Shaken by the nonstop legend around Brexit and the worldwide downturn, the British economy is now revealing indications that indicate an approaching crisis. The U.K.’s most significant banks have actually been handling a growing variety of lenders are having a hard time to settle. At the exact same time, low rates of interest on home loans are restricting chances for income development.

Largest Lenders Write Off More Debt Than a Year Ago

The United Kingdom’s biggest loan providers have actually been crossing out more loans than they were in 2015, another indicator that numerous organisations are injuring in a degrading financial environment. In Q3 of 2019, writedowns on uncollectable bill at 4 significant British banks increased 51% from the exact same quarter of 2018, the Daily Mail reported pricing quote business figures.

The quantity of nonperforming loans that have actually been crossed out by RBS, Lloyds, HSBC, and Barclays in between July and September reached £1.76 billion (approx. $2.27 billion). During the exact same duration in 2015 it was around £1.17 billion ($1.51 billion), an analysis carried out by U.K.-based monetary services business AJ Bell reveals.

The distinction of nearly £600 billion has actually been credited to the intensifying financial conditions that are adversely impacting a growing number of business running in the nation. One such example is the British worldwide travel group Thomas Cook which collapsed in September.

An overall of 4,355 organisations were not able to pay their financial obligations in the 3rd quarter, according to main information from the U.K. federal government’s Insolvency Service. That’s the greatest number in 5 years tape-recorded by the London-headquartered executive firm of the Department for Business, Energy and Industrial Strategy.

Low Interest Rates to Further Squeeze Bank Revenues

Bad loans are not the only difficulty the United Kingdom’s leading loan providers are presently dealing with. According to the publication, the banks have also alerted they anticipate their profits to be adversely impacted by the low home mortgage rates which are nearing their record lows at the minute.

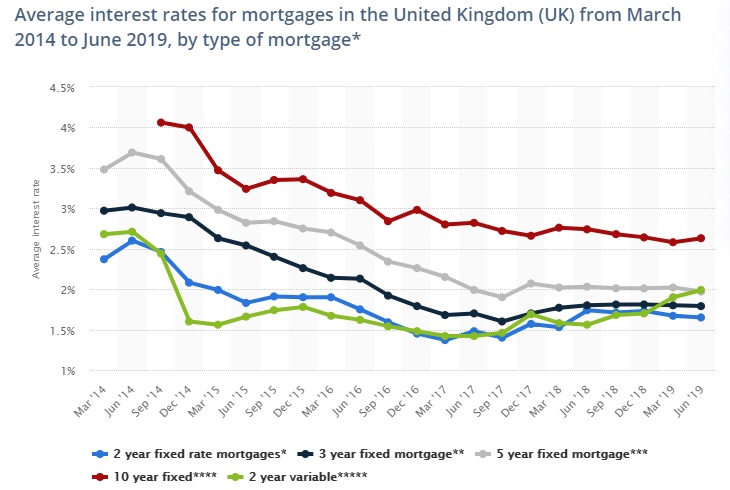

According to a research study released by market information supplier Statista, rates of interest on home loans in Britain have actually been constantly decreasing for the previous 5 years. In June 2019, two-year set rate home loans were at 1.65%, below 2.60% in the summertime of 2014. The two-year variable rate of interest has actually dropped from 2.71% to 1.99. The 10-year repaired rate has actually reduced from 4.06% in September 2014 to 2.63% this past June.

Credit organizations can barely raise rates on home loans today as the base rate of interest set by the Bank of England is just 0.75%. It has actually stayed below 1% since the reserve bank’s Monetary Policy Committee sufficed in 2009 to 0.5% where it remained for around 7 years. The typical variable home mortgage rate at the time was 2.5%. The rate was dropped to its most affordable ever mark of 0.25% in August 2016.

Although the expense of loaning was raised in August 2018 to 0.75%, its greatest level considering that early 2009, severe issues stay concerning the state of the British economy and its point of views. After another not successful effort to leave the European Union, the U.K. is now heading towards its 3rd basic election in 5 years, which is developing more unpredictability for its economy currently compromised by the worldwide financial downturn.

Against this background, things have actually been establishing in a different way in the nascent crypto banking sector where loans backed with digital possessions and cryptocurrency deposits are taking pleasure in growing appeal. Platforms such as Cred use customers a chance to make as much as 10% interest on their holdings in BTC and BCH and obtain utilizing their crypto as security. Cred also supplies options to unbanked service sectors.

Do you believe the growing quantity of bad loans in Britain is a indication of an approaching recession? Share your ideas on the topic in the comments area below.

Do you require a reputable bitcoin mobile wallet to send out, get, and keep your coins? Download one free of charge from us and after that head to our Purchase Bitcoin page where you can rapidly purchase bitcoin with a charge card.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.