Bitcoin costs have actually restored momentum throughout the last 2 days as the rate per coin touched a March 2021 high at $54,822 on Tuesday early morning (ET). Back in December 2020, it was kept in mind that bitcoin on exchanges dropped to a three-year low and this year bitcoin exchange balances continue to drop. A tremendous 189,000 bitcoin was withdrawn from the leading 5 leading cryptocurrency exchanges given that October 2020.

Bitcoin Exchange Balances Plunge on a Myriad of Popular Crypto Trading Platforms

The rate of bitcoin (BTC) is succeeding today and at the time of composing, the leading crypto possession is presently exchanging hands for $53,820 per coin. Last week, the rate was much lower striking a low of $43,171 per system on Bitstamp on February 28. Meanwhile, onchain information reveals that bitcoin exchange balances held on popular trading platforms are continuing to diminish.

On March 7, the sophomore financing significant, William Clemente III tweeted about bitcoin balances on exchanges taking another dive. Clemente shared a chart from the onchain crypto analysis web website Glassnode.

#Bitcoin Balance on Exchanges taking another dive pic.twitter.com/F20tohfXsu

— William Clemente III (@WClementeIII) March 7, 2021

The onchain analysis aggregator Glassnode statistics reveal that popular trading exchanges like Coinbase, Binance, Huobi, and lots of other platforms lost 20% of bitcoin balances throughout the last 12 months. As typical, bitcoiners think that the information recommends financiers are building up, instead of offering the bitcoin on exchanges. For circumstances, news.Bitscoins.net kept in mind that exchange balances were sinking in December 2020 and draining in October 2020 too. On October 16, 2020, our newsdesk reported that 187,000 BTC had actually been withdrawn by consumers given that June 2020.

if (!window.GrowJs) { (function () { var s = document.createElement(‘script’); s.async = real; s.type=”text/javascript”; s.src=”https://bitcoinads.growadvertising.com/adserve/app”; var n = document.getElementsByTagName(“script”)[0]; n.parentNode.insertBefore(s, n); }()); } var GrowJs = GrowJs || {}; GrowJs.ads = GrowJs.ads || []; GrowJs.ads.push({ node: document.currentScript.parentElement, handler: function (node) { var banner = GrowJs.createBanner(node, 31, [300, 250], null, []); GrowJs.showBanner(banner.index); } });

During the Last Four Months, the Top Five Crypto Exchanges by Bitcoin Balance See 189,000 BTC Withdrawn by Customers

144 days earlier in mid-October, Coinbase was the leading exchange with the most bitcoin under the hood, and still is the leader to this day. At the time, nevertheless, Coinbase held 908k BTC and today, statistics reveal Coinbase just holds 870k BTC. That’s 34,000 BTC that’s left the San Francisco exchange in the last 21 weeks. This was also after the exchange saw 36,000 BTC in withdrawals leave Coinbase given that June 2020.

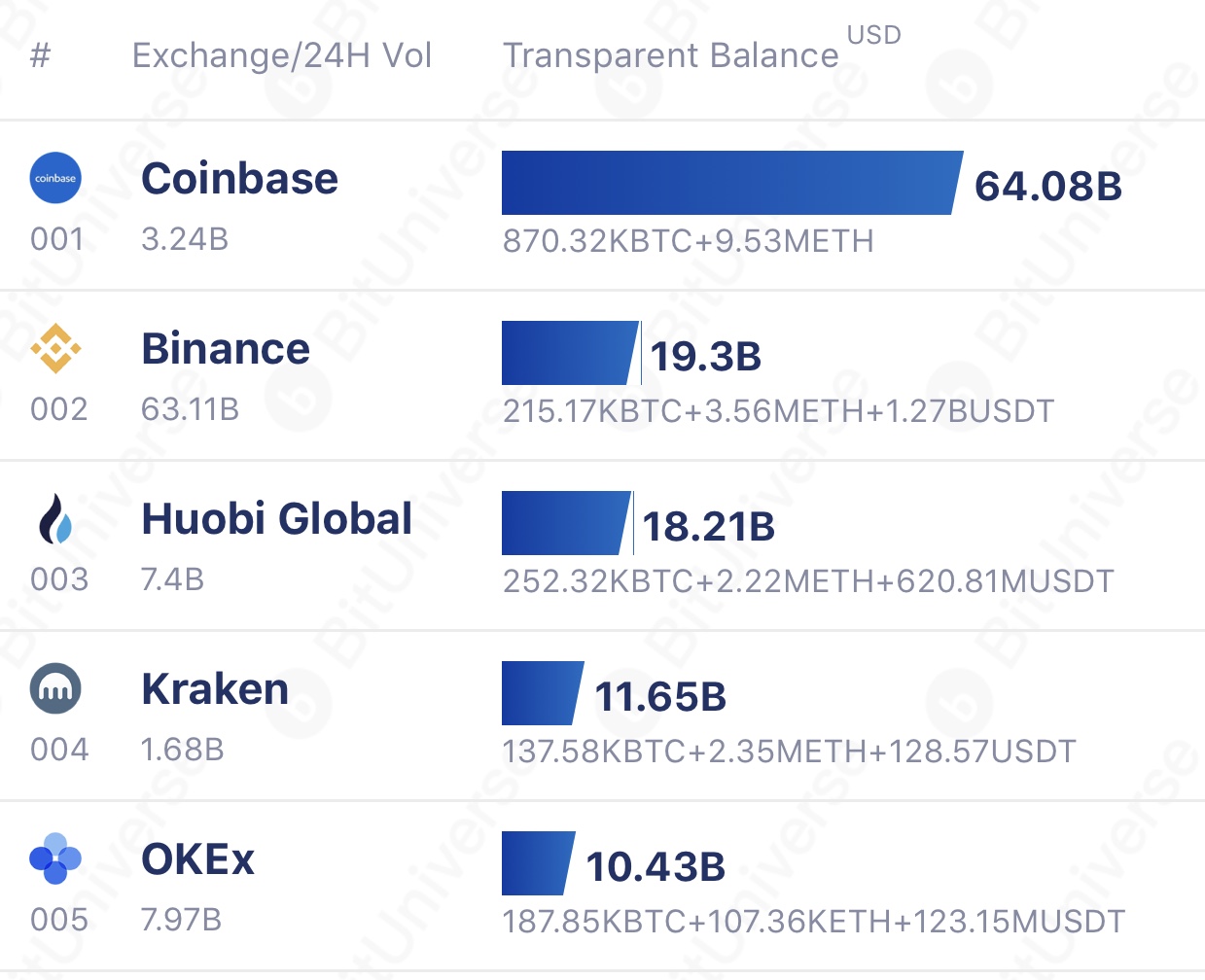

At that time, Huobi Global was the second-largest holder, in regards to crypto exchange balances. However, today Huobi has actually been lowered to the 3rd position and changed by Binance. Huobi had 345k in BTC, however around 93,000 bitcoin left the exchange ever since. The leading 5 cryptocurrency trading platforms, in regards to transparent bitcoin balance rank, are imagined in the screenshot below. Exchange Balance Rank information comes from the Bituniverse exchange market data.

Binance is now the second-largest holder in regards to crypto exchange balances of BTC, according to a mix of Bituniverse, Peckshield, Chain.details, and Etherscan data. The exchange presently holds a supply of 215,000 BTC at the time of publication, however 4 months earlier, Binance held 266k BTC as it lost 51,000 BTC to consumer withdrawals.

Back then, the San Francisco exchange Kraken was the seventh-largest bitcoin exchange balance holder and today, Kraken has actually caught the 4th position. Today Kraken holds 137,000+ bitcoin in reserves, however 4 months ago that aggregate number was 132k BTC. It implies that Kraken has actually gotten some lead in the bitcoin exchange balance race given that October of in 2015.

The 5th located top BTC holding exchange is Okex and the trading platform held the 5th area back in October 2020 too. Still, at that time Okex had 198,000 BTC in reserves and it now holds 187,000 BTC. This implies 11,000 BTC has actually been withdrawn from Okex given that October 16, 2020. Bitmex saw 3,000 BTC withdrawn given that our last research study on the substantial exchange withdrawals occurring throughout the in 2015.

The mix of BTC exchange balance information shows that given that mid-October, the leading 5 leading exchanges lost 189,000 BTC or more than $10 billion utilizing today’s bitcoin (BTC) currency exchange rate. The statistics can be seen leveraging Glassnode’s BTC exchange balance information and by taking a look at specific exchanges utilizing Bituniverse’s Exchange Balance Rank.

Billions of dollars in bitcoin leaving central cryptocurrency exchanges recommends that individuals wish to keep their coins safe in a noncustodial style and to lots of observers, it also implies they put on’t wish to offer those coins in the short-term.

What do you think of the diminishing bitcoin exchange balances and the leading 5 exchanges losing 189,000 bitcoin to consumer withdrawals? Let us understand what you think of this topic in the comments area below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.