Shark Tank star and the owner of the NBA group Dallas Mavericks, Mark Cuban, has actually alerted that the U.S. Securities and Exchange Commission (SEC) will create rules for token registration that will be “the headache that’s waiting on the crypto market.”

Mark Cuban Foresees SEC Coming Up With ‘Nightmare’ Crypto Regulation

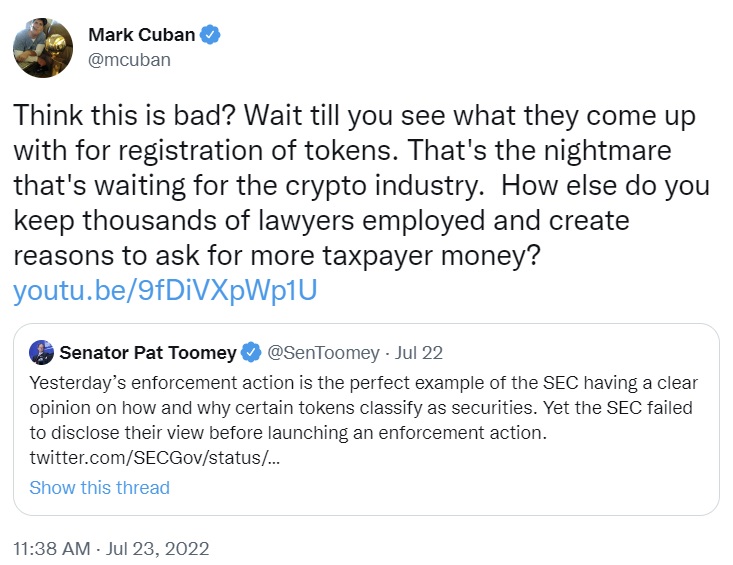

Billionaire Mark Cuban, the Shark Tank star who owns the NBA group Dallas Mavericks, alerted in a tweet Saturday about how the SEC will control crypto tokens.

His caution remained in reaction to a tweet by U.S. Senator Pat Toomey (R-PA) who knocked the securities guard dog over its enforcement action versus a previous Coinbase staff member where 9 crypto tokens were determined as securities. Coinbase rapidly contested the accusation that it noted crypto securities.

Toomey kept in mind that the enforcement action “is the ideal example of the SEC having a clear viewpoint on how and why particular tokens categorize as securities. Yet, the SEC stopped working to reveal their view prior to introducing an enforcement action.”

Cuban, whose net worth has to do with $4.7 billion, thinks that the SEC will create rules on how to register crypto tokens that will be a “headache” for the crypto market. He responded to Toomey: “Think this is bad? Wait till you see what they create for registration of tokens. That’s the headache that’s waiting on the crypto market,” the Shark Tank star composed. How else do you keep countless attorneys utilized and develop factors to request for more taxpayer cash?”

Cuban’s tweet consists of a link to a Youtube video of him trying to send a no-action letter to the SEC in order to make sure that a stock purchase he has to do with to make would not break expert trading laws. However, the billionaire showed that the procedure is extremely made complex, stressing that it does not provide financiers self-confidence that they will not break the law. “What I discovered surprised even me,” Cuban composed after going through the procedure as directed by the SEC.

“Most no-action letters explain the demand, examine the specific realities and situations included, [and] talk about relevant laws and rules,” the SEC specified on its site. If the ask for no action is given, “the SEC personnel would not advise that the Commission take enforcement action versus the requester based upon the realities and representations explained in the private’s or entity’s demand.”

Cuban has actually formerly slammed the SEC for taking an enforcement-centric method to controling the crypto sector.

In August, the Dallas Mavericks owner called out SEC Chairman Gary Gensler on his “financier defense” focus. “If you were dealing with behalf of financiers you make it simple for concerns by financiers and businesspeople to be asked and responded to. You make it near difficult. Those [who] can’t manage attorneys can just think,” he worried.

The SEC just recently came under fire for controling the crypto sector by enforcement. Last week, U.S. Congressman Tom Emmer also knocked the SEC for “punishing business outside its jurisdiction.” He asserted: “Under Chair Gensler, the SEC has actually ended up being a power-hungry regulator, politicizing enforcement, baiting business to ‘can be found in and talk’ to the Commission, then striking them with enforcement actions, preventing good-faith cooperation.”

Do you concur with Mark Cuban? Let us understand in the comments area below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.