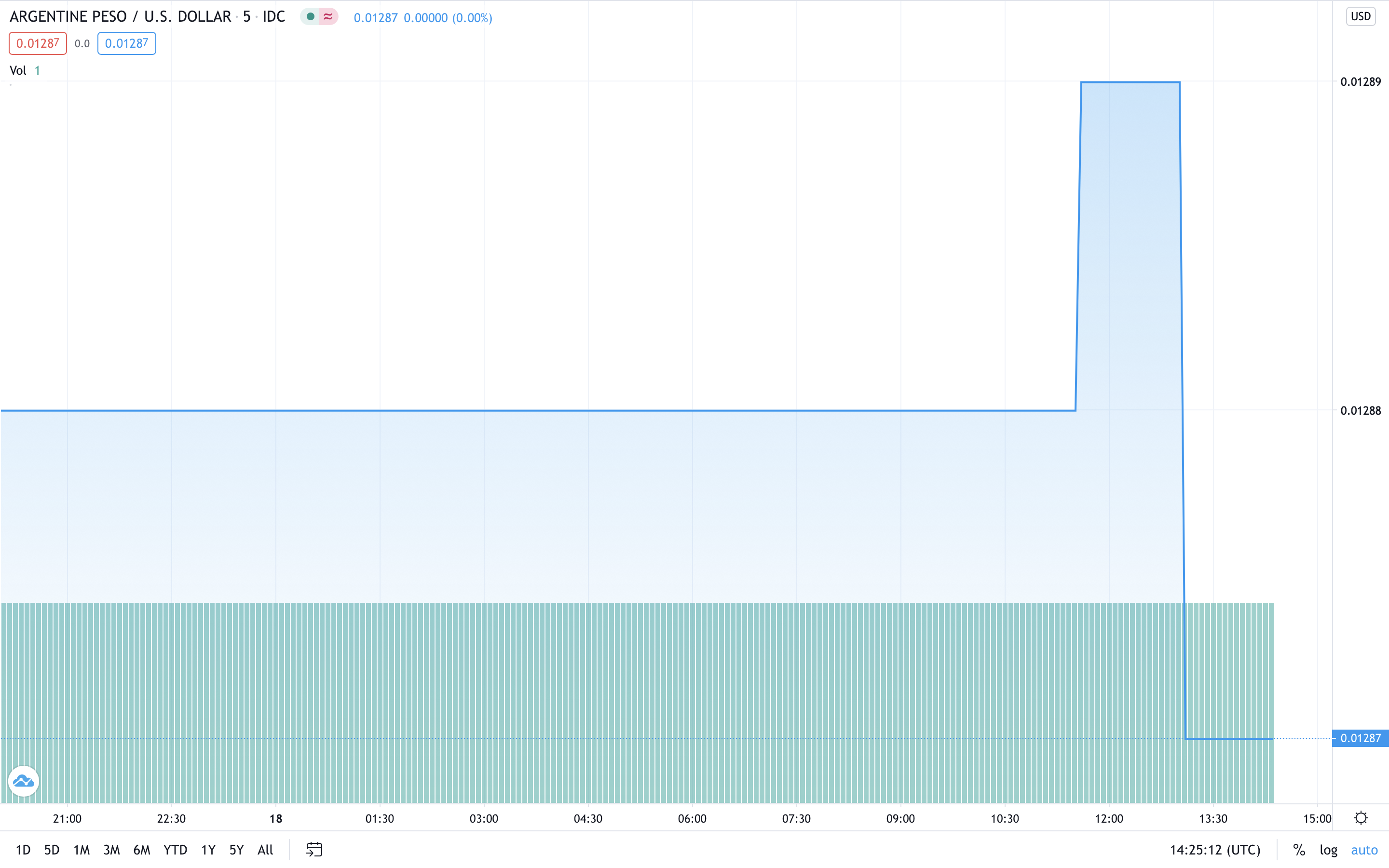

The Argentine peso plunged by more than 10% quickly after the nation’s reserve bank revealed procedures to tighten up controls on the motion of foreign currency. The peso, which is formally pegged at 72 for every single USD, touched brand-new lows of 145 to the greenback on the black market. The most current plunge is viewed as an additional increase to bitcoin and other cryptocurrencies in a nation that has actually been pestered by currency obstacles for over a century.

Still, in a declaration launched on its Spanish language site, the Board of the Central Bank of the Argentine Republic (BCRA) validates the brand-new procedures stating they are an effort “to promote a more effective allowance of foreign currency.” Loosely equated, the declaration goes on to state:

Federal Administration of Public Revenues (AFIP) has actually developed a “system for the collection of taxes on earnings and on individual possessions at a rate 35% for external possession development operations (FAE) by people along with on purchases with cards (debit and credit) in foreign currency.

The goals of the brand-new procedures are to “keep the present quota of $200 monthly whilst preventing the hoarding foreign currency and card expenditures.”

Crisis packed Argentina remains in its 3rd year of a financial recession partially blamed on the nation’s unsustainable external financial obligation levels. BCRA confesses that the maintenance of these commitments is having an undesirable result on the nation’s currency exchange rate.

Consequently, the brand-new procedures also look for to “develop standards for a renegotiation of the personal external financial obligation suitable with the regular operation of the exchange market.”

However, as formerly reported by news.Bitscoins.web, Argentina together with Venezuela, are 2 Latin American nations that are seeing their fiat currencies decline due to extreme printing of cash which triggers inflation.

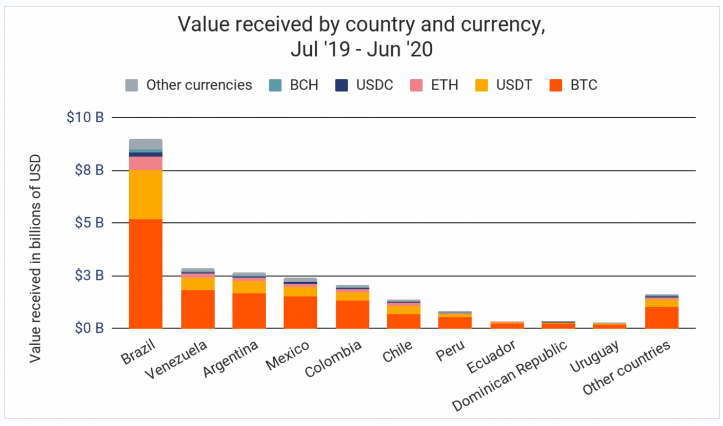

Quoting a Chainalysis research study, the very same report notes that Argentina’s imposition of limitations on the quantity of U.S. dollars that citizens can purchase monthly even more limits offered alternatives of protecting cost savings from inflation. According to experts from the area like Sebastian Villanueva of Chilean crypto exchange, Satoshitango, it is such limitations that are assisting to stimulate on using cryptocurrencies in the nation.

The Chainalysis research study currently ranks Argentina as the nation with the third-highest worth of cryptocurrency got in between July 2019 and June 2020, simply under $3 billion.

Meanwhile, some Argentine citizens responding to the statement by BCRA accept the idea that the current policy modifications will press more towards cryptocurrencies. One person who shares this viewpoint is reporter, Emiliano G. Arnáez. The reporter has actually formerly tweeted how succeeding Argentinian federal governments have actually stopped working the economy and how bitcoin can be an option that his compatriots can utilize.

In his remarks, Arnáez promotes how the primary qualities of bitcoin make the digital currency a much better option to the nation’s fiat currency:

“Remember: if you have Bitcoin, they have their own Central Bank. With cryptocurrencies, there are no stocks, with stablecoins, there are no exchange constraints. They (cryptocurrencies) have a high threat, naturally, they do, however the Argentine economy often appears to be riskier and is (consistently) hacked by the federal governments themselves.”

Another Twitter user, Ramiro Marra confirms the instant effect BCRA’s statement after tweeting that the “crypto dollar is currently at 160. It is going to be an extremely tough day.”

The comments by Argentine citizens declare Villanueva’s earlier assertions that “individuals simply desire a safe method to save cash, and there are no gatekeepers in crypto.”

What do you think of Argentina’s most current currency concerns? Tell us your ideas in the comments area below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.