Digital Currency Group (DCG) just recently released the company’s “State of Crypto 2020” report which surveys more than 150 portfolio crypto companies. According to the research study, 75% of the participants think the worth of their service has actually grown this year, while 50% of the start-ups have actually seen exceeding start-of-year forecasts.

The state of the cryptocurrency industry is growing according to Digital Currency Group’s (DCG) newest report. The research study surveyed over 150 DCG portfolio companies’ executives in order to “measure belief and offer qualitative analysis of functional patterns in the crypto neighborhood.”

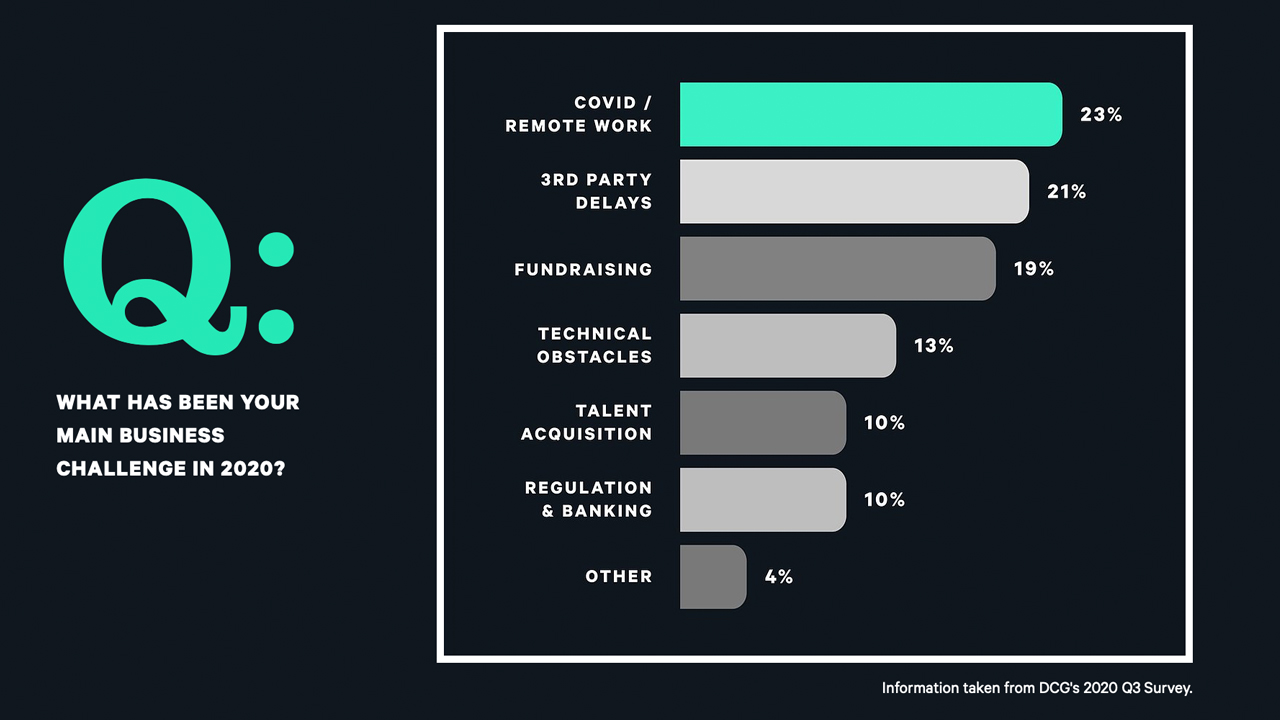

One of the greatest challenges for these companies was the coronavirus break out however numerous companies have actually recovered from the Covid-19 crisis. Still, Covid-19 and remote work was the primary service difficulty in 2020 tape-recorded by 23% of the participants. Other concerns thought about consisted of 3rd party hold-ups (21%), fundraising (19%), and technical challenges (13%).

Unlike 2018 and 2019, tasks in the crypto world are increasing as DCG keeps in mind that 66% of its portfolio companies reported growing in headcount this year. Despite the Covid-19 unpredictability, approximately 35% of the individuals stated they prepare to employ more individuals this year.

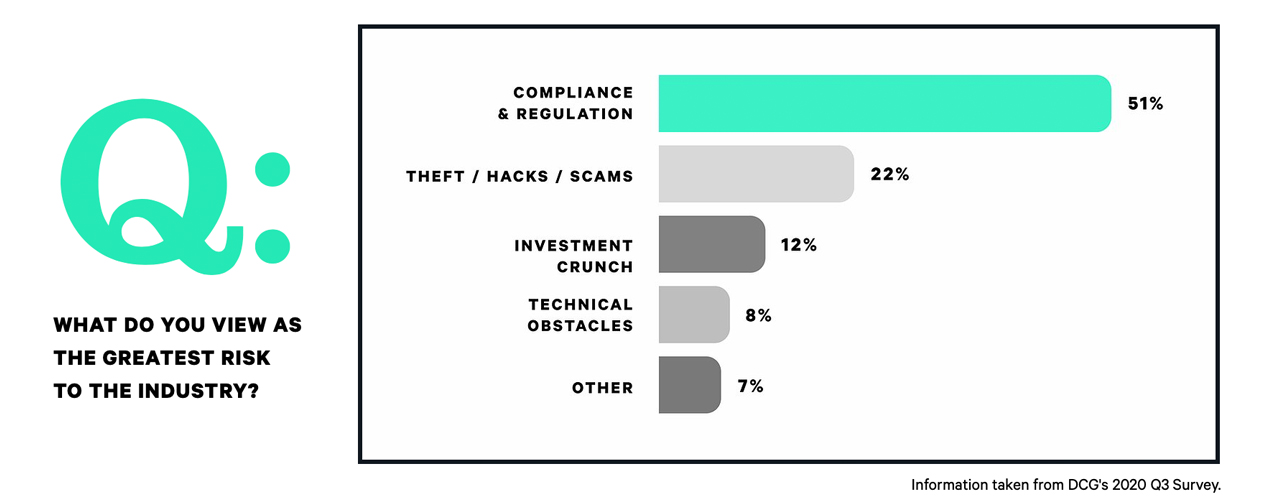

One of the biggest obstacles in the cryptocurrency industry today, besides Covid-19, is regulative compliance. The DCG research study shows 51% of the study participants stated compliance and policy is the greatest issue. Roughly 22% of the executives point to security concerns like theft, hacks, and rip-offs.

When asked what the most bullish crypto industry advancement remained in 2020, 39% stated that it came from decentralized financing (defi) development. 21% stated that bitcoin (BTC) strength was a perk and 15% looked to the stablecoin rise in 2020. 10% of the DCG study individuals look forward to ‘Big Tech’ signing up with the crypto fray.

The 150 portfolio business execs were also asked if they believe Ethereum can scale prior to completing blockchains can capture up to its defi lead. 51% think that Ethereum will scale initially, 25% detailed that it won’t scale initially, and 24% stated that they were “not sure.”

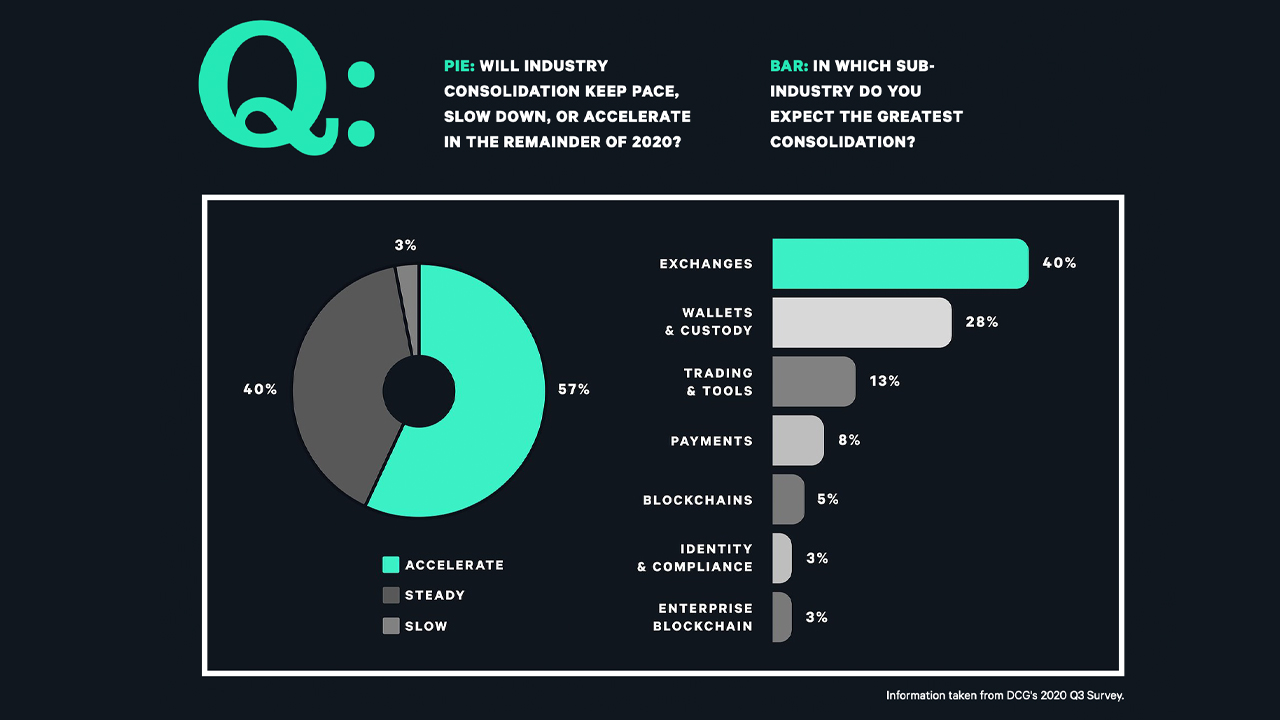

DCG’s study then asked the participants whether they believe the crypto industry will “accelerate,” “consistent,” or “sluggish” from here. 57% completely think that the crypto industry will accelerate while 40% imagine consistent action.

Meanwhile, just 3% of the surveyed people believed that the industry would decrease from here. The participants also imagine sub-industry combination and the biggest anticipated combination would be exchange platforms.

From here, crypto execs believe that the combination will come from wallet and custody options, trading tools, and payments respectively.

One occasion that would move the industry greater would be a going public (IPO) of a significant U.S. based crypto company most of the participants kept in mind. “We appearance to 2020 with a restored sense of chance,” the DCG report highlighted.

“2020 has actually been filled with the unforeseen, unfortunate, and norm-shattering—however it supplied our area with that ‘encouraging’ chance our companied believe it was primed for, and it has actually provided,” DCG’s research study concluded. “One occasion that would definitively mark the end of an industry in the shadows is getting individuals thrilled: 95% of our study participants stated a significant U.S. IPO would be a favorable advancement.”

Furthermore, the execs surveyed were also asked what they believed the rate of BTC would remain in 6 to 12 months from now. 48% stated $10k to $15k, 22% stated $15k to $20k, 21% the rate will cross $21k +, 8% believe it will be in between $5k to $10k, and just 1% presume the rate will be below $5,000 per coin.

What do you consider the bitcoin businesses on the repair and the crypto execs’ positivity in 2020? Let us understand what you consider this topic in the comments below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.