During the last couple of months, a couple of reports from traditional media (MSM) outlets attempted to show that a large amount of bitcoin is managed by a little group of individuals. Recently, Bloomberg declared that “2% of accounts manage 95% of all bitcoin,” a claim that doesn’t hold weight to onchain experts. On Tuesday, Glassnode scientist Rafael Schultze-Kraft’s newest report refutes this claim by MSM, worrying that bitcoin ownership is not highly focused.

Shrimps to Humpbacks: The Ocean of Bitcoin Entities

Oftentimes MSM outlets and press reporters release a story about the cryptocurrency environment without much research study and understanding worrying digital properties. More just recently, after bitcoin (BTC) exceeded the crypto possession’s 2017 all-time high (ATH) and touched a brand-new ATH in 2021, MSM reports worrying the digital currency’s ownership concentration have appeared.

The press reporters typically utilize the ‘Bitcoin Rich List’ originating from the web website Bitinfocharts, a page that shows BTC addresses with the biggest holdings. Glassnode scientist Rafael Schultze-Kraft has actually exposed this theory, as others have in the past, by discussing that “bitcoin ownership is not highly focused” but also includes that “whales are building up.”

Schultze-Kraft states that the problem with reports like the one released by Bloomberg is that these reporters merely comb the circulation of bitcoin throughout the network’s addresses. “This causes deceptive stats, which lead to incorrect stories around BTC ownership amongst stakeholders,” the scientist’s report notes. Highlighting the truth that not all bitcoin addresses are equivalent and bitcoin addresses need to not be thought about an “account.”

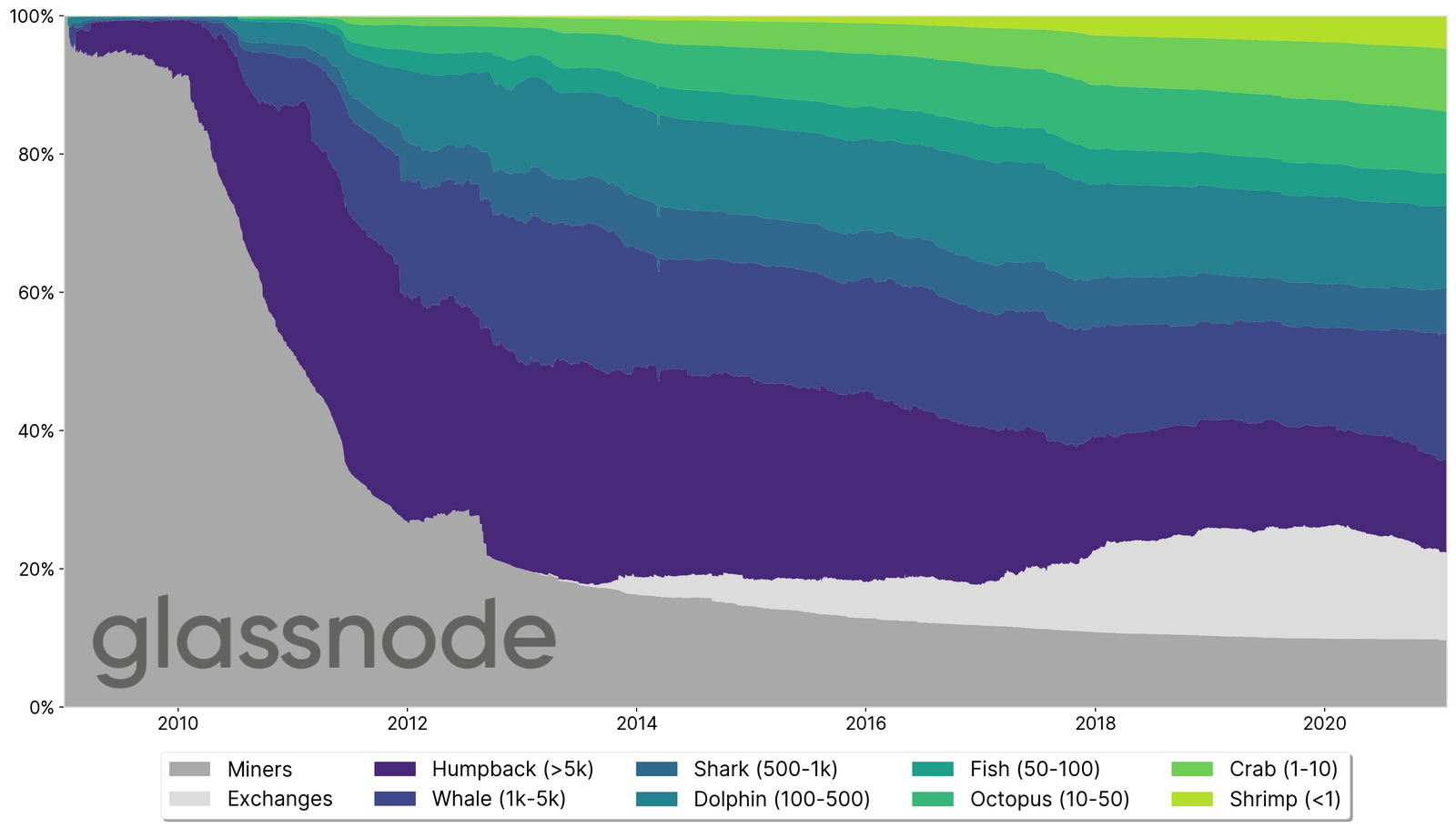

“We examine the circulation of bitcoin throughout network individuals, and reveal that BTC ownership distributes in time and is much less focused than typically reported,” the Glassnode expert stated. “Meanwhile, BTC supply held by whales has actually just recently increased, recommending institutional financiers are getting in,” the scientist included. The report separates the network entities into particular marine types names consisting of: “shrimps (5,000 BTC).”

Schultze-Kraft states the Glassnode group also segregated the entities of recognized exchanges and mining operations into different classifications.

Conclusion: ‘2% of Network Entities Control 71.5% of All Bitcoin’

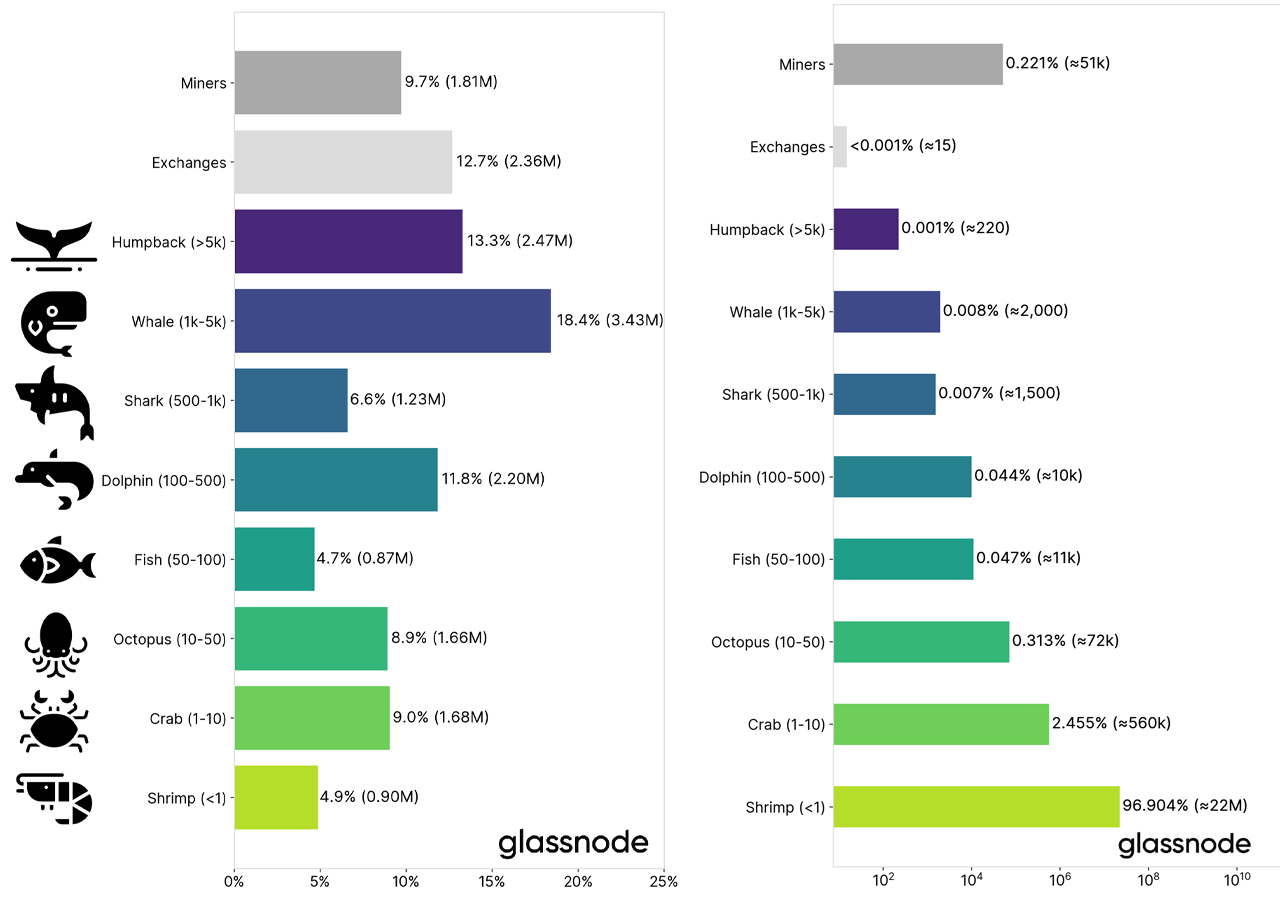

Miners have 9.7% while exchanges have 12.7% and 1,000 to 5,000 BTC whales classification makeup 18.4% of the bitcoin supply circulation. “On the big end of the spectrum, whales and humpbacks are the greatest non-exchange entities that together manage around 31% of the bitcoin supply. These are more than likely organizations, funds, custodians, OTC desks, and other high net worth people,” Schultze-Kraft highlights.

The scientist includes:

On the other hand, smaller sized entities holding up 50 BTC each (shrimp, crab, and octopus) control practically 23% of the supply. This shows that a significant quantity of bitcoins remain in the hands of retail financiers.

if (!window.GrowJs) { (function () { var s = document.createElement(‘script’); s.async = real; s.type=”text/javascript”; s.src=”https://bitcoinads.growadvertising.com/adserve/app”; var n = document.getElementsByTagName(“script”)[0]; n.parentNode.insertBefore(s, n); }()); } var GrowJs = GrowJs || {}; GrowJs.ads = GrowJs.ads || []; GrowJs.ads.push({ node: document.currentScript.parentElement, handler: function (node) { var banner = GrowJs.createBanner(node, 31, [300, 250], null, []); GrowJs.showBanner(banner.index); } });

One specific figure in the Glassnode research study shows the crypto possession’s supply circulation throughout entities in time. “In specific, it emerges that the (relative) quantity of BTC held by smaller sized entities has actually been growing throughout Bitcoin’s life time,” Schultze-Kraft includes. After a variety of other figures and charts, the report highlights the deceptive and unfactual claims made by Bloomberg’s monetary factor Olga Kharif.

“We can obtain that around 2% of network entities manage 71.5% of all bitcoin,” Schultze-Kraft’s report concludes. “Note that this figure is significantly various from the typically propagated ‘2% control 95% of the supply.’”

What do you think of the current report highlighting that bitcoin ownership is not highly focused? Let us understand what you think of this topic in the comments area below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.