Bitcoin’s current rate volatility has actually led lots of to question if massive bitcoin hodlers are benefiting from rate dips to build up more bitcoin. While some metrics might at first recommend a boost in long-lasting holdings, a closer evaluation exposes a more nuanced story, specifically after the existing extended duration of choppy debt consolidation.

Are Long-Term Holders Accumulating?

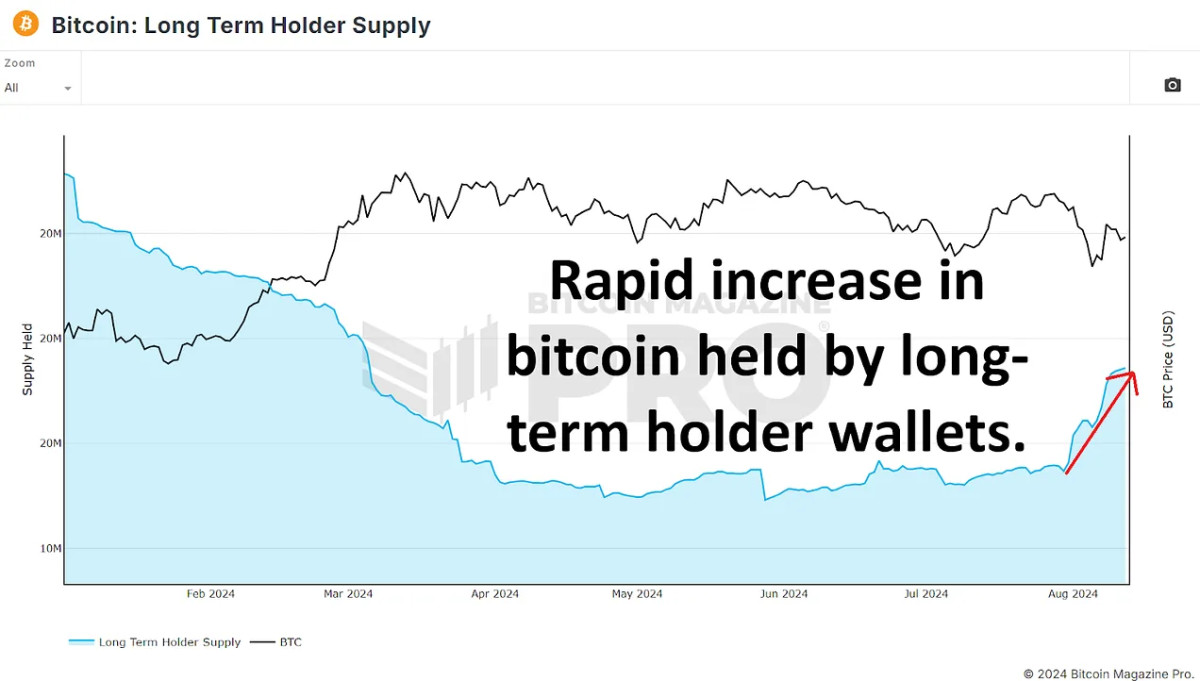

Upon preliminary observation, long-lasting Bitcoin holders are apparently increasing their holdings. According to the Long Term Holder Supply, given that July 30th, the quantity of BTC held by long-lasting holders has actually increased from 14.86 million to 15.36 million BTC. This rise of around 500,000 BTC has actually led some to think that long-lasting holders are strongly buying the dip, possibly setting the phase for the next considerable rate rally.

However, this analysis may be deceptive. Long-term holders are specified as wallets that have actually held BTC for 155 days or more. This week we’ve simply exceeded 155 days given that our newest all-time high. Therefore, it is most likely that lots of short-term holders from that duration have actually merely transitioned into the long-lasting classification with no brand-new build-up taking place. These financiers are now keeping their BTC, expecting greater rates. So in seclusion, this chart does not always suggest brand-new buying activity from recognized market individuals.

Coin Days Destroyed: A Contradictory Indicator

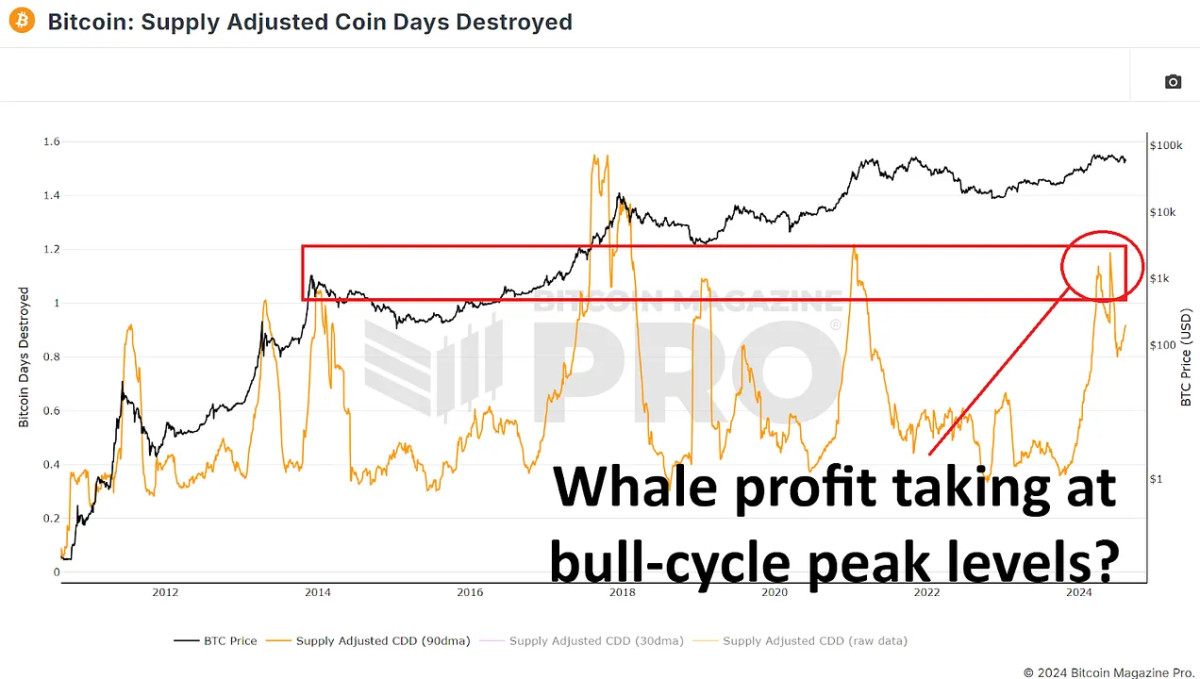

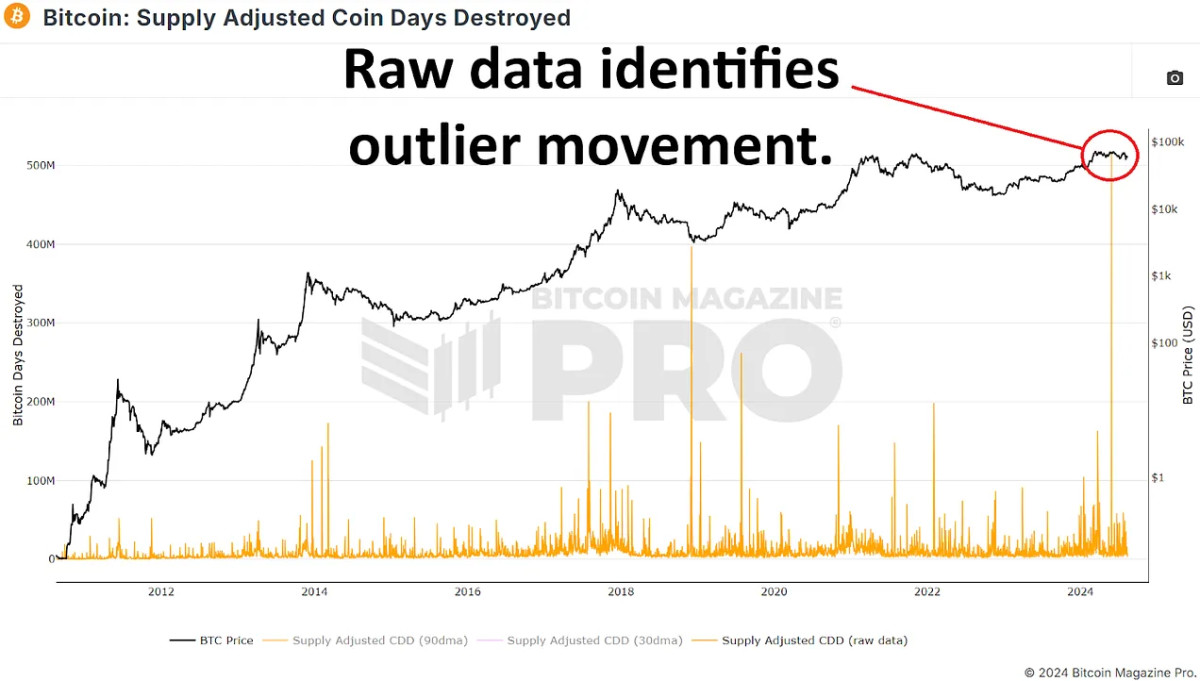

To even more check out the habits of long-lasting holders, we can analyze the Supply Adjusted Coin Days Destroyed metric over the current 155-day duration. This metric procedures the speed of coin motion, providing more weight to coins that have actually been held for prolonged durations. A spike in this metric might suggest that long-lasting holders having a significant quantity of bitcoin are moving their coins, most likely showing more selling instead of collecting.

Recently, we have actually seen a considerable boost in this information, recommending that long-lasting holders may be dispersing instead of collecting BTC. However, this spike is mainly altered by a single enormous deal of around 140,000 BTC from an understood Mt. Gox wallet on May 28, 2024. When we omit this outlier, the information appears a lot more common for this phase in the market cycle, similar to durations in late 2016 and early 2017 or mid-2019 to early 2020.

The Behavior of Whale Wallets

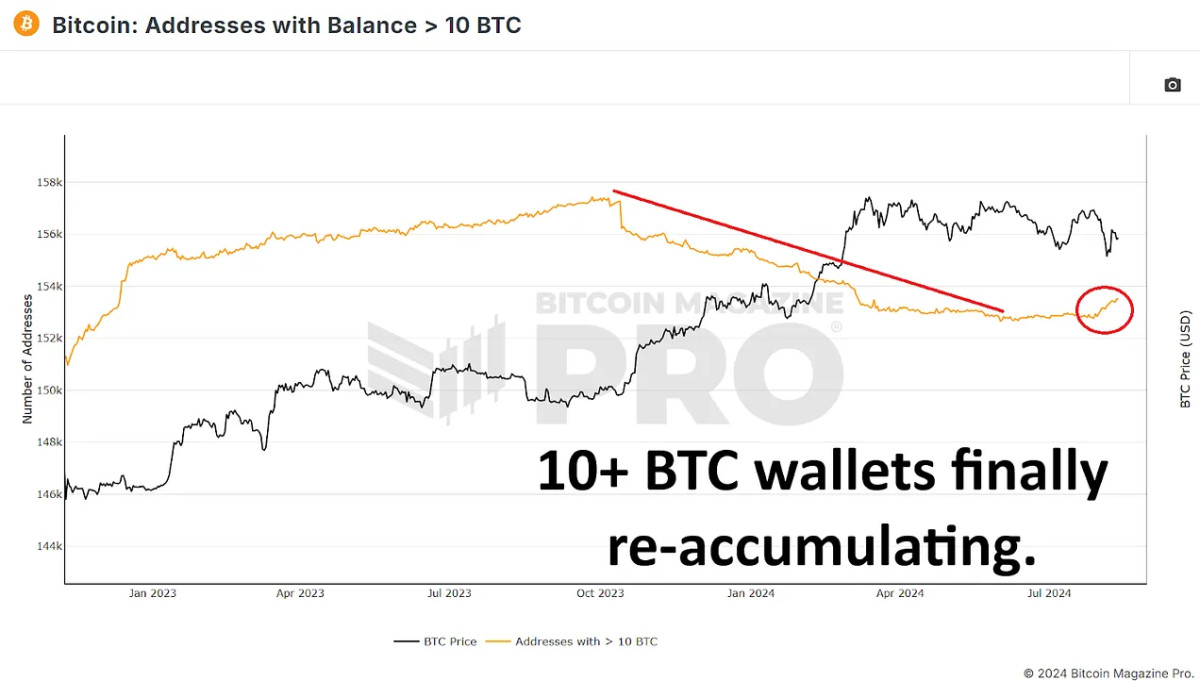

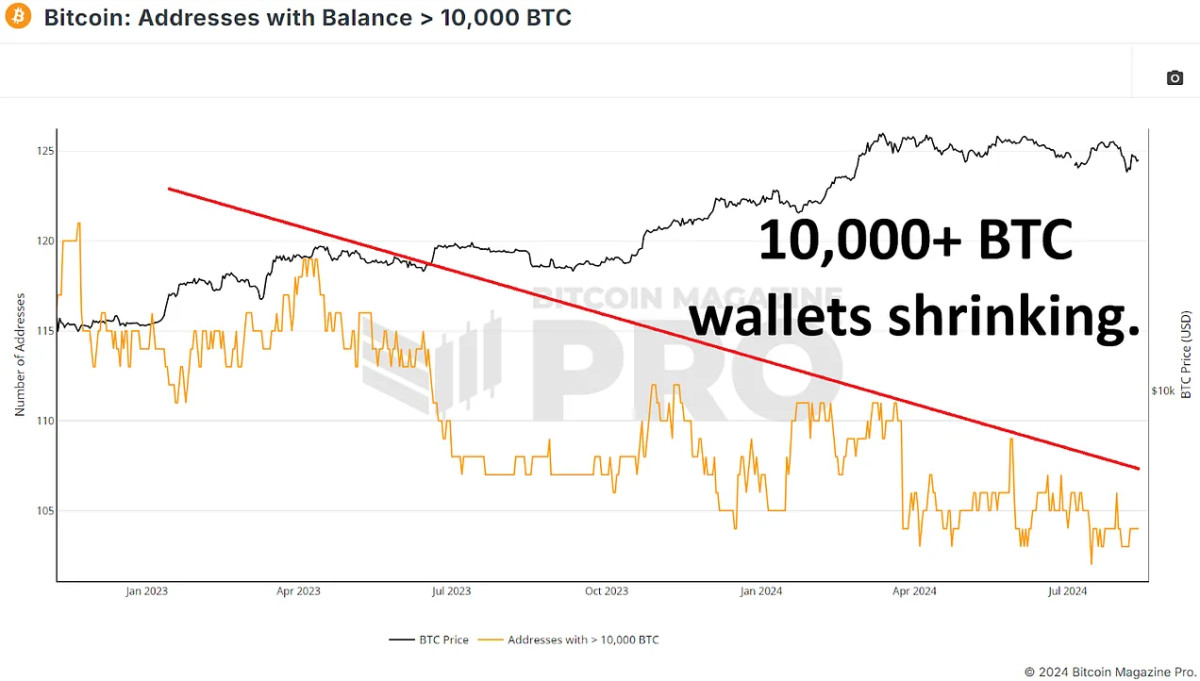

To identify whether whales are buying or offering bitcoin, examining wallets holding considerable quantities of coins is essential. By analyzing wallets with a minimum of 10 BTC (minimum of ~$600,000 at existing rates), we can determine the actions of considerable market individuals.

Since Bitcoin’s peak previously this year, the variety of wallets holding a minimum of 10 BTC has actually somewhat increased. Similarly, the variety of wallets holding 100 BTC or more has also seen a modest increase. Considering the minimum limit to be consisted of in these charts, the quantity of bitcoin built up by wallets holding in between 10 and 999 BTC might represent 10s of countless coins purchased given that our newest all-time high.

However, the pattern reverses when we take a look at bigger wallets holding 1,000 BTC or more. The variety of these big wallets has actually reduced somewhat, showing that some significant holders may be dispersing their BTC. The most significant modification remains in wallets holding 10,000 BTC or more, which have actually reduced from 109 to 104 in the previous months. This recommends that a few of the biggest bitcoin holders are most likely taking some revenue or rearranging their holdings throughout smaller sized wallets. However, thinking about the majority of these incredibly big wallets will usually be exchanges or other central wallets it’s most likely these are a collection of trader and financier coins instead of any one person or group.

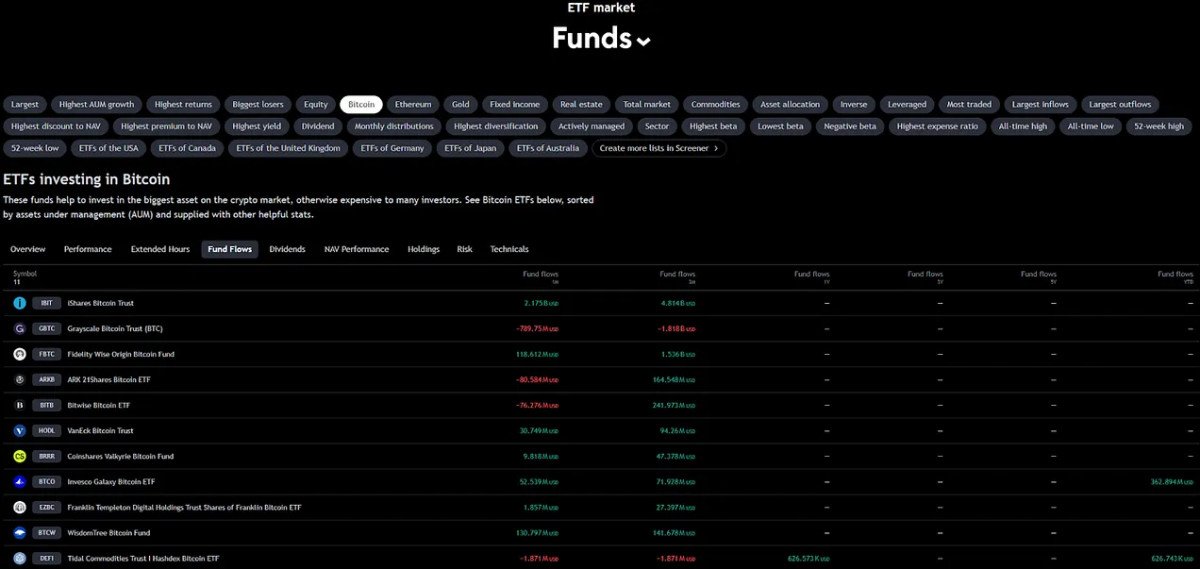

The Role of ETFs and Institutional Inflows

Since reaching a peak of $60.8 billion in possessions under management (AUM) on March 14th, the BTC ETFs have actually seen an AUM reduction of around $6 billion, nevertheless when considering the rate reduction of bitcoin given that our all-time high, this approximately relates to a boost of roughly 85,000 BTC. While this is favorable, the boost has actually just negated the quantity of freshly mined Bitcoin throughout the exact same duration, also 85,000 BTC. ETFs have actually helped in reducing offering pressure from miners and possibly from big holders however have not substantially built up enough to affect the rate favorably.

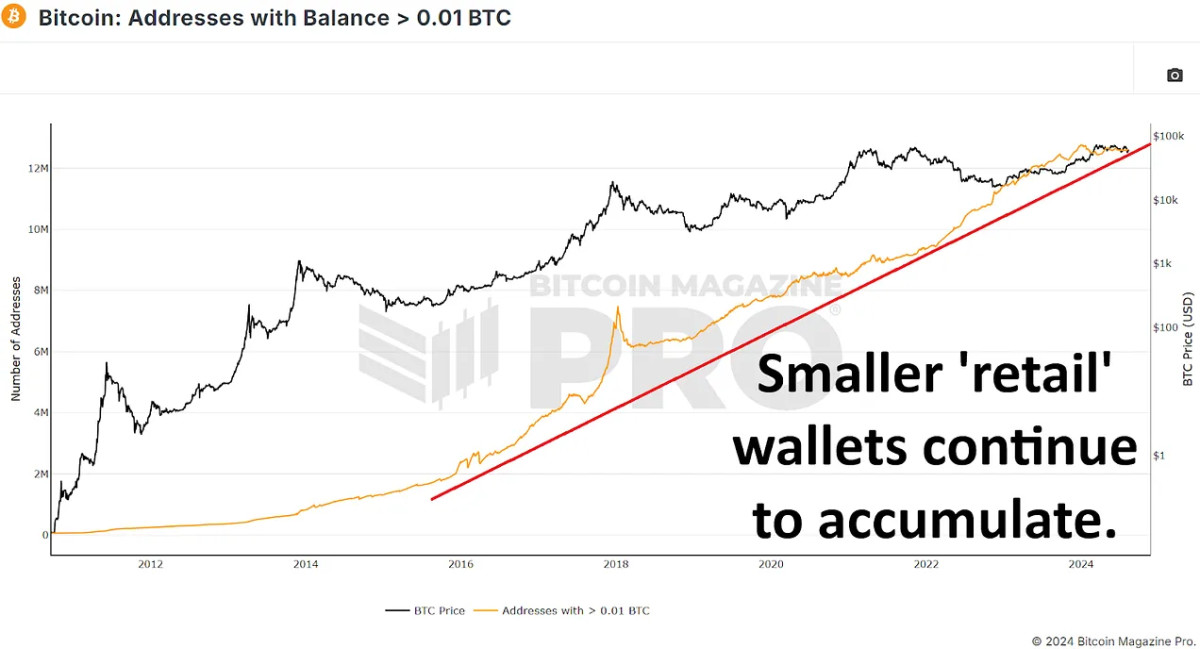

Retail Interest on the Rise

Interestingly, while huge holders seem offering BTC, there has actually been a considerable boost in smaller sized wallets – those holding in between 0.01 and 10 BTC. These smaller sized wallets have actually included 10s of countless BTC, revealing increased interest from retail financiers. There’s been a net modification of around 60,000 bitcoin from 10+ BTC wallets to smaller sized than 10 BTC. This might appear disconcerting, however considering we usually see countless bitcoin switch from big and long-lasting holders to brand-new market individuals throughout a whole bull cycle, this is not presently any cause for issue.

Conclusion

The story that whales have actually been collecting bitcoin on dips and throughout this duration of chopsolidation does not appear to be the case. While long-lasting holder supply metrics at first appear bullish, they mainly show the shift of short-term holders into the long-lasting classification instead of brand-new build-up.

The boost in retail holdings and the supporting impact of ETFs might supply a strong structure for future rate gratitude, specifically if we see restored institutional interest and continued retail inflows post halving, however is presently contributing little to any Bitcoin rate gratitude.

The genuine concern is whether the existing circulation stage takes and sets the phase for a brand-new round of build-up, which might move Bitcoin to brand-new highs in the coming months, or if this circulation of old coins to more recent individuals continues and most likely reduces the prospective benefit for the rest of our bull cycle.

🎥 For a more extensive check out this subject, take a look at our current YouTube video here: Are Bitcoin Whales Still Buying?

And don’t forget to take a look at our other newest YouTube video here, talking about how we can possibly enhance among the very best bitcoin metrics:

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.