The first quarter of 2017 noticed dramatic worth positive factors for the highest cryptocurrencies, as the whole market added practically $7bn in worth.

The so-called ‘blue chip’ cryptocurrencies – these with a market cap larger than $30m – noticed aggressive progress within the first quarter, as bitcoin’s waning dominance set the stage for brand new gamers to say themselves.

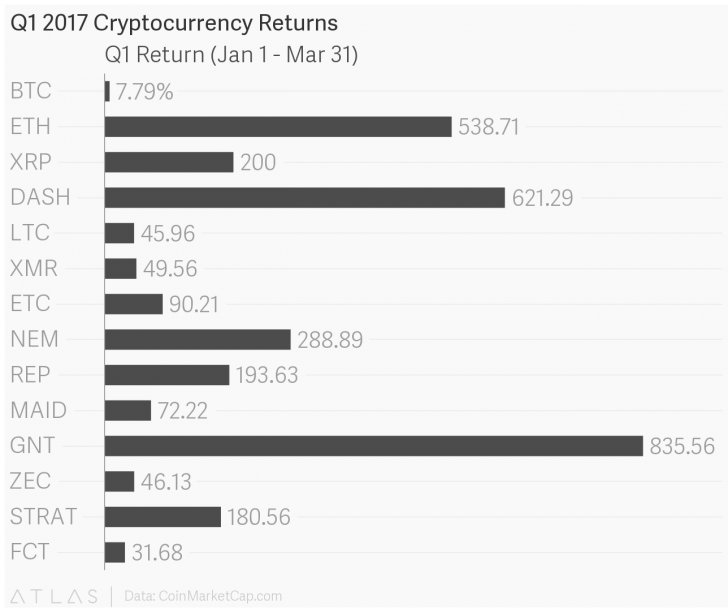

The different 13 cryptocurrencies posted a median worth improve (in USD phrases) of 135.38% over the course of the quarter.

Top performers

The two prime performers from Q1 2017 had been Golem (GNT) and Dash (DASH) which gained 835.5% and 621.three%, respectively.

The majority of Golem’s positive factors got here through the latter half of Q1. Cryptocurrency trade introduced markets for the token on 17th February, and following the announcement, the value rose roughly 100% with 48 hours, from $.02 to $.04 on 19th February, with a quantity of $6.67m.

Prior to the Poloniex announcement, common every day quantity was between $20okay and $100okay per day.

A second spike in worth occurred on 21st March, following the discharge of stories that GNT could be built-in into Shapeshift.io, an altcoin trade platform. That explicit day, the value elevated roughly 22% from $zero.045 to $zero.055 on $5.28m in 24-hour quantity.

The remaining day of Q1, Golem developer Grzegorz Borowik revealed a weblog put up saying Golem for macOS. The information buoyed the market, which boosted GNT to an all-time-high of $zero.094 on quantity of $11.4m.

What’s additionally unclear is the explosion of progress for privacy-centric sprint. Reminiscent of late 2013-era bitcoin, sprint gained practically $600m in market capitalization throughout Q1. Trading at solely $11.26 on 1st January, the currency reached a excessive of $109.82 on 19th March with a every day quantity of round $78m.

The currency was even relisted for trading on Bitfinex on third March after a 19-month hiatus because of low buying and selling quantity. The sprint bubble began to deflate towards the tip of Q1, nonetheless, dropping from the all-time excessive on 19th March all the way down to $81.65 on 31st March.

Bitcoin struggles

Bitcoin’s efficiency within the first quarter was extra muted.

The CoinMarketCap’s Bitcoin Dominance Index – which measures bitcoin’s market share relative to different cryptocurrencies – shed practically 20%, ending the quarter at 68%. A weakening Bitcoin Dominance Index factors to investor desire for various cryptocurrencies.

Bitcoin (BTC) gained simply 7.eight% over the course of the quarter. This was a noticeable lower from its 35.four% achieve in This fall 2016.

General concern, uncertainty and doubt has permeated the bitcoin group and may arguably be blamed for the anemic efficiency of the cryptocurrency compared to options.

Furthermore, bitcoin’s volatility has tapered off because of its maturation, coupled with the evolving narrative that the cryptocurrency is a safe-haven asset.

Chart picture through Shutterstock

Disclaimer: This article shouldn’t be taken as, and isn’t supposed to offer, funding recommendation. Please conduct your individual thorough analysis earlier than investing in any cryptocurrency.

Update: This article has been up to date to account for market knowledge on the dates between 26th March and 31st March.

Source link

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.