Michael J. Casey is the chairman of CoinDesk’s advisory board and a senior advisor for blockchain analysis at MIT’s Digital Currency Initiative.

The following article initially appeared in CoinDesk Weekly, a custom-curated publication delivered each Sunday solely to our subscribers.

The mostly cited quantity for evaluating the value of various crypto initiatives is market capitalization. It is an especially flawed metric.

Critics word, for instance, that poor liquidity, mixed with lax guidelines at many exchanges, let founders and huge holders simply manipulate market cap quotes at websites resembling CoinMarketCap. This made for all types of abuses in the course of the ICO mania of final 12 months.

But there’s a deeper, philosophical drawback with market capitalization. Because it’s benchmarked in {dollars}, this measure (which merely displays a token’s worth multiplied by the variety of issued tokens) implicitly judges the success of every crypto mission when it comes to some anticipated future fiat currency “exit.”

For an business rooted in efforts to reinvent cash and create various, non-fiat types of worth change, that’s a contradiction. And it encourages dangerous conduct.

Prioritizing the dollar-based return on funding fosters communities of coin-pumping fanatics, moderately than these of passionate software program and enterprise builders centered on constructing profitable decentralized crypto-economic initiatives.

Yet the day merchants and YouTube advisors, ubiquitous as they’re, don’t maintain a monopoly over crypto tradition. There are nonetheless loads of folks drawn to this expertise for causes aside from making a fast buck flipping cash.

More than another kind of asset, crypto tokens are outlined by the communities they entice: advert hoc collectives of people motivated by a freely fashioned perception in an thought, a distinctive proposition for decentralizing an financial ecosystem. Not each token’s core thought is a good one, in fact, however the level is that the keenness within the thought is a key determinant of a mission’s worth.

That ardour also varies tremendously, particularly within the levels to which it manifests as a actual dedication to creating the expertise and the group. If we’re to actually measure the worth of those property, we should also discover methods to quantify these qualities, that are, by definition, unbiased of every token’s dollar-based worth.

Enter the Crypto-Economics Explorer

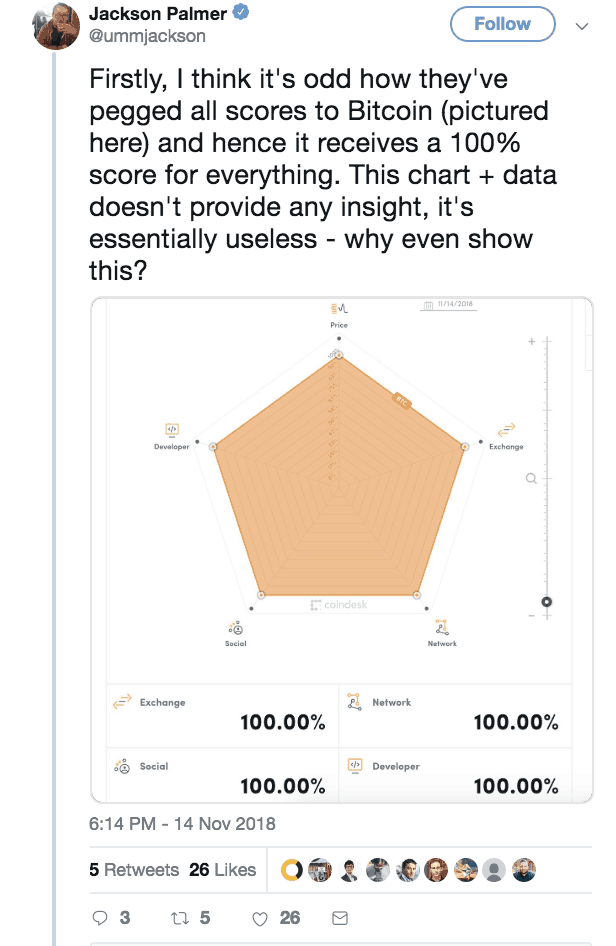

This is why I’m excited by the CoinDesk information staff’s launch of its Crypto-Economics Explorer. Not solely does it use a extra related crypto benchmark than the greenback – bitcoin – it also downplays the importance of worth itself as a measure of worth.

The Explorer provides a weighted, multi-dimensional illustration of worth incorporating a number of goal measures of engagement and curiosity in every crypto mission. Price/market cap is only one of 5 chosen dimensions. The others are developer exercise, on-exchange transactions, on-blockchain transactions and social media exercise.

If you evaluate every coin by this lens – give it a shot; this easy-to-use instrument contains a helpful zoom perform – you’ll discover that it opens a complete new means of understanding the actual drivers of group engagement and communal curiosity in every mission.

Zcash, for instance, is closely skewed towards developer engagement, presumably reflecting the eagerness that many cryptographers have for the pro-privacy zero-knowledge-proof expertise that underpins the coin. But it has only a few transactions and little or no social media engagement.

The profile for XRP, against this, is dominated by social media engagement, maybe reflecting the “XRP Army’s” vocal presence on Twitter and different websites, in addition to the truth that a lot growth is finished in-house by Ripple.

Ripple critics could be tempted to see this as proof that XRP is all present and no substance. But by the bitcoin benchmark-based phrases of the Crypto Explorer itself, group growth is a vital consider any crypto mission’s worth, and social media is a related proxy for that.

Why bitcoin?

Already, critics have attacked the selection of bitcoin because the benchmark, presumably viewing that standing as supporting the biases of so-called “bitcoin maximalists.”

A benchmark that’s constructed on some sort of weighted common of all cash may need assuaged such considerations, however that may be unnecessarily difficult. It’s essential to word that the 100 % rating for bitcoin on all 5 dimensions doesn’t mirror an absolute; it’s merely a foundation for comparability. As defined in backing paperwork, it’s completely potential for a competing coin to outscore bitcoin on all or any of these metrics – in different phrases, to get greater than 100 %.

The mannequin is, on this sense, no completely different from that of world overseas change markets, which use the U.S. greenback as their benchmark. On a purely numerical foundation, one might say the British pound and the euro – at present at $1.28 and $1.14, respectively – are each “worth more” than the greenback. Of course, that may be meaningless. The level is to have some foundation for comparability in time.

In selecting a benchmark, CoinDesk had to begin someplace. And, by the measures chosen, bitcoin is with out a doubt the granddaddy of crypto cash. In the longer term, maybe another composite could possibly be utilized in its case. But for now, that is a completely good place to begin for a mannequin of comparative worth.

Work in progress

Still, it’s essential to word that, as with all customary of worth, the alternatives made within the Crypto-Economics Explorer’s methodology are, by definition, arbitrary. They should not primarily based on some absolute fact.

The excellent news is that CoinDesk regards this mission as a work in progress and, within the phrases of Editor-in-Chief Pete Rizzo, is inviting the group leaders to “beat our tool up. Kick it to death.” Collaborative iteration will lead to an ever-improving mannequin.

So dive into the methodology. Perhaps you’ll be able to consider an alternate benchmark to bitcoin. Perhaps there are good arguments for altering the weightings inside every class. Should mining income account for kind of of the 20 % at which it’s at present weighted inside the Explorer’s “Network” measure? Are there different metrics which can be related to measure developer exercise past the eight GitHub-derived numbers?

This is a place to begin, not an finish level. But it’s a great spot to begin reframing the dialog round what we must be valuing within the cryptocurrency universe.

And the timing couldn’t be higher.

No. Not as a result of the greenback costs of crypto property tanked final week and we’d like another, non-price distraction, however as a result of institutional buyers are on the verge of coming into the market and it’s important that they put aside their dollar-centric valuation fashions and acknowledge that worth is a completely different idea within the crypto world.

These new huge gamers discuss crypto as “a new asset class” – as if crypto tokens are simply an alternate retailer of worth, not too dissimilar to a inventory, bond or commodity, that may sooner or later carry them greenback returns once they money out again into fiat. Yet what they’re actually “buying” by investing in a crypto token is publicity to the whims of a group who’ve fashioned round a core thought. And very often that concept has as its goal the disintermediation of the very establishments from which this new breed of buyers comes. There’s some confused, contradictory logic in investing in one thing that’s designed to kill you.

Regardless, the deep pockets of those buyers have the potential to add considerably extra volatility to the one metric of worth for a lot of token initiatives. So, as much more consideration goes to the merchants, it’s nice that we’ve got a mannequin with which to level out that there are different methods of taking a look at this business aside from with {dollars}.

Image through Shutterstock

Source link

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.