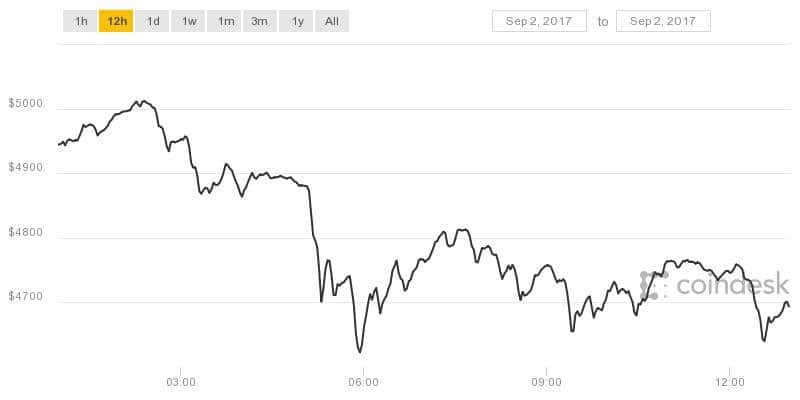

It’s the greatest sell-off given that mid-July

Atpress time, the overall worth of all openly traded cryptocurrencies was $166 billion, a figure that was down more than 7 percent from a high of almost $180billion last night.

That’s when bitcoin, rising on technical enhancements and growing financier optimism, topped $5,000 on the CoinDesk Bitcoin Price Index for the very first time.

< img class =-LRB- **********) src =-LRB- ***********) alt =-LRB- ************) width =-LRB- *************) height =-LRB- **************)/ >

< img class =-LRB- **********) src =-LRB- ***********) alt =-LRB- ************) width =-LRB- *************) height =-LRB- **************)/ >

(*************************** )Thedecrease resembled exactly what was observed onbitcoin, with typical worldwide rates decreasing from a high of$ 5,01391to a low of$ 4,61997, a more than$250decrease.

Overall, it was the biggest sell-off in thecryptocurrencymarketssince July 15, when the overall worth of the possession class plunged approximately 12 percent from $72billion to $63billion. However, that decrease became part of a multi-day sell-off that saw rates drop more than 25 percent on exactly what was then issue over bitcoin’s technical roadmap.

Atpress time, market observers appeared split on ways to check out the marketplace motion.

Inremarks to CoinDesk, some mentioned it may be prematurely to state the marketplace has actually peaked provided the current upswell in institutional interest and the limited nature of brand-new cryptocurrency production.

Onthe latter point, some presumed to hypothesize the decrease might be a “bear trap,” one that rapidly unlocks for bigger gains.

“Since bitcoin is getting a lot of media attention lately a lot of people are looking for a moment to enter the market,”Bram Ceelen, creator of cryptocurrency brokerage AnyCoin, informed CoinDesk.

Othersindicated decreases in July and May as proof the marketplace has actually still pulled back, even throughout its 2017 rally, which additional decreases were possible.

Money in mousetrap imagethrough Shutterstock

Source link

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.