Andrew Yang has actually required to Twitter in vibrant style since late, marketing his universal standard earnings (UBI) proposition referred to as the “Freedom Dividend.” While tossing cash at individuals expense constantly produces a buzz, there’s a mathematically and fairly damaged side to the strategy couple of are discussing.

Also Read: Do You Know the Newspeak of the Looming ‘NIRP’ Economic Meltdown?

A Real-Life Political Cartoon

Not so long ago individuals utilized to joke about the common shyster political leader and their bigger than life project guarantees. Wisecracks about the next White House wannabe focused around grease-ball political leaders actually tossing cash at citizens to purchase their assistance. Well now, under the guise of a hip brand-new governmental project, the cash tossing is in fact taking place. To review Andrew Yang is no simple job, provided the reasonable and vibrant assistance he’s gotten versus the background of a completely corrupt and greedy political and monetary system. It stands to ask, though: Is he truly set to alter things? Upon better evaluation, UBI is bit more than an inefficient and unethical tactic for socioeconomic power.

If it feels this excellent to provide 10 Americans $1,000 a month think of how it will feel to do the very same for numerous countless us. It will be among the best days in human history.

— Andrew Yang🧢 (@AndrewYang) November 1, 2019

Generous (With Other People’s Money)

Math. It’s a discipline unlike others for its specific responses and absence of space for dispute. One plus one is 2. There’s very little dissent possible here, beyond the periodic stoner drum circle or deep esoteric fireside conversation. Nothing incorrect with either, naturally, however this is simply to prepare for an argument. Namely, that a person cannot provide away worth one doesn’t have. While Yang is presently providing a “Freedom Dividend of $1,000 a month for a whole year to 10 American households” out of his own pocket, when in workplace that cash set to “do the very same for numerous countless us” will originate from your pockets.

Mixed Up Math

Yang’s project site sets out the foundation for his suggested “Freedom Dividend.” While a dividend is typically specified as a share of revenues paid to investors, Yang’s “dividend” will be enabled “by combining some well-being programs and carrying out a Value Added Tax of 10 percent.” Not precisely a share of revenues as much as cash pulled from the pockets of Americans, however for the sake of argument, that will provide for now. In mitigating worries of inflation, unfavorable financial effect and even inbound communism, Yang preserves on the website:

The federal government just recently printed $4 trillion for bank bailouts in its quantitative reducing program without any inflation.

This evaluation is enormously unethical, and if not, enormously oblivious of standard financial truths. It disregards mathematics, to put it simply. There are lots of kinds of inflation and a few of the most pernicious conceal underneath the surface area of popular recommendation. While customer rate index inflation (CPI) might appear nearly untouched throughout some durations of quantitative easing (QE) due to a mix of market aspects (consisting of the mental element of customer self-confidence), possession rate inflation is the genuine trigger for more major issues. In other words, even as the financial obligation racket of modern-day federal government paper spirals out of control, if individuals are positive in their cash and the state’s peace of mind of its worth, CPI might remain reasonably steady, and organisations will be not able to increase costs due to this psychology and other aspects such as healthy, restorative deflation.

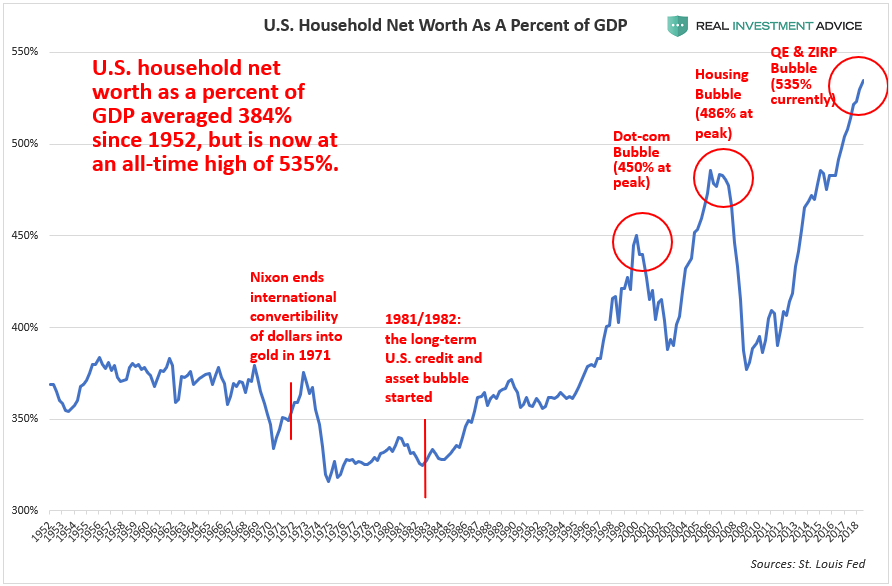

While Yang declares the printing of $4 trillion for bailouts triggered “no inflation” the real estate and possession market is calling BS in unmatched and genuinely frightening style. If a home deserved $200,000 5 years earlier, and now deserves $300,000, this doesn’t always imply your house altered, or that the home ended up being legally better. What it frequently indicates is that the dollar ended up being considerably weaker versus the possession. As these possession costs are hence pumped up, banks have the ability to offer larger and larger loans versus the possession security. Once the jig is up, the bubble bursts and the tumble down is extreme, with security worth no longer covering loans. The chart above programs simply how drastically this accumulation is taking place presently, with possession inflation indicated by U.S. family net worth versus GDP at an all-time-high given that 1952 of 535%.

Stolen Generosity

Not only is Yang’s proposal financially unsound, it’s also ethically objectionable. This is a difficult tablet to swallow for lots of enthusiastic millennials and Yang gang advocates of any ages, tired of scraping by and having a hard time in the present corrupt, Keynesian paradigm. That regardless of, Yang’s “Forward” is no various from the unclear and vapid “Hope,” Change,” or “I’m a much better guy” of previous prospects.

To pay the Freedom Dividend, Yang proposes you be robbed. Business owners not wanting to use his recommended BARREL would be penalized for rejection. Consumers not wanting to pay it, also. It’s an undesirable truth, however there’s no chance to put it more precisely. Yang describes:

A Value Added Tax (BARREL) is a tax on the production of items or services a company produces. It is a reasonable tax and it makes it much harder for big corporations, who are professionals at concealing revenues and earnings, to prevent paying their reasonable share.

Many are not sure of what Andrew Yang’s reasonable share of their earnings need to be. If I likewise were required to pay every next-door neighbor I have a part of my income since 15 or 20 of them stated I must, or be put in a cage, individuals would be naturally scandalized by the sociopathic idea. But if the theft is euphemized as a “Freedom Dividend” it’s unexpectedly made far more tasty to the masses. While some keep tax is a needed evil for protecting civilization, this position is illogical. There’s absolutely nothing civil about taking from anybody under risk of violence, and a social requirement doesn’t validate criminal activity, anyhow. If it did, the folks in the U.S. throughout the plantation slavery period would have been proper in their demonstrations versus abolition: “But who will choose the cotton!?”

Bitcoin’s Fix

Leaving Andrew Yang’s universe for a minute, it appears essential to deal with crypto as a possible option for the present political corruption he apparently stands versus. A current viewpoint piece in the Washington Post declares: “Facebook’s cryptocurrency won’t assist the bad gain access to banks. Here’s what would.” The piece goes on to information the impossibility of Facebook’s upcoming Libra cryptocurrency in fact assisting the unbanked of the world, due to federal government guidelines. The short article un-ironically nearby recommending that the extremely exact same self-important federal government is the option, specifying: “It’s real that monetary addition would assist countless Americans and benefit the economy. But it can be attained through reliable and democratic organizations. In truth, the United States currently has a public payments system: the Federal Reserve.”

What so couple of in the area appear to recognize about crypto is that the capacity for banking the unbanked, pulling individuals out of hardship, and allowing cost savings and the structure of wealth for the typical person is currently here. The state stands in the method with limitless security, KYC/AML requirements, taxes and capital controls, so it takes place in the regulative fractures, at present.

Instead of a $1,000 regular monthly income in garbage cash, why not drop all limitations on trade and enable individuals to grow their wealth and organisations separately? If we’re concerned that criminal warlords and kingpins would take control of, simply browse — they currently have. It is specifically since of the illogical centralization of power and absence of a sensible, equal opportunity that a prospect like Yang can acquire any prominence at all. In a totally free society — and no offense here to Yang personally — he’d most likely be referred to as simply a typical scam artist.

What are your ideas on Yang’s proposed UBI? Let us understand in the comments area below.

OP-ed disclaimer: This is an Op-ed short article. The viewpoints revealed in this short article are the author’s own. Bitscoins.internet is not accountable for or accountable for any material, precision or quality within the Op-ed short article. Readers needs to do their own due diligence prior to taking any actions connected to the material. Bitscoins.internet is not accountable, straight or indirectly, for any damage or loss triggered or declared to be brought on by or in connection with making use of or dependence on any details in this Op-ed short article.

Did you understand you can confirm any unofficial Bitcoin deal with our Bitcoin Block Explorer tool? Simply total a Bitcoin address search to see it on the blockchain. Plus, check out our Bitcoin Charts to see what’s taking place in the market.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.