Bitcoin is a permissionless ledger. In plain English, which means you don’t have to ask anybody’s rattling permission to make use of it. There are not any phrases and situations to read, no checkbox to tick, and no kinds to signal earlier than you’ll be able to ship or obtain bitcoin. But if some folks had their method, pseudonymous cryptocurrencies, in addition to nameless cash like monero, would solely be used with the authorities’s permission. These individuals are flawed. So flawed it hurts.

Bad Advice is Easy to Come By

Ever since bitcoin grew to become formally cool, someday final 12 months, all its earlier haters and ignorers have come out of the woodwork, providing to share their insights. Every day, the editorial inbox at information.Bitscoins.web fills with pitches from bankers, regulators, and financiers desperate to dispense soundbites on this new asset class known as cryptocurrency – the exact same one which we may swear we’ve been masking for years.

Ever since bitcoin grew to become formally cool, someday final 12 months, all its earlier haters and ignorers have come out of the woodwork, providing to share their insights. Every day, the editorial inbox at information.Bitscoins.web fills with pitches from bankers, regulators, and financiers desperate to dispense soundbites on this new asset class known as cryptocurrency – the exact same one which we may swear we’ve been masking for years.

There’s no disgrace in being late to crypto; cool factors will not be awarded for the quantity of years you’ve been utilizing bitcoin. But it does stick in the craw when johnny-come-latelies attempt to place themselves as cryptocurrency consultants and demand on telling the relaxation of us what to do with them. One such newcomer is Weiss, an company based in 1971 that has since gone on to charge greater than 55,000 establishments and investments. It’s new to cryptocurrency although – 2018 new – and it exhibits. We initially reported on its nonsensical crypto scores again in January, when it awarded BTC a “C+” – i.e mediocre. It then supplemented this with a evaluate of 93 cryptocurrencies in May, during which BTC scored a “B-”.

The company’s newest pronouncement, on privateness cash, which it urges the public to keep away from, may be its most misinformed but. It’s laborious to inform whether or not Weiss Ratings truly believes the recommendation it dispenses or is solely taking pictures for rage clicks. If its technique is the latter, it’s succeeding; if it’s the former, it ought to return to reviewing legacy monetary establishments, cos Weiss is hopelessly out of its depth on the subject of crypto.

How You Spend Your Privacy Coins is No One Else’s Business

A new report by Martin D. Weiss addresses authorities issues about privateness cash, however observes that their know-how can present main advantages. It mentions authorities fears of privateness cash getting used for the typical vices – medicine, kiddie porn, terrorism – earlier than espousing the view that such cash don’t current a menace proper now attributable to their low utilization. This tallies with comments from a DEA agent that privacy-focused cryptocurrencies like monero and zcash will not be liquid sufficient, so “the overwhelming majority of dealings are still in bitcoin.”

In observing that privateness cash don’t presently current a menace to governments, Weiss is on agency floor. It then goes off at the deep finish, nonetheless, and loses all credibility with the assertion that follows. In its view, “cryptocurrencies that adhere to the high standards of transparency pioneered by Bitcoin still provide more than adequate resistance to censorship. Thus, efforts to discourage the usage of privacy coins for illicit activities would not hurt the crypto industry. Nor would it deny citizens protection from invasions of their privacy.”

In observing that privateness cash don’t presently current a menace to governments, Weiss is on agency floor. It then goes off at the deep finish, nonetheless, and loses all credibility with the assertion that follows. In its view, “cryptocurrencies that adhere to the high standards of transparency pioneered by Bitcoin still provide more than adequate resistance to censorship. Thus, efforts to discourage the usage of privacy coins for illicit activities would not hurt the crypto industry. Nor would it deny citizens protection from invasions of their privacy.”

That’s proper, Weiss simply advised it could be in the pursuits of everybody to discourage use of privateness cash, as a result of bitcoin will suffice. In an period of Chainalysis, unprecedented state surveillance, and crackdowns on dissidents, there may be apparently no want for privateness cash. According to Weiss, encouraging residents to keep away from privateness cash wouldn’t encroach on their proper to privateness. That’s some twisted logic proper there.

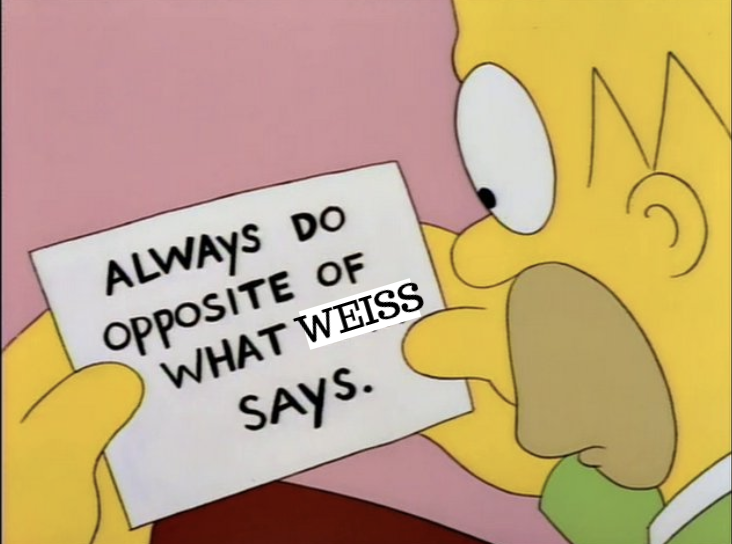

Always Do the Opposite of What Weiss Says

It’s nobody’s enterprise what you do together with your cash, be it paper or digital, pseudonymous or nameless. While Weiss doesn’t come out as wholly towards privateness cash in its report, and acknowledges that banning them could be unattainable and undesirable, the notion that there is no such thing as a want for privateness cash is laughable. As proof of how little the company understands cryptocurrency, it finishes its report by recommending that “The public should avoid privacy coins until the controversy and uncertainty surrounding their usage are resolved.”

Fun truth: there’ll by no means be a time when privateness cash will not be controversial, and there’s no uncertainty over their utilization to resolve. Coins like monero and zcash work, they work properly, and their utilization pisses off governments and legacy scores companies. If that’s not sufficient of an incentive to make use of them, what’s? Instead of privateness cash, Weiss recommends “cryptocurrencies that enjoy better scalability and transaction volume, focusing on those that earn Weiss Ratings of B- (good) or better, such as Cardano (B), EOS (B), and Stellar Lumens (B-)”.

Stick to spending shitcoins that Weiss offers a clear invoice of well being and also you’re gonna have a foul time. While it is sensible, from an funding perspective, to amass a various basket of cryptos, together with each privateness and non-privacy cash, anybody critical about preserving their anonymity will need to use a cryptocurrency that’s designed for this goal. Ignore Weiss Ratings and cease ready for the day when the authorities says it’s okay to make use of privateness cash as a result of that day won’t ever come. If you’re in search of permission to make use of cryptocurrency, you most likely shouldn’t be utilizing cryptocurrency.

What do you suppose of Weiss Ratings’ privateness coin suggestions? Let us know in the comments part below.

OP-ed disclaimer: This is an Op-ed article. The opinions expressed on this article are the writer’s personal. Bitscoins.web doesn’t endorse nor assist views, opinions or conclusions drawn on this post. Bitscoins.web just isn’t chargeable for or answerable for any content material, accuracy or high quality inside the Op-ed article. Readers ought to do their very own due diligence earlier than taking any actions associated to the content material. Bitscoins.web just isn’t accountable, straight or not directly, for any harm or loss brought about or alleged to be brought on by or in reference to the use of or reliance on any info on this Op-ed article.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.