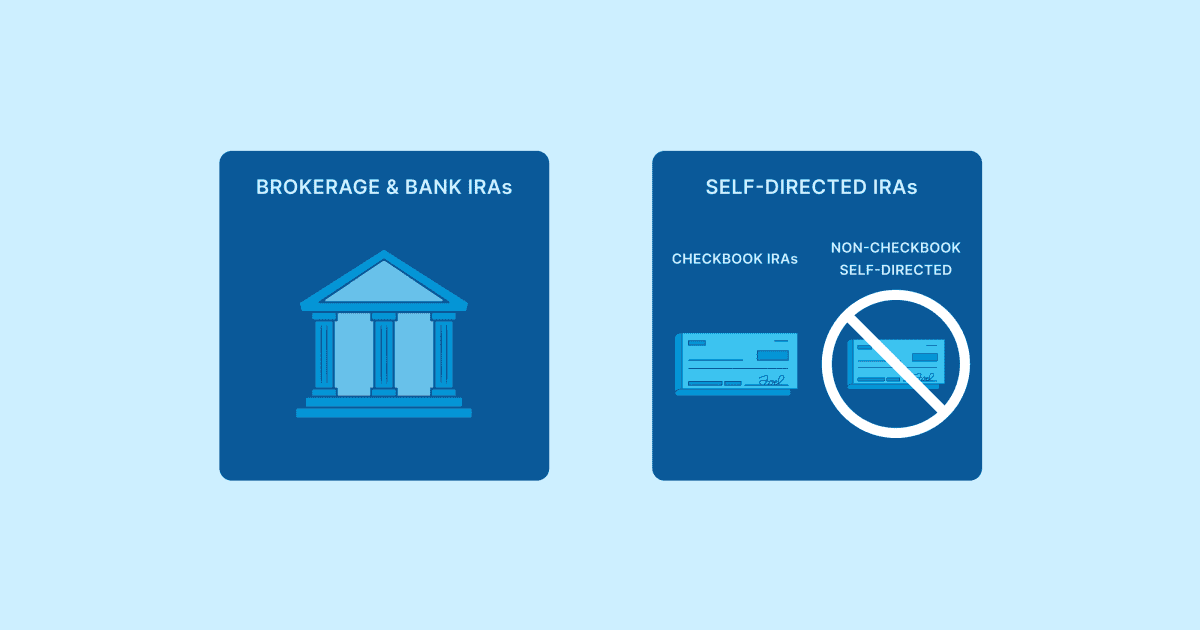

The various individual retirement account structures can act in an “every square is a rectangle, but not all rectangles are squares” kind of method. IRAs can be Traditional (pre-tax) or Roth (post-tax) regardless of custodial relationship/structure. All IRAs are custodial. A custodian, in the context of IRAs, is a certified banks supervising and administering the individual retirement account.

Brokerage and Bank IRAs

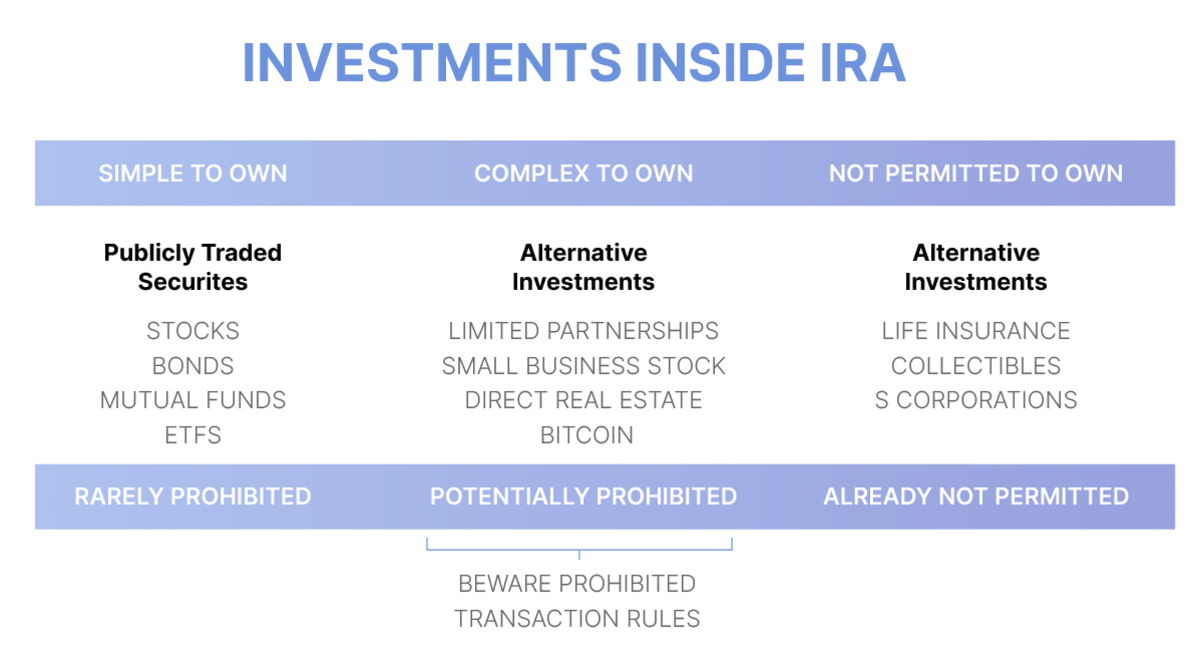

Brokerage and bank IRAs are the most familiar and common types. Brokerage and Bank IRAs enable financiers to buy stocks, bonds, ETFs, shared funds, and other securities, along with banking items (CDs, bank account, and so on.). Examples include your common Fidelity, TD Ameritrade, or Charles Schwab INDIVIDUAL RETIREMENT ACCOUNT. The Unchained individual retirement account is closest to this structure in this hierarchy.

Self-directed individual retirement account (SDIRA)

A self-directed individual retirement account is a custodial individual retirement account where the custodian enables broadened financial investment alternatives exterior of or in addition to common brokerage and bank possessions (stocks, bonds, CDs, and so on.). Owners of self-directed IRAs can buy non-traditional possessions like property, services, personal loans, tax liens, rare-earth elements, and digital possessions. Although the internal revenue service doesn’t have a conclusive list of enabled financial investments, it definitely has a couple of that are not enabled (antiques, life insurance coverage, particular derivatives, S-Corps, and so on.).

Checkbook INDIVIDUAL RETIREMENT ACCOUNT

Checkbook IRAs are a subset of self-directed IRAs. The term “checkbook IRA” is not basic, however it typically describes a self-directed individual retirement account that provides an account owner control of financial investments through a bank account, typically through an LLC avenue. The account holder can then make financial investments with individual retirement account funds merely by composing a check (“checkbook control”). With the included liberty of extra financial investment options comes included duty of administration, along with legal obscurity regarding whether the structure still certifies as a tax-exempt individual retirement account.

Non-checkbook self-directed individual retirement account

A subset of self-directed individual retirement account where the custodian authorizes deals before financial investments are made. Investors need to wait on the custodian to evaluate each possible financial investment and officially accept title to the hidden property. These were typically utilized genuine estate and personal equity financial investments and started gaining back appeal when extra legal unpredictabilities developed relating to checkbook IRAs in late 2021 (talked about in area 4 below).

Risks to look for when utilizing a self-directed or checkbook individual retirement account

1. Liquidity

Unfortunately, numerous self-directed possessions do not have liquidity, making them tough to offer rapidly. Examples consist of property, independently held services, rare-earth elements, and so on. If money is ever required for a circulation or internal cost, offering a possession quick might be an issue (which substances into other issues, i.e., inadvertently combining funds). Self-directed individual retirement account owners need to carry out extensive due diligence on property liquidity before devoting to a financial investment technique.

2. Formation and legal structure

When forming a checkbook individual retirement account, a self-directed individual retirement account LLC is developed initially. Then, the LLC develops an inspecting account much like any other company entity. Next, the LLC is moneyed by sending out the individual retirement account funds to the bank account.

With the correct legal structure, the individual retirement account owner can end up being the sole handling member of the LLC and have signing authority over the bank account. However, incorrect legal structure, registration, or entitling might all trigger major issues for the tax-advantaged status of the individual retirement account. Many checkbook individual retirement account facilitators are proficient, however mistakes might constantly cause problems and possible disqualification/loss of the whole individual retirement account.

3. Misreporting deals

Within a checkbook individual retirement account, owners can money financial investments rapidly and easily, however this includes the duty of effectively following guidelines and self-reporting deals.

At completion of each year, the owner of the LLC will require to supply total deal information to its individual retirement account custodian and send reasonable market assessment (FMV) details. Without oversight into each deal you make, a custodian is most likely to misreport earnings on your financial investments. Always guarantee the custodian has precise details to prevent inadvertently breaking the law.

4. “Deemed distribution” treatment

Clients seeking to purchase rare-earth elements, property, or digital possessions need to understand the danger of “deemed distributions” treatment. A current United States tax lawsuit, McNulty v. Commissioner, highlights the substantial threats of preserving a checkbook individual retirement account. In the McNulty case, a taxpayer utilized her checkbook individual retirement account LLC to buy gold from a rare-earth elements dealership. She kept the LLC’s gold in the house in her individual safe. The court ruled that her “unfettered control” over the LLC’s gold without 3rd party guidance produced a considered taxable circulation from her individual retirement account.

It is difficult to understand how far a tax court will go using “deemed distribution” treatment to any provided deal or financial investment within a checkbook individual retirement account. For checkbook individual retirement account owners that hold the secrets to bitcoin in a without supervision structure, there is a threat that the McNulty judgment might trigger your whole individual retirement account to be based on tax. Further, given that alternative financial investments were relatively just recently (2015) contributed to internal revenue service Publication 590, it’s totally possible that the internal revenue service and Congress might use more examination to checkbook IRAs moving forward. Read more about the McNulty case and its ramifications.

5. Prohibited deals

All self-directed individual retirement account owners are constantly restricted from combining individual and individual retirement account possessions or utilizing any individual funds to enhance individual retirement account possessions. “Self-dealing” is one of the most common pitfalls for self-directed account holders. For example, if you utilize your individual retirement account to buy property, you are not enabled to utilize the residential or commercial property yourself—not even a little bit. You cannot live there, remain there, or lease workplace to yourself there. You are not even enabled to make your own repair work or supply “sweat equity.”

It’s not just the individual retirement account owner that can’t take part in any “self-dealing,” however partners, kids, and grandchildren also. They are thought about disqualified people, and charges are stiff. These are strict guidelines and can lead to substantial tax headaches if breached. I don’t plan to squash any dreams, however investing your 401k/IRA into your lakefront Airbnb villa and having you or your household remain there even when is a bad concept. No acquiring a rental home and leasing it out to relative either. For even more enjoyable, see the internal revenue service list of restricted deals here.

Here are a couple of examples of how restricted deals guidelines might be used to digital property financiers:

- Commingling individual wallets with individual retirement account wallets

- Leverage without a non-recourse loan

- Investing in particular collectible NFTs1

6. Financing

Financing within a self-directed individual retirement account is also more made complex for a number of factors:

- Typically, a non-recourse loan and bigger deposit are required for any residential or commercial property purchases.

- Unexpected expenses and charges can build up rapidly and consume into any earnings.

- IRA-owned active services might encounter the problem of UBIT (Unrelated Business Income Tax). This also impacts the overlap of bitcoin mining within an individual retirement account.

- Any earnings and costs need to stay within the individual retirement account structure and never ever combined with individual funds. For example, when the hot water heater heads out (property) or wages require to be paid (services), the individual retirement account itself need to spend for those services out of the individual retirement account’s own money. Individual retirement account owners might be lured to co-mingle funds momentarily as they try to find short-term liquidity to fix their money requirements.

What does this mean for bitcoin IRAs?

The self-directed individual retirement account area has numerous possible threats if not effectively handled. The INTERNAL REVENUE SERVICE and Congress have actually been paying unique attention to how these structures are utilized and mistreated. Combine this with their interest in managing digital possessions, and the landscape appears ripe for more examination. With that, bitcoin IRAs require a unique method that alleviates these pitfalls.

Unchained INDIVIDUAL RETIREMENT ACCOUNT is not a checkbook individual retirement account

If you’re seeking to hold real bitcoin in your IRA account, you need to think about the Unchained INDIVIDUAL RETIREMENT ACCOUNT. It’s not a “checkbook IRA” where deals need to be self-reported, and Unchained utilizes its type in the collective custody setup to track inflows and outflows of individual retirement account vaults. That exposure system permits the custodian to actively keep an eye on the individual retirement account and for that reason permits users to stay certified with existing individual retirement account guidelines and policies.

There is no self-reporting needed, and the non-checkbook structure assists reduce the danger of possible pitfalls (McNulty, misreporting deals, and so on.). If bitcoin values like numerous financiers hope and anticipate, holding coins in an individual retirement account structure effectively is of the utmost value.

This short article is attended to instructional functions just, and cannot be trusted as tax suggestions. Unchained makes no representations relating to the tax effects of any structure explained herein, and all such concerns need to be directed to a lawyer or certified public accountant of your option. Jessy Gilger was an Unchained staff member at the time this post was composed, however he now works for Unchained’s affiliate business, Sound Advisory.

1While not technically part of the Prohibited Transaction Rules (area 4975 of the Internal Revenue Code), antiques are independently restricted from being kept in an individual retirement account under area 408(m).

Originally released on Unchained.com.

Unchained is the main United States Collaborative Custody partner of Bitcoin Magazine and an important sponsor of associated material released through Bitcoin Magazine. For more details on services used, custody items, and the relationship in between Unchained and Bitcoin Magazine, please visit our site.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.