Recognizing that organisations are looking for option methods to raise capital besides bank loaning, the Bank of Lithuania has actually provided brand-new guidelines on security token offerings. The objective is to clarify suitable guidelines without presenting more policies.

Guidelines Aiming to Avoid More Regulations

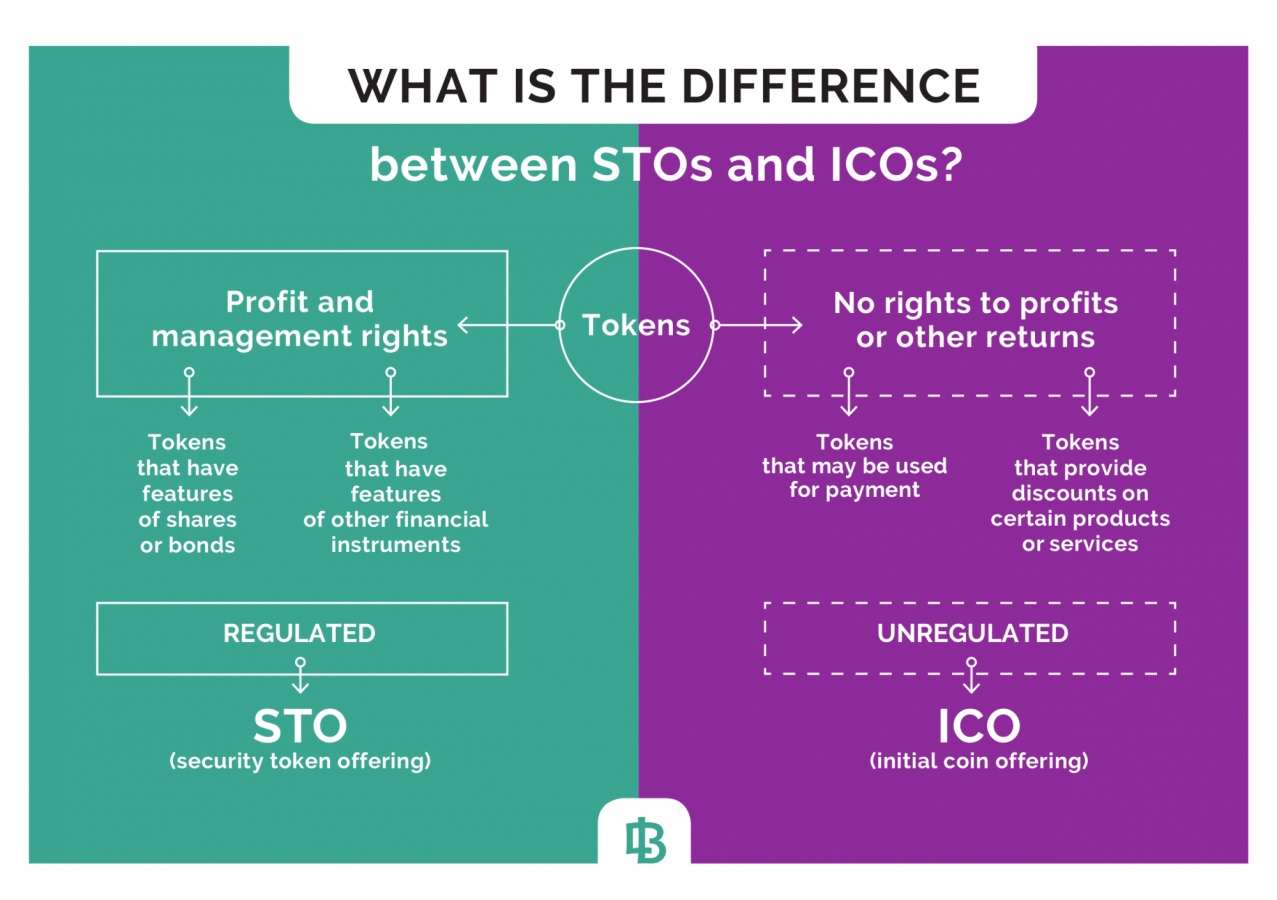

The reserve bank of the little Baltic country of Lithuania has actually just recently kept in mind that the focus in the crypto area is moving from preliminary coin offerings (ICOs) to security token offerings (STOs). Explaining the distinctions in between the 2, the Bank of Lithuania provided suggestions on capital raising through STOs.

Lietuvos Bankas is amongst the very first monetary regulators to release guidelines on STOs. In a statement released on its site, the bank stressed that the brand-new guidelines supply higher regulative clearness while focusing on greater financier security. Times have actually altered and as Bank of Lithuania Board Member Marius Jurgilas put it:

The present focus on security token offerings is taking control of the subsiding interest in ICOs. Businesses have an interest in this specific method of raising capital as an option to bank loaning.

The guidelines supply the bank’s position relating to STOs instead of develop brand-new regulative plans, Jurgilas explained. “In a rigorous regulative environment, such as the securities market, it ends up being essential to set guidelines in order to prevent any miscommunication, misconceptions and their repercussions,” he stated.

Adopting a regulative method that deals with tokens as a monetary instrument, the Bank of Lithuania has actually focused on categorizing tokens, some of which have functions of securities or other monetary instruments. It also prepares to examine particular cases individually, supply suggestions associated to the problem of security tokens, and clarify suitable legal policies.

Companies Alerted About the Rules to Comply With

Lithuania is one of the 3 Baltic countries that have actually embraced a typically favorable method to the market handling cryptocurrencies. Earlier this year, the nation’s reserve bank upgraded its position on decentralized digital currencies and tokens provided in coin offerings, breaking the ice for crypto payments in the nation.

At the very same time, the federal government in Vilnius is preparing to shift the most recent EU Anti-Money Laundering Directive into nationwide law. In its current news release, Lietuvos Bankas worried that business preparing to utilize the STO technique to release tokens classified as transferable securities or other monetary instruments will need to adhere to suitable EU and Lithuanian legislation controling capital raising activities.

“In case market individuals are uncertain whether their used tokens undergo guideline, we stand prepared to supply them with assessment on this matter,” Jurgilas mentioned. To meet its dedication in that regard, the bank has actually currently started 2 public assessments. While preparing its guidelines, the regulator considered some of the recommendations it got.

The Bank of Lithuania declares it has actually taken a “technology-neutral regulative method,” which indicates that if a specific item has functions of a monetary instrument, such as securities, it will use pertinent guideline and guidance regardless of the innovation utilized in its production. But offered the special nature of this type of item, it assures to examine each case separately. Substance over kind will be the assisting concept.

The bank described that STOs “are the brand-new method of raising capital where an entity looking for to raise its funds does not release shares, bonds or any other conventional monetary instruments. Instead, it issues tokens tape-recorded on a public or personal journal which entitle the bearer to a range of rights comparable to the rights given to investors or owners of bonds or other monetary instruments.” The reserve bank also kept in mind that the issuance of these tokens is performed through dispersed journal innovation.

What do you make of the Bank of Lithuania providing guidelines on security token offerings? Share your ideas on the topic in the comments area below.

Enjoy the most convenient method to buy bitcoin online with us. Download your complimentary bitcoin wallet and head to our Purchase Bitcoin page where you can purchase BCH and BTC firmly.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.