As reserve banks on the African continent battle to keep cryptocurrencies from going mainstream, much more migrant employees are progressively turning to money-sending platforms that utilize cryptocurrencies when moving funds throughout borders.

More Than Just an Investment

Thus in addition to ending up being a “hot financial investment for hedge funders and business magnates,” crypto-assets like bitcoin are now viewed as “an affordable method to transfer cash throughout the establishing world.” Also including to the growing appeal of cryptocurrencies, are lockdown steps enforced in numerous nations beginning in March 2020.

In a quote to stop the spread of Covid-19, federal governments all over the world enforced constraints on human motion and this, in turn, made the usually trusted cash transfer channels less available. With motion now greatly cut, bitcoin and other cryptocurrencies naturally became the next safe and economical alternative ways of moving cash throughout borders.

As different research studies have actually revealed, cryptocurrency usage rose after March 2020. Since then, some reserve banks have actually been attempting to inspect this growing appeal. To show, prior to the Nigerian Central Bank (CBN) released an order that disallowed banks from servicing crypto consumers, remittances into that nation through cryptocurrencies had actually been rising. On the other hand, main information reveals that remittances through regular channels had actually plunged to record lows.

According to some Nigerian-based crypto lovers, it is this plunge (in remittances) that prodded the CBN into acting versus the crypto market. Similarly, the CBN’s just recently revealed reward plan for Nigerians getting remittances through authorities channels represents another effort to stop the continuing slide cross-border remittances inflows.

if (!window.GrowJs) { (function () { var s = document.createElement(‘script’); s.async = real; s.type=”text/javascript”; s.src=”https://bitcoinads.growadvertising.com/adserve/app”; var n = document.getElementsByTagName(“script”)[0]; n.parentNode.insertBefore(s, n); }()); } var GrowJs = GrowJs || {}; GrowJs.ads = GrowJs.ads || []; GrowJs.ads.push({ node: document.currentScript.parentElement, handler: function (node) { var banner = GrowJs.createBanner(node, 31, [300, 250], null, []); GrowJs.showBanner(banner.index); } });

Cryptocurrencies and UN SDGs

Meanwhile, as the Quartz Africa report acknowledges, it is these “very little crypto deal expenses that make it possible for cryptocurrencies to “beat inflated deal costs of conventional cash wire business like Western Union and Moneygram.” Similarly, Bitscoins.net News reported in October 2020, that a World Bank research study had actually discovered Sub-Sahara Africa to be the most pricey area worldwide with a typical sending out expense of 8.47% in Q3 of 2020. This figure is well above the UN Sustainable Development Goal (SGD) 10C targeted limit of 3%.

On the other hand, a Chainalysis 2020 Geography of Cryptocurrency report likewise validates that numerous African migrants are undoubtedly choosing for cryptocurrencies when sending out funds back to the area. The report exposes that “approximately $562 million worth of cryptocurrency was moved straight from abroad addresses to ones based in Africa in retail sized payments.”

While the Chainalysis report yields that this figure ($562 Million) is not likely to represent remittances from all migrants,” the blockchain analysis company still discovers that numerous migrants are selecting cryptocurrencies due to the “low-fee remittances.” To show this point, the report exposes that for “some nation sets that see big remittance streams, such as South African to Nigeria or South Africa to Malawi, the costs can be as high as 15%.”

Cryptocurrencies Offer Cheapest Remittance Fees

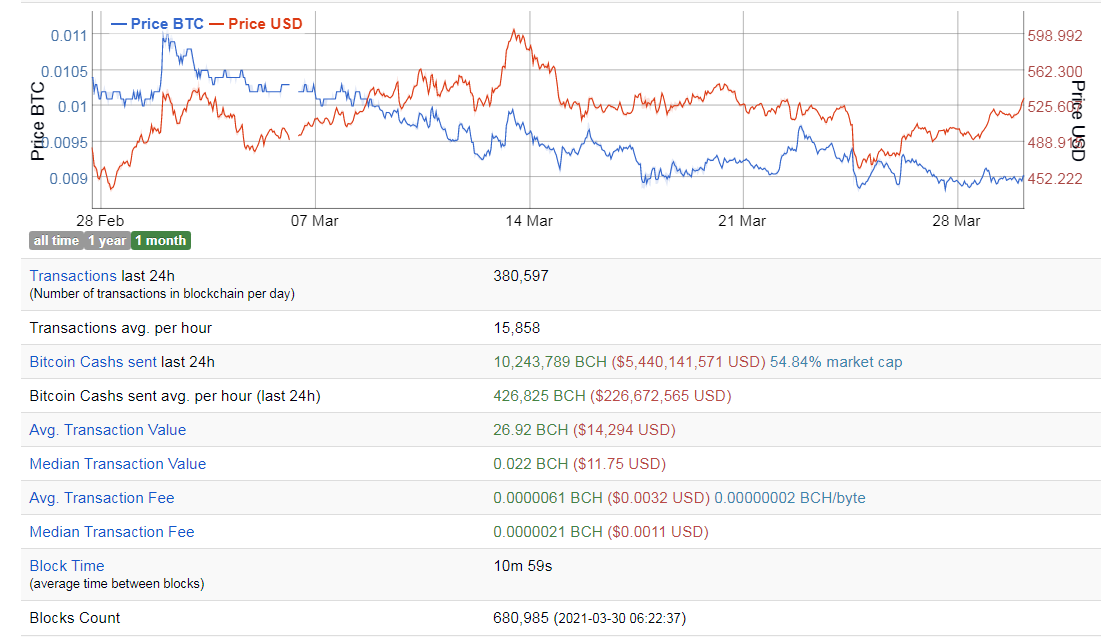

Yet as Bitinfocharts information programs, the network costs (or deal expenses) of some crypto possessions like bitcoin money (BCH), XRP, and XlM just represent an extremely small portion of one dollar. For example, a typical cost of $0.0032 per deal was understood from the 360,000 plus deals that were tape-recorded on March 29 on the Bitcoin Cash network. According to the information, each of these deals had a typical worth of $15,020.

Similarly, other altcoins like XRP, dash, and excellent all have network costs that are much lower than the UN target of 3%. Unless reserve banks and banks work to lower remittances costs, making use of cryptocurrencies when sending out cash abroad will continue to grow. Simply prohibiting or trying to eliminate cryptocurrencies will not prosper when there is no option.

Do you concur that cryptocurrencies use the most affordable sending out expenses? You can share your views in the comments area below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.