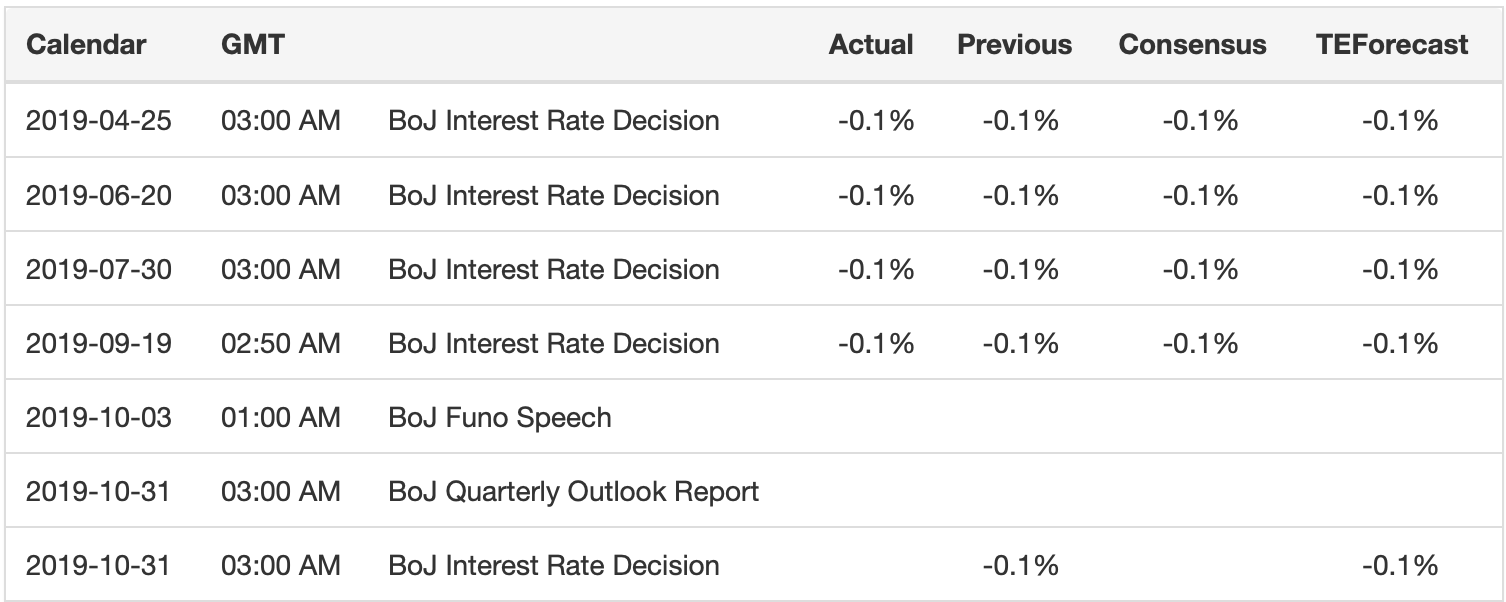

In a current rate evaluation conference of the Bank of Japan (BoJ), bank guv Haruhiko Kuroda and others on the nine-member board prompted leaving all choices on the table, where more cuts to the nation’s negative rate of interest are worried. The talk of more stimulus shows an ever-growing trend on the planet economy to slash rates and synthetically pump brand-new cash into markets. For some financial experts the trend is worrying, offered the declines that have actually traditionally followed such steps.

Also Read: Central Banks in Panic Mode – Extreme Tactics Like Helicopter Money Discussed

Kuroda’s Halloween Surprise

Following the September 19 BoJ conference, Kuroda commented: “If it’s a concern of whether I’m more likely to proceed with alleviating than at the last conference, yes, that’s right,” verifying the worries of minority dissenters on the board who see the capacity October 31 choice as a misstep. With local banks in Japan currently combining as an outcome of continual monetary difficulty, some see the talk as a bad prophecy. The nationwide sales tax also leaps from 8% to 10% today, October 1 (having actually last been treked in April 2014), raising more issue that using more stimulus is not a sustainable option. In a quote to keep 10-year Japanese Government Bond (JGB) yields at 0%, the board reported it will buy the bonds; the main conference declaration stating:

The Bank will buy Japanese federal government bonds (JGBs) so that 10-year JGB yields will stay at around no percent.

The report also kept in mind that “Downside dangers worrying abroad economies appear to be increasing, and it also is essential to pay attention to their effect on companies’ and families’ belief in Japan.” Citing the continuous U.S. trade war with China and the U.K.’s Brexit, the declaration took into consideration negative impacts coming from these occasions. Noticeably unmentioned, nevertheless, was the increased rate of interest slashing by the U.S. Federal Reserve and negative yields and rates of interest in the Eurozone contributing even more to global slump.

The declaration did note that since “downturns in abroad economies have actually continued to be observed and their drawback dangers appear to be increasing, the Bank judges that it is ending up being essential to pay closer attention to the possibility that the momentum towards attaining the rate stability target will be lost.” The response to maintaining this momentum is seemingly more rate cuts.

Similar Policy Elsewhere

The European Central Bank’s (ECB) refinancing operations rate presently sits at no, while the deposit rate was reduced 10 basis indicate an unmatched low of -0.5% in September. Banks throughout the Eurozone are having a hard time to simply tread water, using unconventional strategies to soften the blow, such as motivating clients to use fiduciary call deposits to prevent charges.

Across the Atlantic, things in the U.S. aren’t looking a lot more appealing. After a July 31 cut from 2.50% to 2.25%, the Fed more chainsawed rates to 2%, with U.S. president Donald Trump still unhappy, calling vociferously for “rates of interest down to ABSOLUTELY NO, or less.” Australia and New Zealand are marching in lockstep with the global motion towards sub-zero area as well, the RBA striking a record low of 1% in September (to make a brand-new choice October 1) and the Reserve Bank of New Zealand cutting rates in August by 0.5%.

The BoJ’s talk might sound favorable, as political and pseudo-economic feel-good rhetoric constantly does, however there are just a lot of methods to put lipstick on a pig, and eventually the aggregate of years of negative and low-rate policy worldwide might come house to roost, as they did back in 2008. Should that happen, having a reserve of decentralized, permissionless digital currency will likely be available in really convenient.

What are your ideas on the BoJ’s upcoming Halloween choice? Let us understand in the comments area below.

Image credits: Shutterstock, reasonable usage.

Did you understand you can purchase and offer BCH independently utilizing our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The Local.Bitscoins.net market has thousands of individuals from all around the world trading BCH today. And if you require a bitcoin wallet to safely keep your coins, you can download one from us here.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.