As Bitcoin continues to develop itself within six-figure cost area, with expectations for even greater assessments ending up being prevalent, the assessment of important on-chain information yields important insights into the market’s essential health. By analyzing these indications, financiers are much better geared up to predict cost variations and prepare for prospective market peaks or upcoming retracements.

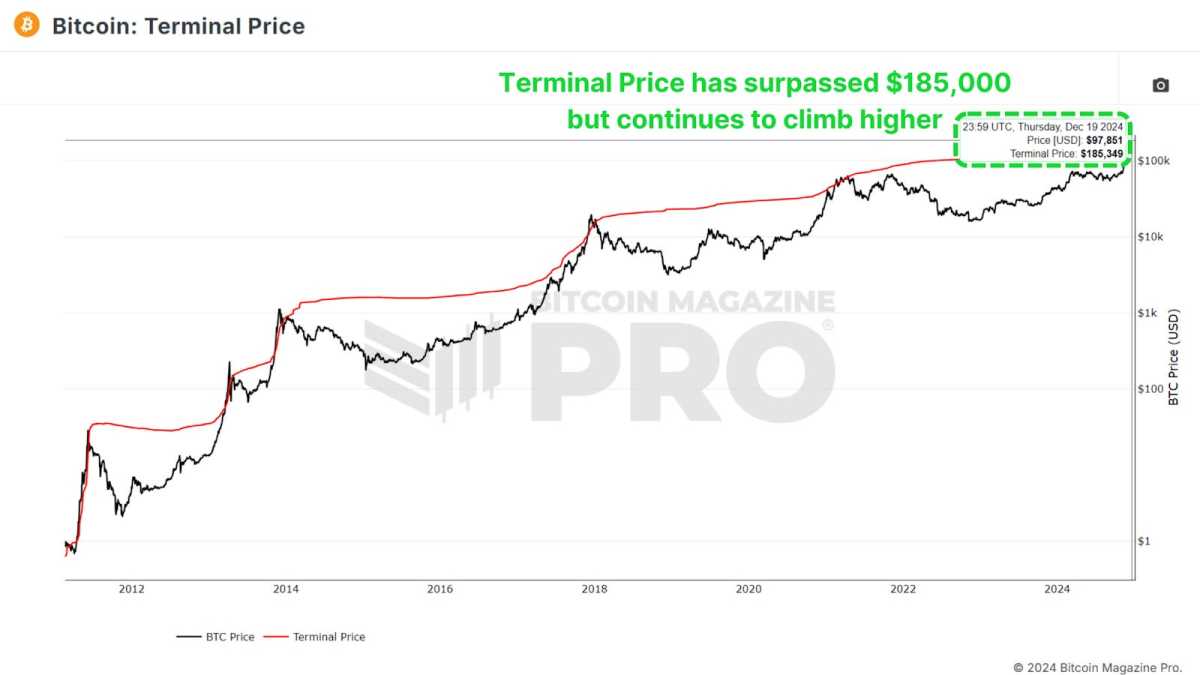

Terminal Price

The Terminal Price metric, which incorporates Coin Days Destroyed (CDD) while accounting for Bitcoin’s supply, has actually shown historic dependability as a sign for expecting Bitcoin cycle peaks. Coin Days Destroyed evaluates the frequency of coin transfers, thinking about both the period of ownership and the volume of Bitcoin negotiated.

View Live Chart 🔍

Currently, the Terminal Price has actually surpassed $185,000 and is forecasted to approach $200,000 as the existing cycle unfolds. Given Bitcoin’s current breach of the $100,000 mark, it might suggest that a number of months of beneficial cost activity lie ahead.

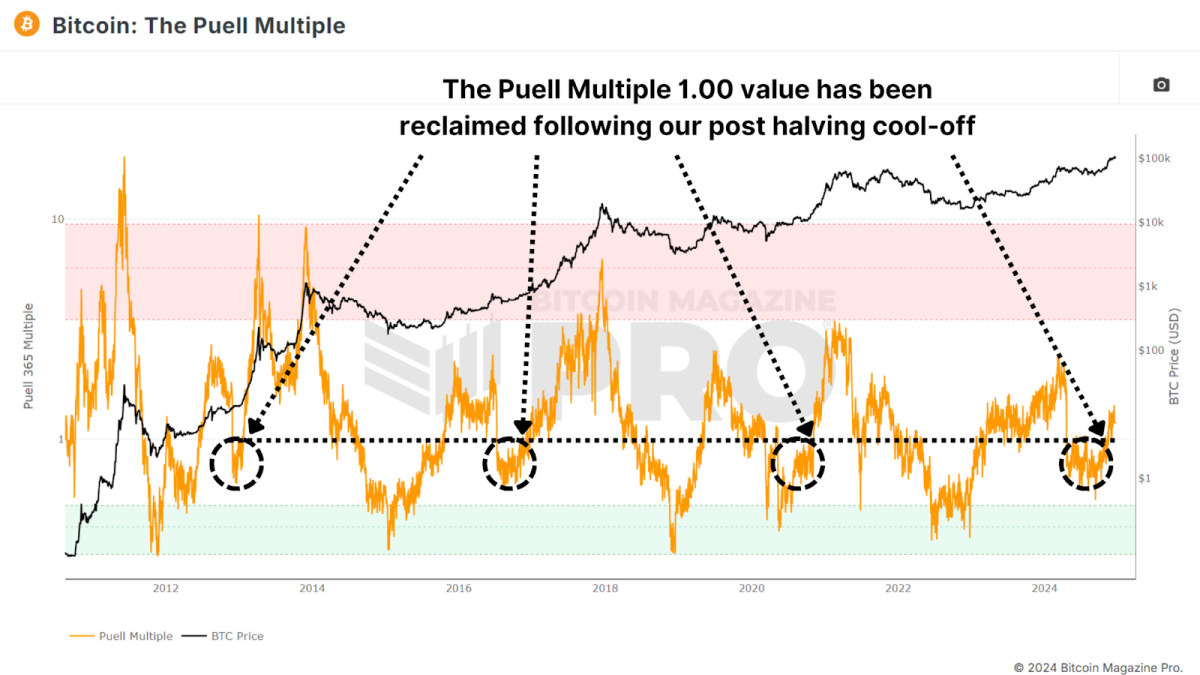

Puell Multiple

The Puell Multiple evaluates everyday miner earnings (denominated in USD) relative to its 365-day moving average. Following the cutting in half occasion, miners experienced a considerable decrease in earnings, causing a duration of debt consolidation.

View Live Chart 🔍

At present, the Puell Multiple has actually increased above 1, suggesting a go back to success for miners. Historically, exceeding this level has actually signified the later phases of a booming market, typically identified by rapid cost rallies—a pattern regularly observed in previous bull runs.

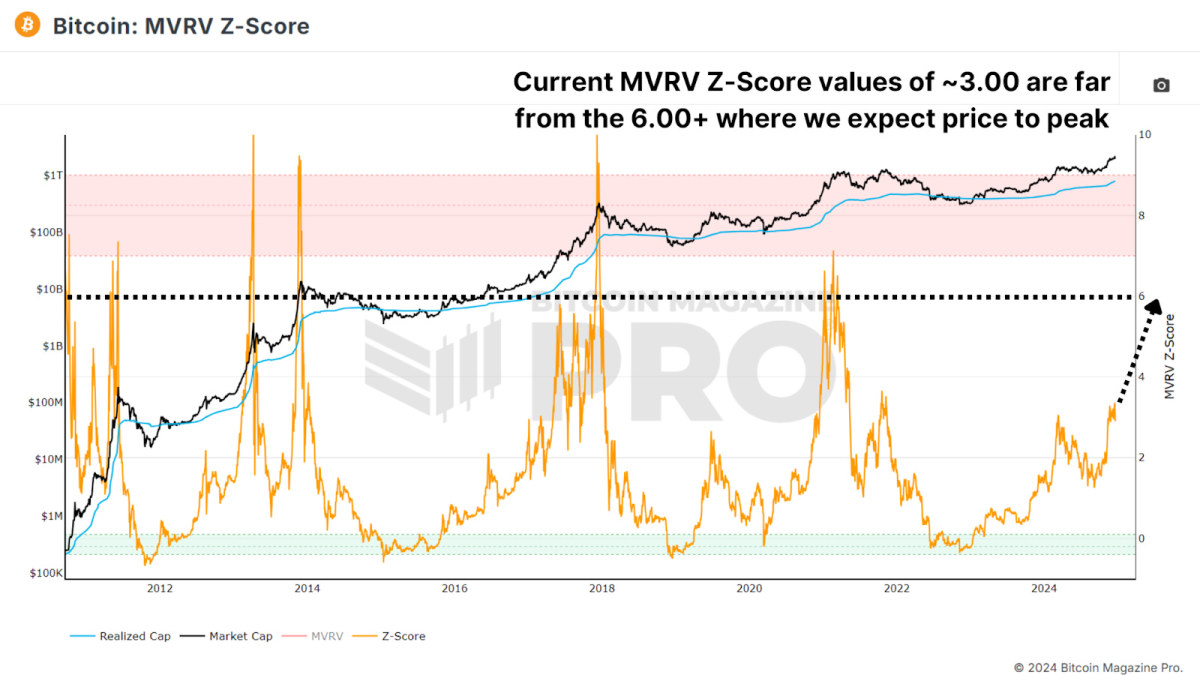

MVRV Z-Score

The MVRV Z-Score examines market price in relation to understood worth (the typical expense basis for Bitcoin holders), standardized into a Z-Score to accommodate the property’s volatility. This metric has actually shown to be extremely reliable in determining market cycle peaks and bottoms.

View Live Chart 🔍

Currently, Bitcoin’s MVRV Z-Score remains below the overbought limit, signing up around 3.00. This recommends that there stays substantial capacity for development. Despite a pattern of reducing peaks in current cycles, the Z-Score suggests that the market is far from reaching a state of blissful peak.

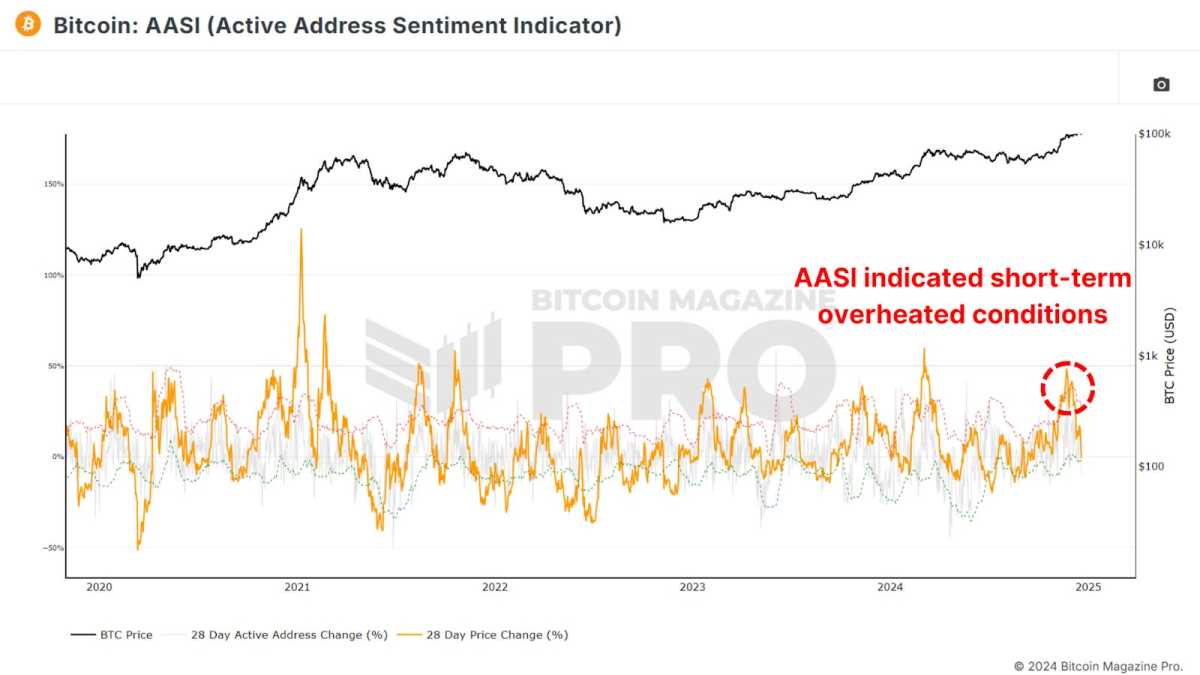

Active Address Sentiment

This metric displays the 28-day portion modification in active addresses on the network in addition to cost variations within the exact same timeframe. When cost gratitude overtakes network activity, it might recommend that the market is briefly overbought, questioning the sustainability of the favorable cost momentum provided network usage.

View Live Chart 🔍

Recent information exposes a small cooling pattern following Bitcoin’s swift climb from $50,000 to $100,000, showing a healthy debt consolidation stage. This time out is most likely developing the foundation for continual long-lasting development, recommending that beliefs need to not lean towards a medium- to long-lasting bearish outlook.

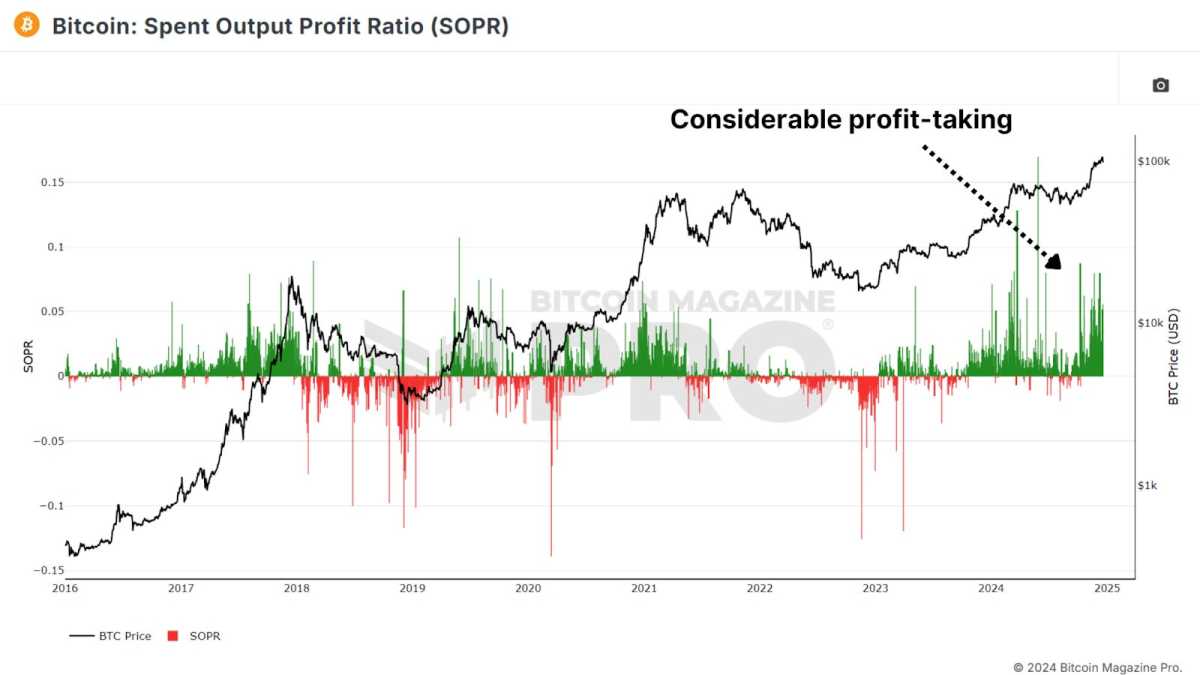

Spent Output Profit Ratio

The Spent Output Profit Ratio (SOPR) measures understood make money from Bitcoin deals. Recent observations show a boost in profit-taking activity, which might recommend that the market is getting in the latter stages of the existing cycle.

View Live Chart 🔍

One essential factor to consider is the increasing frequency of Bitcoin ETFs and acquired items. Investors seem transitioning from self-custody to ETFs for benefit and tax benefits, which might affect SOPR figures.

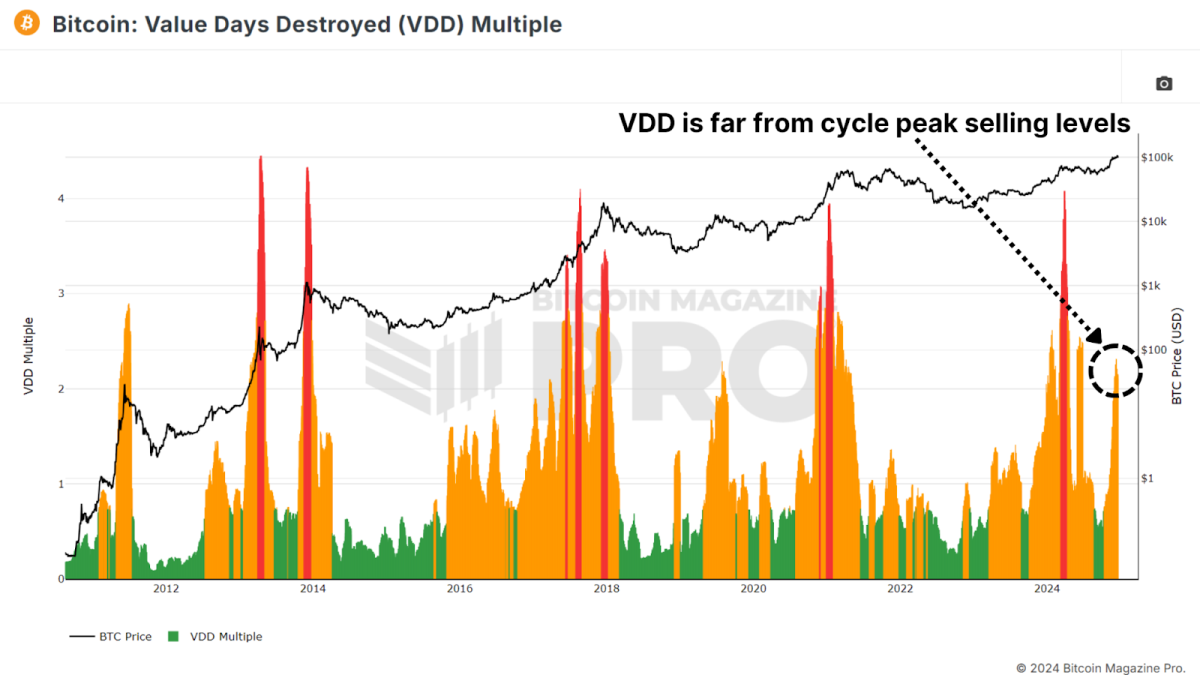

Value Days Destroyed

The Value Days Destroyed (VDD) Multiple builds on CDD by appointing more weight to bigger, long-lasting holders. When this metric gets in an overheated state, it often suggests significant cost peaks, as the market’s most popular and experienced individuals start to take advantage of their financial investments.

View Live Chart 🔍

Although existing VDD levels recommend a somewhat overextended market, historic patterns show it might preserve this variety for a prolonged duration prior to a peak. For example, in 2017, VDD signified overbought conditions almost a year before the cycle’s peak.

Conclusion

Collectively, these metrics show that Bitcoin might be getting in the latter phases of its bullish market cycle. While specific indications expose indications of short-term cooling or small overextension, the majority of recommend substantial staying upside prospective extending into 2025. Target resistance levels for this cycle might develop in between $150,000 and $200,000, with metrics such as SOPR and VDD offering clearer signals as the market approaches its peak.

For an extensive expedition of this subject, readers are motivated to see a current YouTube video entitled: What’s Happening On-chain: Bitcoin Update.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.