This is a viewpoint editorial by L. Asher Corson, a partner at UTXO Management.

As a Bitcoin Maximalist, I enjoy Ordinals. Other Maximalists must also think about caring Ordinals, as they show Bitcoin’s supremacy in methods not formerly possible. Ordinals make it possible for performances that weaken the requirement for other blockchains to even exist. The utilize cases that were shown on other blockchains are now possible natively on Bitcoin. Despite Bitcoin’s enhancing position, some self-proclaimed Maximalists on X (previously Twitter) bizarrely commemorated reduced network charges and stated Ordinals to have actually stopped working. This relatively indicates that Bitcoin may in some way take advantage of a failure of the Ordinals procedure and lower miner profits. But Ordinals haven’t stopped working and the interest isn’t almost over. To the contrary, trading volume throughout digital artifacts, distinct satoshis and BRC-20 tokens has actually been historical. According to cryptoslam which tracks on-chain NFT volume, Ordinals have actually done over $500 countless trading volume given that they were gone for the start of 2023. Despite volume and rates being down presently, financiers in the community are composing huge checks to Ordinals business. Xverse, an Ordinals wallet, simply raised 5 million dollars on a 50 million dollar appraisal from a few of the most advanced financiers in the community. It’s even more most likely we are at the start of this phenomenon than completion.

What are Ordinals? It is a procedure established by Casey Rodarmor (@rodarmor) that allows any information to be consisted of in a Bitcoin deal. It utilizes Ordinal Theory to associate that information with a particular satoshi (the tiniest system of Bitcoin) which can be owned and traded. This development allows the development and trading of digital properties straight on the Bitcoin blockchain without a peg or a bridge.

Bitcoin Maximalists comprehend that there have actually never ever been major competitors to change bitcoin as digital cash, and it’s not likely any will ever emerge. Viable altcoin usage cases have actually never ever been based upon having much better financial homes than bitcoin since that truly isn’t possible. Absolute digital deficiency is not likely to be found once again since the situations surrounding Bitcoin’s development were so distinct, in part, since today’s federal government comprehends the dangers of letting a decentralized network grow too big and they won’t let it occur once again.

On the other hand, feasible altcoin usage cases belong to functions that Bitcoin couldn’t formerly assistance. Some of those usage cases that the marketplace has actually indisputably accepted consist of: decentralized trading, non-fungible tokens (NFTs), stablecoins, capital development, borrowing/lending and on-chain utilize. Uniswap, a decentralized exchange, has actually done nearly $500 billion in trading volume given that it was introduced in 2018. Additionally, Ethereum has actually done $43.6 billion in NFT trading volume, according to CryptoSlam!. Source: CryptoSlam! NFT information, rankings, rates, sales volume charts, market cap

Although numerous don’t like it, these usage cases will exist someplace since the marketplace has a cravings for them. My strong choice is that they exist mostly on Bitcoin and not on other chains. It would definitely be much better for Bitcoin and the effort to separate cash and state, if there were not a lot of completing chains taking in market share. Ordinals have the possible to not just make it possible for these usage cases to be constructed natively on Bitcoin, however also to exceed their altcoin variations in regards to application. These would be much better constructed on Bitcoin since the procedure itself is more decentralized and protected than altcoins. Bitcoin has the biggest market capitalization compared to all the other chains that can support the advancement of these usage cases. But also much better since these usage cases will be customized to the Bitscoins.netmunity and will for that reason embody Bitcoin perfects of decentralization, immutability and permissionlessness.

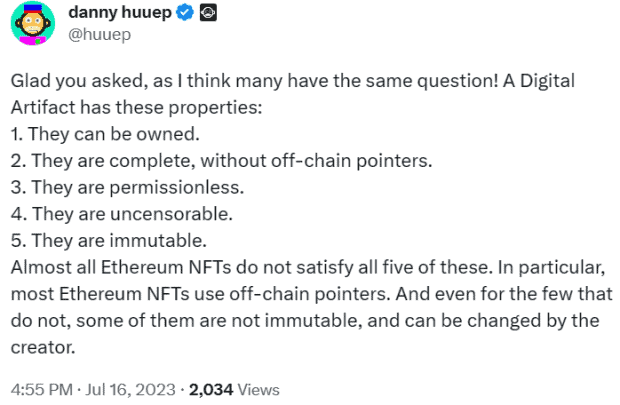

Although the procedure itself can’t stop rip-offs, Rodarmor actively constructed Ordinals with Bitcoin perfects at the leading edge of his style choices. For example, the Ordinals application of digital artifacts is objectively exceptional to the method nearly all NFTs were carried out on Ethereum and other chains. Danny Huuep explains the homes of a digital artifact, all of which Ordinals fulfill, very well:

Source: X

Imagine a piece of digital art worth $1 million, or think of politically delicate info like categorized files that information federal government atrocities. Should these important or delicate properties be dispersed utilizing innovation that can quickly vanish or that can be quickly altered? The response is certainly no. It’s also rather apparent that with time, the very best artists, designers , activists, and financiers will gravitate towards innovation with more powerful immutability that can securing their development, info, or financial investment for hundreds and even countless years. In the case of digital art particularly, they will move to digital artifacts on Bitcoin that keep the real art work, rather of NFTs that simply indicate where it’s saved on an off-chain server that might decrease at any time.

Bitcoin stands alone atop the world of digital cash, and the increase of Ordinals just seals that standing. This is not almost the concept of Bitcoin supremacy in market capitalization terms, however the large supremacy of Bitcoin’s concepts and the large capacity of its immutable blockchain. With Ordinals opening extraordinary chances within the Bitcoin community, I see a seismic shift on the horizon. This shift ought to make Maximalists smile.

This is a visitor post by L. Asher Corson. Opinions revealed are totally their own and do not always show those of BTC Inc or Bitcoin Magazine.

Disclosure: L. Asher Corson is a partner at UTXO Management, subsidiary of BTC Inc., the moms and dad business of Bitcoin Magazine

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.