Founder: Jesse Shrader and Anthony Potdevin

Date Founded: March 2021

Location of Headquarters: Nashville, TN

Number of Employees: 10

Website: https://amboss.tech/

Public or Private? Private

According to Jesse Shrader, 2024 is expected to be an essential year for the Lightning Network.

With the increasing cost of Bitcoin and the integration of Tether (USDT) onto the Lightning platform, Shrader asserts that an increasing number of companies and organizations are most likely to acknowledge Lightning’s possible as a payment service in the future.

Amboss, his business, is tactically placed to facilitate this shift.

“Our goal is to extend Bitcoin as a payment system, utilizing Lightning to do so,” Shrader mentioned in an interview with Bitcoin Magazine. “We aim to develop Lightning into a high-efficiency, high-performance system.”

To understand this aspiration, Shrader and the group at Amboss have actually produced a variety of tools and services developed to onboard the upcoming wave of institutional users to the world’s biggest permissionless payment network, especially now that USDT is functional on Lightning.

Overview of Amboss

Amboss mainly concentrates on offering innovative payment facilities for digital deals through the Lightning Network.

“We offer insights to help users enhance payment efficiency on the network,” kept in mind Shrader.

To accomplish this, Amboss has actually established a range of items and services.

One of the most significant offerings is Amboss Space, a Lightning Network explorer that makes use of device discovering to help users in recovering info or linking to any node within the network.

In addition to their analytics software application, Amboss also provides tools and services targeted at enhancing liquidity conditions on Lightning.

Among these services is the Magma Marketplace, which helps with the purchasing and selling of liquidity on the Lightning Network. This platform enables users to offer liquidity—without giving up custody of their Bitcoin—in exchange for a yield.

An extension of this service, Hydro, allows users to automate their liquidity purchases, therefore boosting the probability of effective deals.

Amboss also deals Reflex, a compliance suite targeted at service customers with Anti-Money Laundering (AML) reporting responsibilities.

The analytics software application and resources from Amboss are developed for high-volume deals, which have actually ended up being significantly practical on the Lightning Network.

“We simulate businesses’ payment capabilities to help them understand their reach within the network,” discussed Shrader. “We assist businesses in assessing how much of the network they can actually access when attempting a payment.”

The Landscape of Lightning

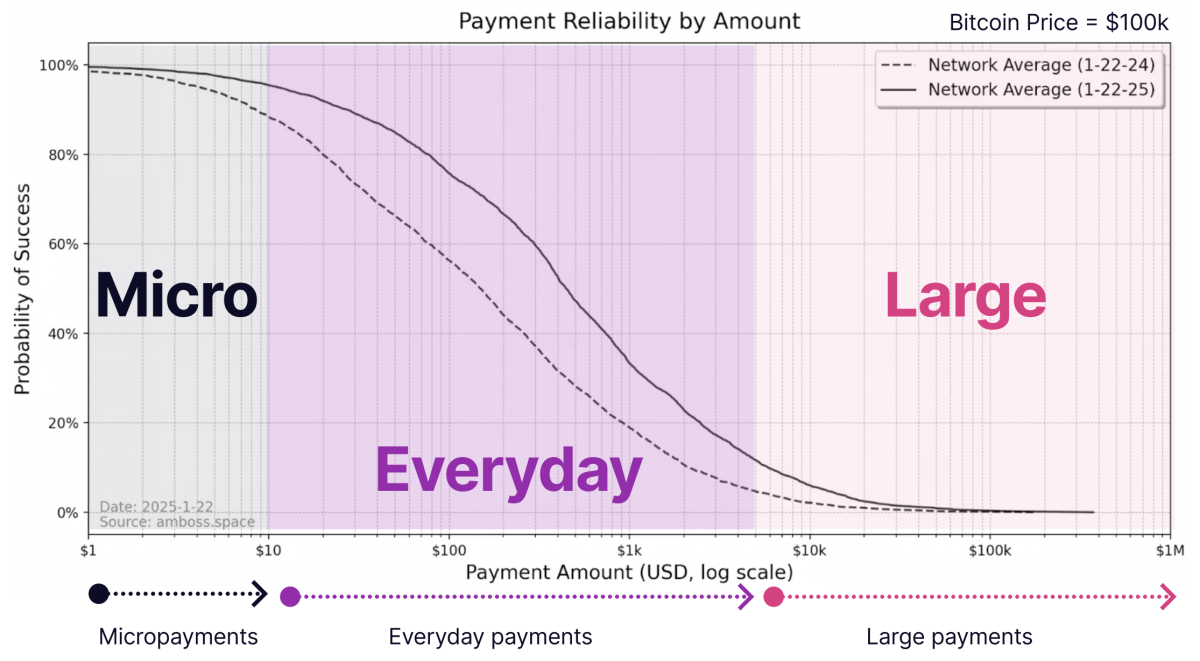

Shrader reveals strong optimism concerning the development trajectory of the Lightning Network. Users are significantly depending upon the network for deals going beyond simple micropayments.

“We have been successfully processing what I categorize as everyday payments on Lightning, which range from $10 to $4,000,” he mentioned. “We are focused on further enhancing the network’s capabilities, particularly in terms of decentralization.”

However, processing payments that surpass $4,000 stays an obstacle. Shrader showed that extra capital is needed to assist in bigger deals effectively.

Nevertheless, he acknowledged that Bitcoin’s current cost rise has actually favorably affected the processing of bigger payments.

“The rise in Bitcoin’s price has enhanced settlement capabilities across all Lightning channels,” Shrader mentioned. “Given that these channels are denominated in Bitcoin, it effectively expands our capacity.”

Shrader holds that the integration of Tether (USDT) into Lightning will bring in much more liquidity, even more reinforcing the network.

Tether (USDT) on Lightning

In late 2023, Lightning Labs revealed the intro of USDT to Bitcoin and the Lightning Network through the Taproot Assets procedure.

This upgrade enables Bitcoin provider to incorporate and accept USDT more perfectly, a development that Shrader consider as extremely useful for the Lightning facilities.

“Last year, it facilitated $10 trillion in payments, surpassing both Visa and MasterCard,” he included. “The demand for U.S. dollars is evident.”

While acknowledging issues from some in the Bitscoins.netmunity concerning the usage of USDT on Bitcoin and Lightning, Shrader feels sorry for these perspectives, valuing Bitcoin’s intrinsic worth. However, he asserts that the benefits of incorporating USDT onto Lightning exceed the objections, especially as lots of people stay not familiar with Bitcoin and are reluctant to accept its volatility.

“A significant number have yet to fully appreciate the benefits of Bitcoin,” he discussed. “While I regard Bitcoin as an incredible tool, my objective is to extend its reach to as many individuals as possible. There exists a multitude of issues within traditional payment systems, and Bitcoin offers a secure, auditable solution that I aspire to deliver on a large scale.”

“The volatility of Bitcoin can intimidate many, whereas USDT, being a low-volatility asset, when paired with secure, trustless systems, represents a significant advantage.”

Addressing USDT’s Role on Lightning

Shrader remembered that the inaugural Bitcoin-focused conference hosted by MicroStrategy was entitled “Lightning for Corporations,” where companies were motivated to pay staff members in Bitcoin through Lightning, typically without completely acknowledging the associated issues.

“Employers soon discovered that the requirement for 1099 submissions for employees was burdensome,” kept in mind Shrader. “Additionally, they faced considerable regulatory challenges.”

He highlighted that compensating staff members in USDT through Lightning not just enhances accounting and regulative procedures however also alleviates the counterparty threats connected with conventional banking—a concern Shrader is acutely conscious of.

“Previously, our payroll was processed through Silicon Valley Bank,” situated Shrader. “On one occasion, my payroll provider requested that I resend mid-month payroll after an attempted payment. This resulted in a significant loss of financial runway due to the bank’s insolvency.”

“By transitioning to Bitcoin and Lightning, I can minimize counterparty risks within the financial system, thereby enhancing my overall position.”

[It should be noted, however, that some counterparty risks still persist with USDT, as trust in Tether’s backing of the tokenized dollars it issues remains essential.]

Risks Inherent in USDT on Bitcoin

Shrader acknowledged a number of possible threats connected with USDT on Bitcoin and Lightning however appeared mostly undisturbed by them.

“There are some Miner Extractable Value (MEV) risks when utilizing assets outside of a blockchain’s native currency on-chain,” he elaborated. “However, Bitcoin already accommodates Ordinal inscriptions that introduce additional assets, indicating that this issue is not novel.”

He stayed unfazed by issues concerning the ramifications of a Bitcoin fork on the worth of USDT on one of the resulting chains, nor did he think there was a considerable danger that bigger financial nodes within the Bitcoin network, such as Coinbase—accountable for custodying the Bitcoin for U.S. area Bitcoin ETFs—would decide to back a “Tether fork” that may result in destructive outcomes for Bitcoin in the long term.

“Bitcoin consensus is independent of Bitcoin custody,” mentioned Shrader. “While a prominent business like Coinbase might advocate certain changes or initiatives, it does not guarantee the implementation of protocol modifications.”

Rather than house on the threats connected with USDT’s execution on Bitcoin, Shrader chooses to highlight the chances that develop from this integration.

“The potential for arbitrage on Bitcoin itself is particularly intriguing,” he mentioned. “As every node has the capacity to transact in both USDT and Bitcoin, exchanging them natively on Lightning is feasible; one can send Bitcoin from one Lightning channel while receiving USDT in another, thereby effectively rebalancing holdings.”

Looking Ahead to 2025

In concluding his insights, Shrader articulated 2 critical factors he thinks 2025 will declare a considerable period for Lightning.

The very first factor is that it will no longer be needed for people to hold Bitcoin to make use of Lightning.

“Historically, obtaining Bitcoin was a prerequisite for utilizing Lightning, creating a substantial barrier for many,” observed Shrader. (He included that outdoors the United States, acquiring access to USDT is fairly simple and commonplace.)

“The market for Bitcoin-only payment processing is quite limited. However, we have now eliminated that barrier, allowing consumers to transact using an alternative asset—USDT—a space that already boasts considerable demand,” he elaborated.

Shrader even more kept in mind that even with USDT operating on Lightning, Bitcoin continues to benefit, as the USDT is transformed into Bitcoin throughout its transit throughout the network. He highlighted that “the increase of Bitcoin within the network improves the benefits connected with running a Lightning node.”

Additionally, he stressed that Lightning users will sustain substantially lower deal costs compared to conventional monetary systems.

“We provide liquidity at rates below 0.5%,” commented Shrader. “In contrast, users engaging with large payment card networks often pay around 4% for transaction processing, with funds being inaccessible for days or weeks post-payment.”

“With Lightning, transaction processing costs are reduced by nearly a factor of ten.”

Given these insights offered by Shrader, it is challenging to imagine a circumstance where 2025 does not become a transformative year for the Lightning Network.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.