Since the creation of Bitcoin, federal governments have actually attempted to track all the deals occurring on the general public blockchain. As the years advanced, authorities have actually revealed a distaste for cryptocurrency mixing applications like Coinjoin. On Dec. 19, a Binance consumer couldn’t withdraw his bitcoin due to the fact that the exchange informed him he utilized the mixing wallet Wasabi. Eventually, the consumer got his funds back, however just after assuring not to deposit to a toppling wallet once again.

Also Read: European Crypto Exchange Bitbay Ends Monero Trading due to Anonymity Features

Coin Tumbling Users Beware

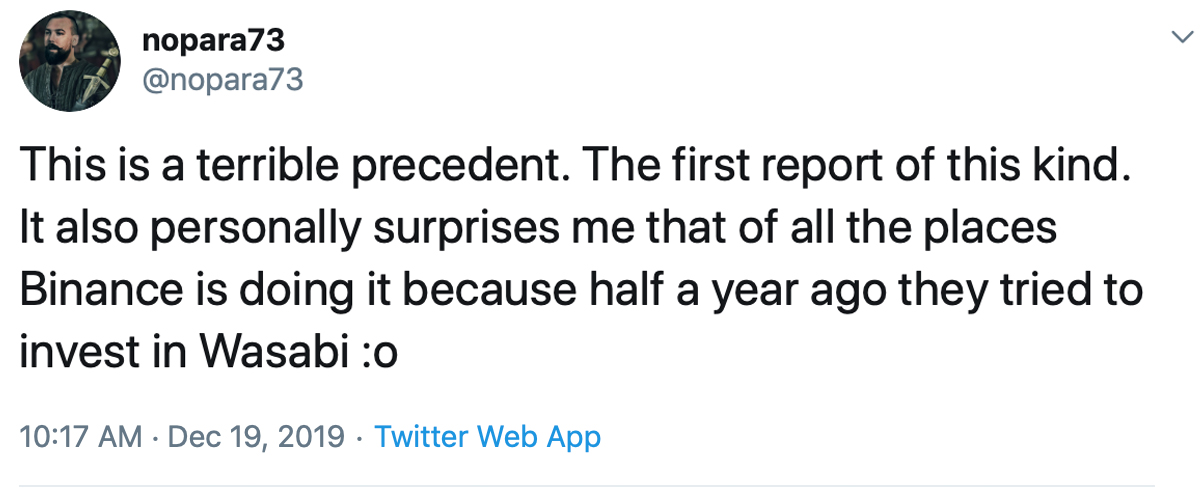

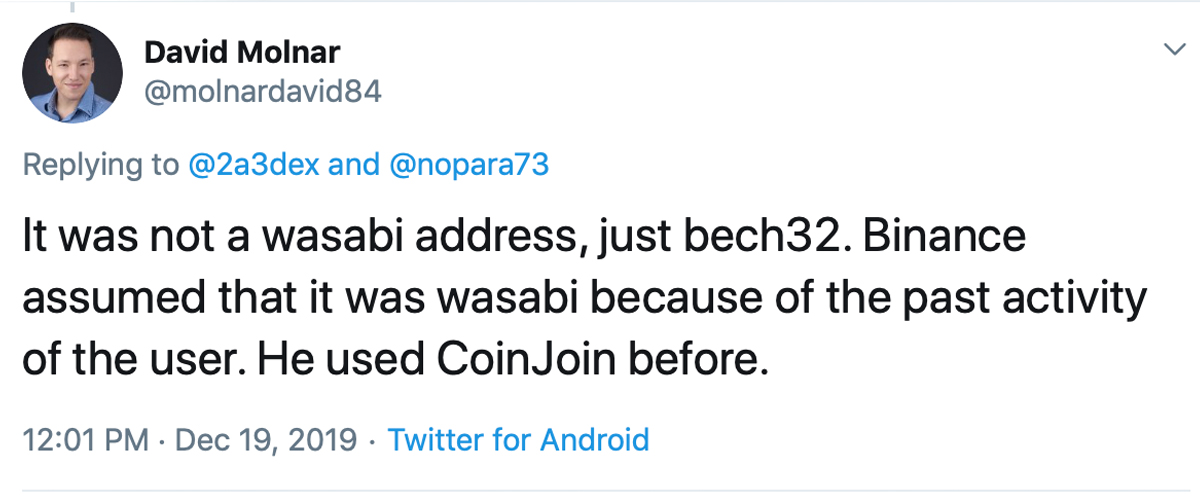

The fight for cryptocurrency privacy is upon us and federal governments are attacking the extremely decentralized structures created to bypass their so-called authority. Last Thursday, a Binance consumer discussed on Twitter that his funds were frozen due to the fact that he was withdrawing to a wallet that blended his UTXOs. “Bitcoiners be cautioned: this is what occurs if Binance discovers you withdrawing to Wasabi wallet,” the Binance customer tweeted. The consumer called @Bittlecat stated he wasn’t shocked to learn his deals were tracked, however worried that he was extremely worried that Binance understood he was sending out to Wasabi. After informing the general public about the event, Bittlecat said that he got his BTC back. “I got my [satoshis] back, however not without appealing Big Brother I wouldn’t mix those UTXOs,” he mentioned. Bittlecat included:

It is truly unfortunate that [Coinjoin] is viewed as criminal activity, and I’m grateful that we are discussing this.

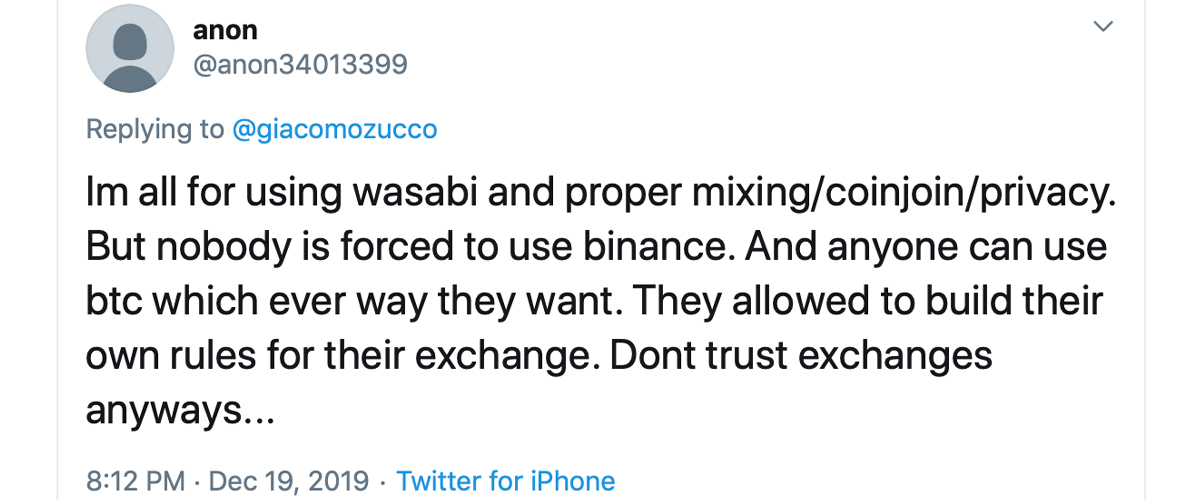

Bittlecat’s tweet, naturally, rapidly made its method throughout social networks and crypto online forums, ending up being a viral subject in a matter of no time at all. Binance CEO Changpeng Zhao (CZ) replied to Bittlecat’s tweet and divulged that the exchange runs under regulative standards. “Binance SG runs under the requirements stated by MAS and our MAS managed partner, Xfers. Hence there are AML CFT manages embeded in location,” CZ reacted. “Not something for us to choose [and] I think they have actually currently connected to you to clarify and describe.” The Wasabi user responded to CZ’s reaction and stated that he anticipated the CEO to “decentralise the blame.” “How does this policy make good sense, when Binance has currently KYC-ed me?” he asked. “Mixing is not prohibited, it’s personal privacy.”

Governments Dislike Crypto Mixers and UTXO Tumblers

A variety of crypto advocates believe that problems like the Wasabi/Binance issue are simply the start of a big uphill struggle for personal privacy. Governments around the world and the Financial Action Task Force (FATF) are preparing to punish exchanges after FATF galvanized the reality that the “Travel” guideline will definitely use to cryptocurrencies. For years now, federal governments have actually targeted tools like BTC mixers and tumblers (Coinjoin-based) to eliminate versus so-called cash laundering and terrorist funding. For circumstances, in January 2017, a group of authorities from Europol, Interpol, and the Basel Institute on Governance satisfied in Doha, Qatar and went over the subject of crypto mixers. During the two-day occasion, individuals going to the anti-crime concentrated conference had a variety of suggestions consisting of taking apart crypto tumbler services. The Basel Institute’s press declaration firmly insisted:

All nations are encouraged to do something about it versus digital currency mixers/tumblers. Such services are created solely to anonymize deals and to make it difficult for police to find and trace suspicious deals. The presence of such business need to not continue to be endured.

Since then, police authorities have actually acted versus digital currency mixers. Furthermore, a couple of online mixing services on clearnet and the deep web chose to close down services in worry of criminal charges. For circumstances, after the takedown of the 2 darknet markets Alphabay and Hansa, the exceptionally popular Bitmixer.io willingly closed operations in July 2017. Two years later on, in May, the operation Bestmixer.io was taken by Europol and the Dutch Fiscal Information and Investigation Service (FIOD). At the time, Dutch authorities implicated the Bestmixer administrators of mixing 27,000 BTC. A month later on, in June 2019, the BTC toppling service Bitcoin Blender willingly bailed out and closed its operations.

After a variety of digital currency mixer/tumbler services bit the dust, cryptocurrency designers have actually produced in-wallet platforms that enable users to blend UTXOs in a noncustodial style. For BTC, there are popular mixing wallets like Samourai and Wasabi wallet and bitcoin money (BCH) users have access to Cashshuffle. Moreover, BCH designers are enhancing Cashshuffle with a procedure called Cashfusion. Additionally, as federal governments and regulators have actually threatened exchanges who wear’t abide by AML/KYC standards, a myriad of trading platforms have actually delisted cryptos with privacy-centric qualities like monero (XMR), and zcash (ZEC). Officials from Japan pressured Japanese exchanges to delist personal privacy coins and a variety of other worldwide exchanges have actually dropped digital currencies that offer privacy.

FATF Rules Will Further Disrupt Privacy Advocates and the Anonymous Crypto Applications They Use

People think exchanges delisting personal privacy coins, police punishing mixers, and the current concern with a Binance consumer utilizing Wasabi is simply more signals of a FATF-driven program versus cryptocurrencies. Individuals and companies understood huge modifications were following the June G20 leaders’ top ended in Japan. At the time, G20 individuals consisting of leaders from the EU, U.S., Germany, Japan, South Korea, the U.K., and India declared that the FATF guidelines would use to the digital currency community. By this spring of 2020, the entire cryptocurrency environment might look totally various due to the FATF regulations and naturally anything to do with personal privacy, like utilizing mixers like Wasabi, will be discredited.

What do you consider Binance freezing a consumer’s BTC due to the fact that they utilized the Wasabi wallet to blend UTXOs? Let us understand what you consider the FATF-driven program versus privacy and cryptocurrency use? Do you believe regulations will get much even worse? Let us understand what you consider this topic in the comments area below.

Image credits: Shutterstock, Binance and Wasabi Logos, Fair Use, Wiki Commons, and Twitter.

Verify and track bitcoin money deals on our BCH Block Explorer, the very best of its kind throughout the world. Also, stay up to date with your holdings, BCH, and other coins, on our market charts at Bitscoins.web Markets, another initial and complimentary service from Bitscoins.web.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.