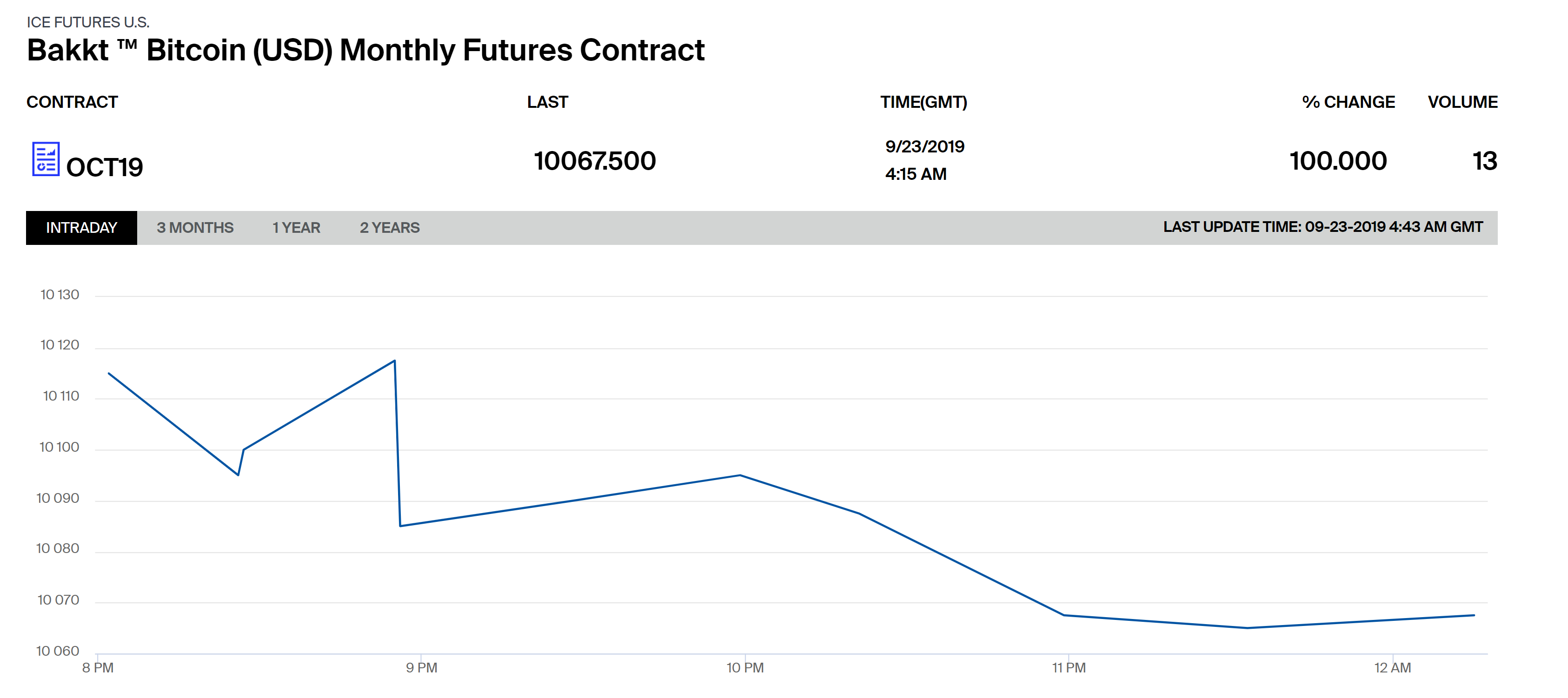

Trading is now live for Bakkt’s regulated, physically-delivered everyday and regular monthly bitcoin futures, with the very first trade carried out at 8: 02 pm ET on Sunday. Customers’ bitcoins are saved in the Bakkt Warehouse, a certified custodian, regulated by the New York State Department of Financial Services. Bakkt is powered by Intercontinental Exchange, owner of the New York Stock Exchange.

Bakkt’s Bitcoin Futures Now Live

Bakkt, a much-hyped digital possession platform powered by Intercontinental Exchange Inc. (ICE), the moms and dad business of the New York Stock Exchange (NYSE), started trading its physically-delivered bitcoin futures items Sunday. The Bakkt Bitcoin (USD) Daily Futures Contract and the Bakkt Bitcoin (USD) Monthly Futures Contract are now trading on ICE Futures U.S., among the world’s biggest products markets, and cleared by ICE Clear U.S. The 2 ICE platforms are available by competent market individuals both in the U.S. and globally. Bakkt tweeted not long after launch:

We’re live! The very first Bakkt Bitcoin Futures trade was carried out at 8: 02 pm ET at a cost of $10,115.

Institutional traders now have a market for physically-delivered bitcoin futures, which suggests that real bitcoins are kept in Bakkt’s storage facility and will be provided at the expiration of the agreement.

Bakkt has actually introduced its bitcoin futures items ahead of 2 other CFTC-regulated exchanges: Ledgerx and TD Ameritrade-backed Erisx. Cash-settled bitcoin futures are presently readily available on the Chicago Mercantile Exchange (CME), which just recently revealed its strategies to release alternatives on bitcoin futures agreements in the very first quarter of 2020, pending regulative evaluation.

About Bakkt’s Bitcoin Futures

ICE Futures U.S. has actually formerly exposed some requirements for purchasing Bakkt’s brand-new items. For both everyday and regular monthly agreements, there is a “hedge preliminary requirement” of $3,900 and “speculative preliminary requirement” of $4,290. The inter-month add-ons hedge rate for both items varies in between $400 and $1,000, and in between $440 and $1,100 for the speculative rate. “The margin rate differs within the variety by the expiration dates and the distinction in expiration dates of agreements,” the business explained. Each agreement size is one BTC.

Customers’ bitcoins are saved in the Bakkt Warehouse, run by Bakkt Trust Company Llc, a certified custodian which is regulated by the New York State Department of Financial Services (DFS). “The Bakkt Warehouse is consisted of both online (‘warm’) and offline, air-gapped (‘cold’) digital possession storage,” the business detailed, including that its system algorithmically stabilizes in between the 2 to lessen threats related to online wallets. Both types are covered by a $125,000,000 insurance plan from a leading worldwide distribute. Further, Bakkt boasts “Bank-level AML/KYC policies, coupled with substantial blockchain security.”

ICE Inc. initially revealed its strategy to form Bakkt in August in 2015, with an objective to deal with a variety of business consisting of BCG, Microsoft and Starbucks, according to its filing with the U.S. Securities and Exchange Commission (SEC). They objective “to produce an incorporated platform created to make it possible for customers and organizations to purchase, offer, shop and invest digital properties on a smooth worldwide network,” the file reveals. Bakkt initially prepared to release in December in 2015 however dealt with regulative obstacles, consisting of the federal government shutdown at the start of the year.

Licensed and Regulated

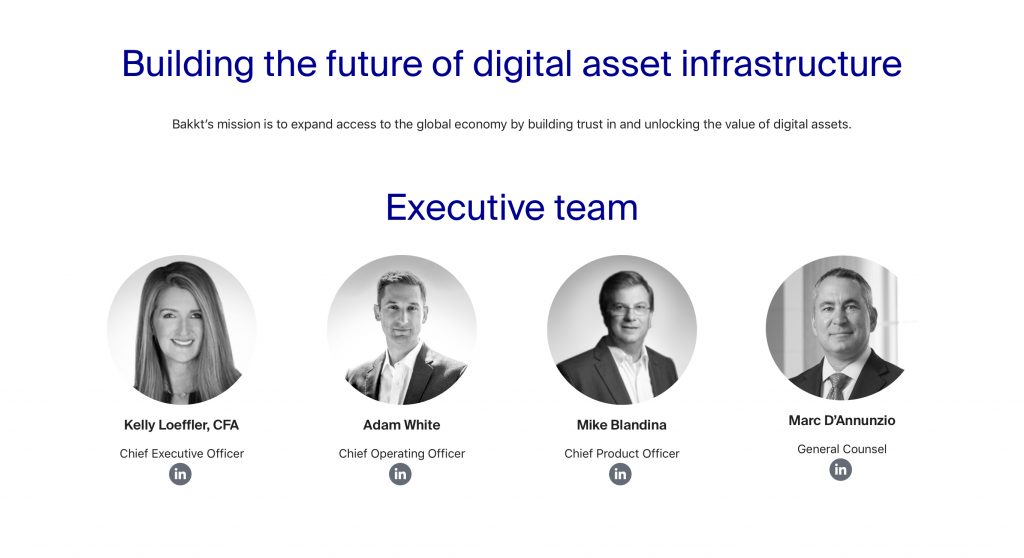

Bakkt had actually been awaiting approval from the DFS in order to totally release its items. The regulator revealed on Aug. 16 that it has actually given a charter under New York Banking Law to Bakkt Trust Company Llc to run as a restricted liability trust business. “DFS has actually licensed Bakkt to offer custody services for bitcoin in combination with the launch of physically provided bitcoin futures agreements,” the regulator explained. “Bakkt will serve institutional clients; its bitcoin futures agreements will be noted for trading on Intercontinental Exchange (ICE) Futures U.S. and cleared through ICE Clear U.S.” The business’s COO, Adam White, clarified:

This now allows us to use institutional-grade custody through the Bakkt Warehouse together with the federally regulated Bakkt Bitcoin Futures agreements.

Both Bakkt’s everyday and regular monthly futures are certified with the regulative requirements of the Commodity Futures Trading Commission (CFTC), the business validated. They also adhere to the requirements of ICE Futures U.S. and ICE Clear U.S. The previous is a CFTC-regulated Derivatives Clearing Organization, while the latter a CFTC-regulated Derivatives Clearing Organization. In addition, Bakkt Trust Company Llc is signed up with the Financial Crimes Enforcement Network (Fincen).

Potential Impact

While the real effect Bakkt will have on bitcoin markets stays to be seen, CEO Kelly Loeffler informed Fortune in an interview that “The funds that trade on our exchanges revealed to us that they put on’t desire to handle today’s uncontrolled markets, and desire end-to-end federal oversight, on the level of the NYSE, to feel safe trading in bitcoin.” Claiming that possession supervisors informed her that bitcoin might be a benefit for stabilizing their portfolios if it is safe enough, she was estimated as stating:

Bitcoin’s volatility is a huge unfavorable for retail deals today, however not for institutional financiers … A great deal of products that funds utilize as alternative financial investments are extremely unstable.

“Pension funds, for instance, are diversifying into options,” COO White mentioned. He thinks that “Regulated bitcoin futures might be part of their financial investment required, given that they have various connections with both stocks and bonds, and other options such as gold.” Loeffler included that she anticipates great deals of action from retail brokerage companies, specifying that “The brokers are constantly searching for an edge to bring in brand-new clients, and offering bitcoin might have great deals of appeal.” She also anticipates interest from college endowments and pension funds, given that “They’re the ones who are normally in the leading edge in embracing brand-new financial investment concepts.”

What do you consider Bakkt’s bitcoin futures launch? How much effect do you believe Bakkt will have on the marketplaces? Let us understand in the comments area below.

Did you understand you can purchase and offer BCH independently utilizing our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The Local.Bitscoins.net market has countless individuals from all around the world trading BCH today. And if you require a bitcoin wallet to safely keep your coins, you can download one from us here.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.