As Bitcoin gets in a stage of price discovery when again, market experts and lovers are questioning whether retail financier interest, frequently described as FOMO (worry of losing out), has actually emerged or if it is still waiting for advancement as it did in previous bull cycles. By taking a look at information from active addresses, historic market cycles, and different indications, an examination of the present state of the Bitcoin market and its ramifications for the future will be carried out.

Rising Interest

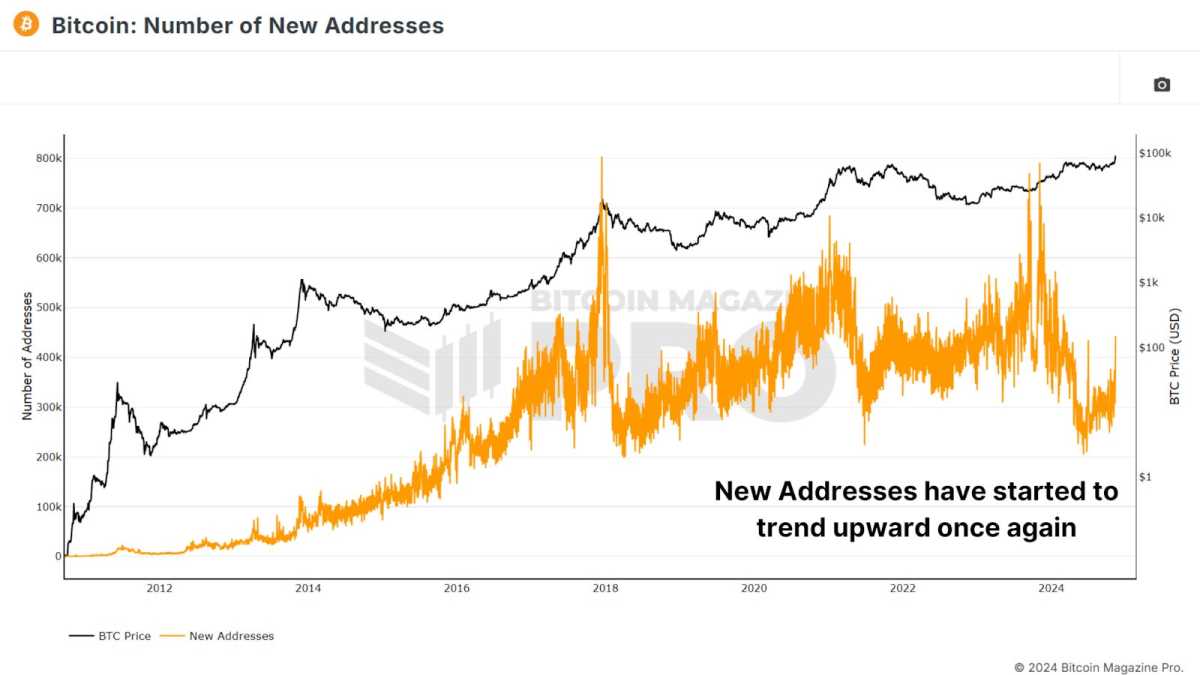

A main sign of retail interest is the development of brand-new Bitcoin addresses. Traditionally, considerable rises in brand-new address registrations have actually declared the start of booming market as brand-new retail investors get in the fray. However, the present development in brand-new addresses has actually not shown the sharp boost that may be expected. Last year, the Bitcoin network experienced around 791,000 brand-new addresses developed in one day, showing considerable retail engagement. Presently, the numbers stay substantially lower, although a small uptick has actually been observed just recently.

View Live Chart 🔍

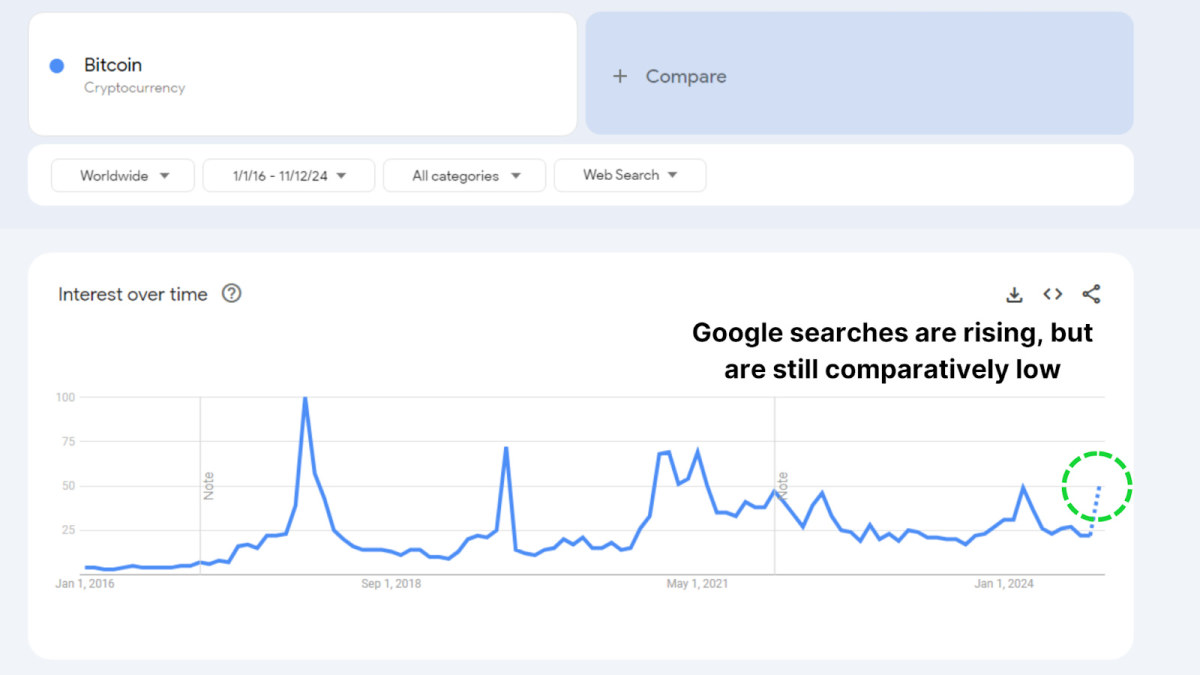

Data from Google Trends also echoes this soft level of interest. Although search questions for “Bitcoin” have actually increased over the last month, they stay considerably below peaks observed in 2021 and 2017. This recommends that while retail investors are showing a restored interest, there has yet to be the extreme eagerness normal of FOMO-driven markets.

Supply Shift

A notable pattern is the steady shift of Bitcoin from long-lasting holders to more recent, short-term investors. This shift in supply might show the possible start of a brand-new market stage, where skilled holders start profit-taking and offer to brand-new individuals. Nevertheless, the overall volume of Bitcoin being moved stays restricted, recommending that long-lasting holders continue to keep their properties regardless of present market gains.

View Live Chart 🔍

Historically, throughout the previous bull run from 2020 to 2021, considerable outflows from long-lasting holders to more recent market entrants stimulated a price rally. Presently, this transitional motion is very little, showing that long-lasting holders stay mainly undisturbed by dominating price levels and are selecting to preserve their Bitcoin holdings. This hesitation to offer shows a self-confidence in the possession’s future capacity for gratitude.

A Spot-Driven Rally

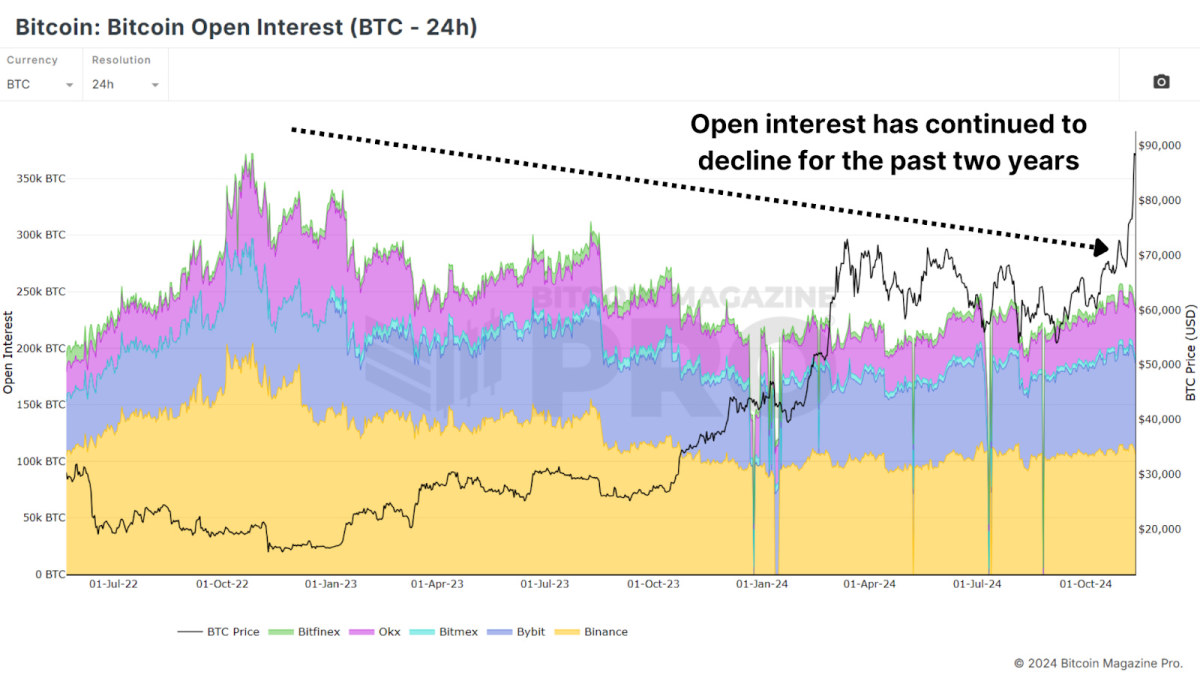

One noteworthy attribute of Bitcoin’s current rally is its spot-driven nature, contrasting with previous booming market that were primarily sustained by leveraged positions. The open interest in Bitcoin derivatives has just knowledgeable small boosts, varying considerably from previous highs. For example, open interest was substantially popular prior to the FTX crash in 2022. A spot-driven market, defined by restricted take advantage of, tends to display higher stability and durability, with lowered danger of forced liquidations amongst investors.

View Live Chart 🔍

Big Holders Accumulating

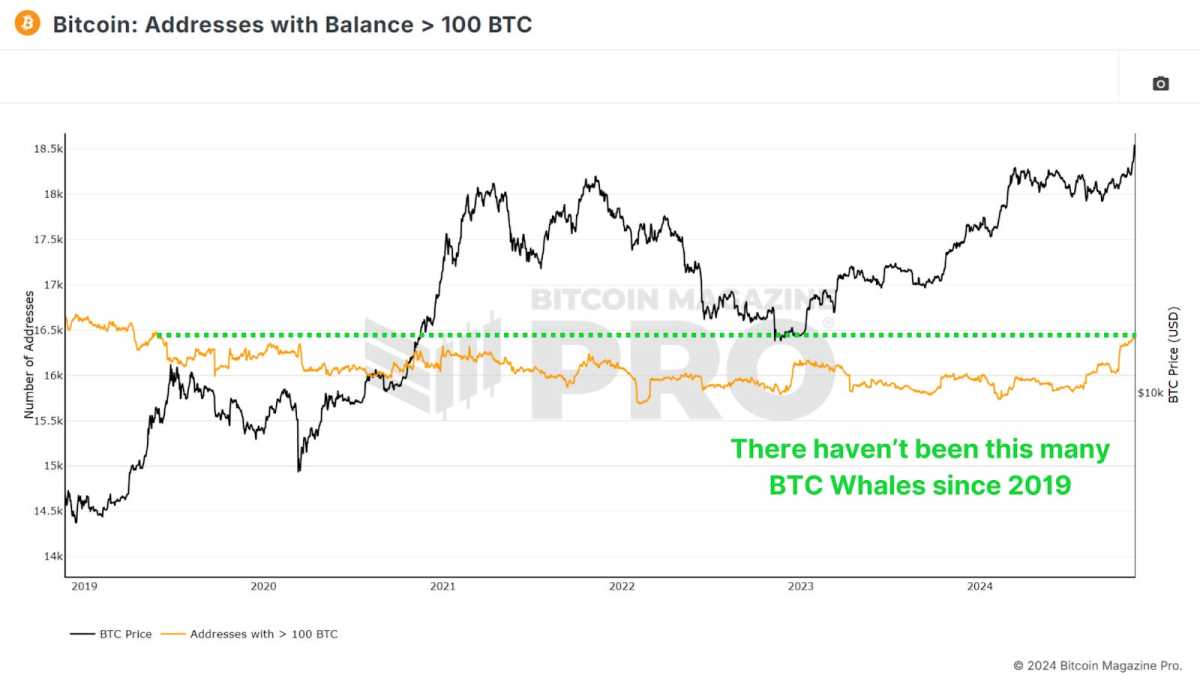

Interestingly, while retail addresses have actually disappointed significant development, “whale” addresses, specified as those holding a minimum of 100 BTC, have actually been on the increase. In current weeks, wallets with big BTC holdings have actually collected 10s of countless coins, representing billions of dollars in worth. This pattern suggests self-confidence amongst Bitcoin’s biggest investors concerning the capacity for additional price boosts, even as Bitcoin approaches all-time highs.

View Live Chart 🔍

In previous bull cycles, considerable sell-offs or decreases in positions by whales generally happened near market peaks. This habits has actually not yet been observed in the present market, recommending that the continued build-up by knowledgeable holders is a robust bullish sign, showing strong belief in Bitcoin’s long-lasting potential customers.

Conclusion

Although Bitcoin’s climb to all-time highs has actually reignited interest, the market has yet to witness extensive signs of retail FOMO. Current retail involvement appears fairly suppressed, suggesting that this rally might be in its early phases. The steadfastness of long-lasting holders, the build-up by whales, and the restrained take advantage of within the market all add to a photo of a healthy and sustainable rally.

As the present bull cycle advances, the dominating market structure recommends that the capacity for a significant surge driven by retail interest lies ahead. Should this interest certainly emerge, it might raise Bitcoin to unmatched heights.

For a more detailed assessment of this subject, the audience is motivated to see a current YouTube video entitled, “Has Retail Bitcoin FOMO Begun?”

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.