The possibility of purchasing Bitcoin at considerably raised costs compared to a couple of months ago can cause apprehension. Nevertheless, with suitable methods, financiers can profit from Bitcoin purchases during market dips, attaining a beneficial danger-to-benefit ratio while passing through the bullish market trajectory.

Confirmation of Bull Market Conditions

Prior to collecting Bitcoin, it is important to validate the dominating booming market conditions. The MVRV Z-score acts as a important analytical tool to determine whether the marketplace is overheated or underestimated by examining the variance in between market price and understood worth.

View Live Chart 🔍

Investors must avoid making purchases when the Z-score reaches raised levels, such as above 6.00, as this shows an overextended market with a danger of a bearish turnaround. Should the Z-score fall below this limit, dips might represent suitable minutes for acquisition, especially when supported by other signs. During bearish market, the focus must move to determining macro bottoming procedures instead of aggressive build-up.

Analysis of Short-Term Holders

The typical expense basis of brand-new market individuals is detailed in the following chart, supplying insight into the activities of Short-Term Holders. Historically, during bull cycles, considerable cost rebounds taking place off the Short-Term Holder Realized Price line (or small dips below it) have actually indicated outstanding build-up chances.

View Live Chart 🔍

Evaluating Market Sentiment

Though uncomplicated, the Fear and Greed Index uses considerable insights into market feelings. Scores of 25 or lower normally show severe worry, which frequently accompanies illogical sell-offs. Such circumstances can provide beneficial danger-to-benefit conditions for financial investment.

View Live Chart 🔍

Identifying Market Overreaction

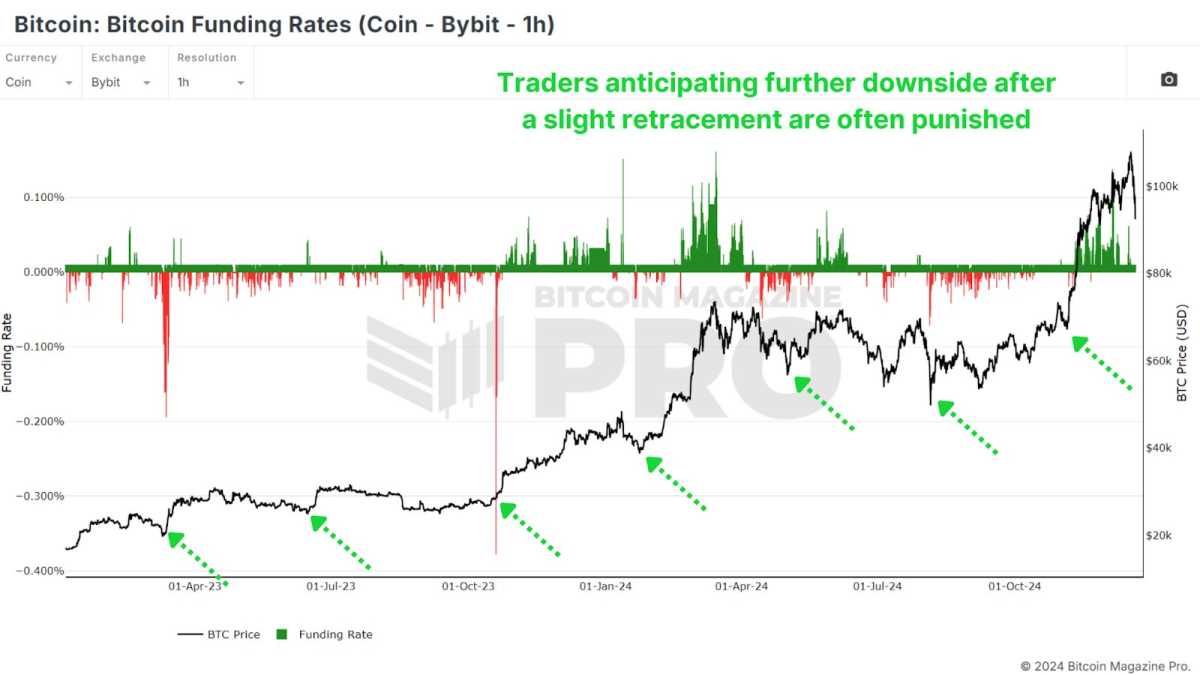

Funding rates are a sign of trader belief within futures markets. Particularly visible is the event of unfavorable financing rates during bull cycles, which work as a strong build-up signal during market dips, particularly on platforms drawing in retail financiers, such as Bybit.

View Live Chart 🔍

In circumstances where traders make use of Bitcoin as security, unfavorable financing rates regularly show helpful purchasing conditions. This habits tends to show care among those interesting in brief selling. Consequently, concentrating on Coin-Denominated Funding Rates is chosen over basic USD rates.

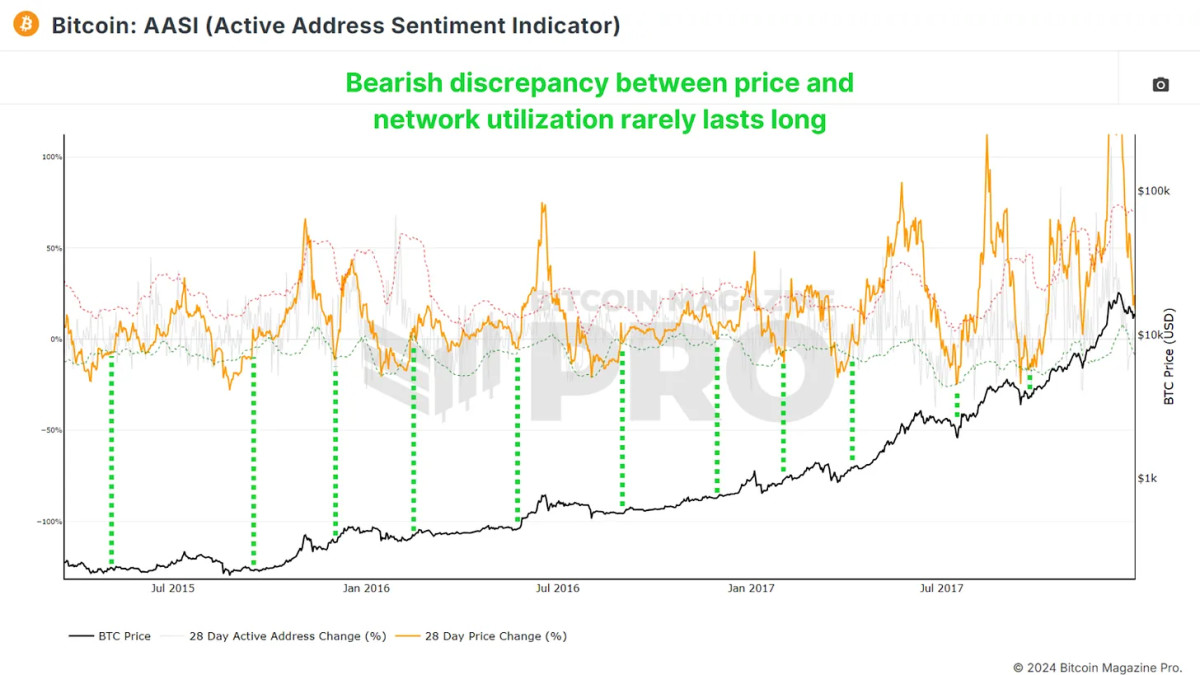

Active Address Sentiment Indicator

The Active Address Sentiment Indicator acts as a tool to evaluate the divergence in between Bitcoin’s cost and network activity. When a divergence takes place within the AASI, it recommends that unfavorable cost motions might be baseless relative to the robust hidden network use.

View Live Chart 🔍

The preferred method includes waiting on the 28-day portion cost modification to dip below the lower basic variance band of the active addresses’ portion modification, consequently validating a purchase signal once it crosses back above. This approach enhances the recognition of network strength and possible cost turnarounds.

Conclusion

To efficiently collect Bitcoin during bull market dips, it is important to handle danger instead of pursue market bottoms strongly. Investing at somewhat raised cost points while in oversold conditions can lessen the possibility of experiencing a considerable drawdown compared to purchasing in the middle of sharp rallies.

Investors must validate continuous booming market conditions to guarantee that dips are undoubtedly feasible purchasing chances, determining beneficial purchasing zones through different metrics for increased confluence, such as Short-Term Holder Realized Price, Fear & Greed Index, Funding Rates, and AASI. Emphasizing little, incremental purchases (dollar-cost averaging) over big financial investments, while focusing on danger-to-benefit ratios over outright financial quantities, is a good idea.

By incorporating these methods, financiers can make educated choices and take the distinct chances occurring from booming market dips. For a extensive expedition of this subject, audiences are urged to gain access to a current YouTube discussion entitled “How To Accumulate Bitcoin Bull Market Dips.”

For even more in-depth Bitcoin analyses and to gain access to advanced functions such as live charts, customized indication notifies, and extensive market reports, please see Bitcoin Magazine Pro.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.