There are a number of exemptions the U.S. Securities and Exchange Commission (SEC) uses that enable business to release their bitcoin financial investment products without registration. While waiting on the SEC to authorize their bitcoin ETF, some firms have actually benefited from these exemptions to offer an interim item.

New Bitcoin Product Emerges

Despite efforts by numerous business, the SEC still has actually not authorized a bitcoin exchange-traded fund (ETF). The commission has actually been taking its time to examine any proposed guideline modifications for such an item that have actually come its method, consistently extending the time it requires to decide on each.

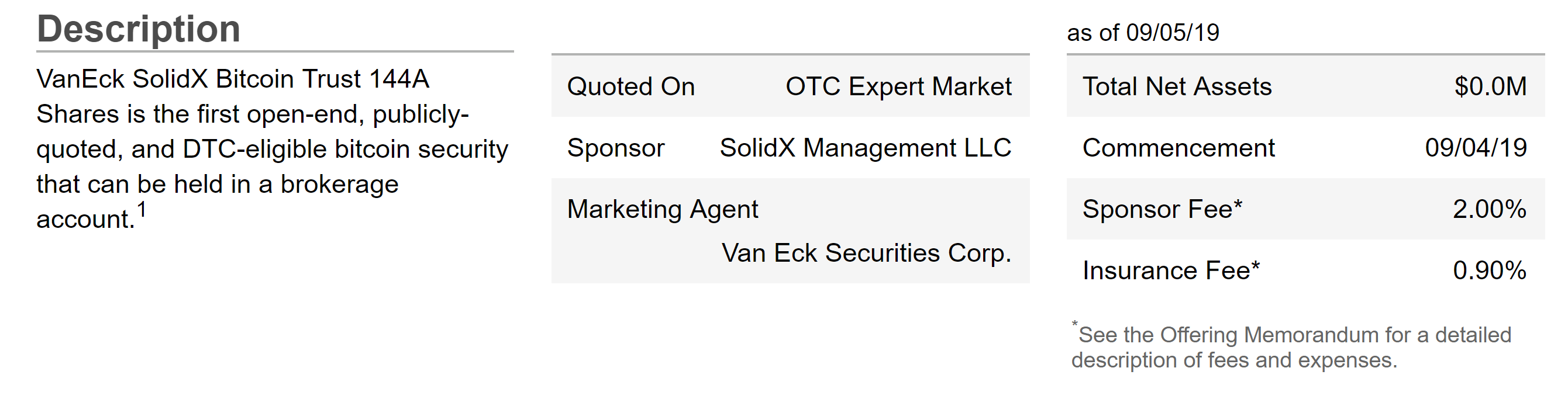

One prominent bitcoin ETF that has actually been waiting on approval from the SEC for over a year is Solidx Bitcoin Shares released by Vaneck Solidx Bitcoin Trust, to be noted on Cboe BZX Exchange. While waiting on the commission’s approval, Vaneck and Solidx chose to go on and offer their item under Rule 144A of the Securities Act of 1933, as modified. Shares used under this guideline are exempt from registration requirements. Solidx CEO Daniel H. Gallancy commented:

As the very first bitcoin item in the U.S. with basic ETF development and redemption and recognized cleaning and settlement procedures, institutional financiers can lastly acquire direct exposure to bitcoin within a familiar context.

Solidx Management Llc is the sponsor and Van Eck Securities Corp. is the marketing representative of this brand-new financial investment item, which began on Sept. 4. The sponsor cost is 2% and the insurance coverage cost is 0.9%. The trust’s BTC is kept in freezer with insurance coverage versus theft or loss. “Shares might be redeemed by licensed individuals in baskets and redemption earnings will remain in bitcoin,” Vaneck detailed.

Cboe BZX Exchange Inc. initially submitted a proposed guideline modification with the SEC to list and trade shares of Solidx Bitcoin Shares released by Vaneck Solidx Bitcoin Trust on June 20, 2018. The exchange withdrew the filing early this year when the U.S. federal government closed down, however refiled on Jan. 30. After several conferences with the business included, the SEC designated Oct. 18 as the date by which it will decide on this proposed guideline modification.

Vaneck and Solidx’s 144An item cannot be called a bitcoin ETF, nevertheless, because it will not be traded on an exchange. Its shares are priced estimate on OTC Link ATS, an SEC-managed alternative trading system. The company highlighted that the OTC Link ATS is not an exchange and has actually restricted liquidity. Further, rather of being offered to the general public, 144A shares are limited securities, offered to just certified institutional purchasers (QIBs).

Besides the proposed guideline modification for shares released by Vaneck Solidx Bitcoin Trust, the SEC is also thinking about a proposed guideline modification submitted by NYSE Arca Inc. for Bitwise Bitcoin ETF Trust. The commission has also designated Oct. 13 as the date by which it will decide on this proposed guideline modification.

Rule 144A and Who Can Invest

A business might not offer or offer securities unless the offering has actually been signed up with the SEC or an exemption from registration is offered. The exemption which Vaneck and Solidx have actually chosen to make the most of is under Rule 144A. It supplies a safe harbor exemption from the registration requirements of the Securities Act of 1933 for particular resales of limited securities to certified institutional purchasers.

The Jumpstart Our Business Startups (Jobs) Act, signed into law by previous President Barack Obama on April 5, 2012, directed the SEC to change the Securities Act and broaden a number of exemptions. “The Jobs Act in 2012 modified Rule 144A to enable brokers and dealerships to offer Rule 144A securities through basic solicitations. General solicitation might also boost liquidity for financiers in Rule 144A securities if resale platforms establish for such products,” Vaneck described.

The business verified that just QIBs might trade the Vaneck Solidx Bitcoin Trust 144A shares. QIBs are specified typically as an organization with a portfolio of securities valued at over $100 million, a signed up broker-dealer with a minimum of $10 million in securities owned or handled, and a bank with a minimum of $100 million in 3rd party securities and has an audited net worth of a minimum of $25 million. Examples of QIBs consist of organisation advancement business, corporations, ETFs, hedge funds, insurance provider, shared funds and signed up financial investment advisors.

QIBs are not to be puzzled with “certified financiers” which might consist of any natural individual whose net worth surpasses $1 million. A natural individual is ruled out a QIB, Vaneck highlighted.

How the Interim Product Affects Bitcoin ETF

Vaneck and Solidx have actually not quit on their objective to release a bitcoin ETF, and the proposed guideline modification for their bitcoin ETF is still pending with the SEC as previously. Vaneck described that needs to the commission authorizes its public bitcoin ETF, the Vaneck Solidx Bitcoin Trust 144A shares will stop to be priced estimate on OTC Link ATS and brand-new baskets of shares will not be produced for sale. “Existing baskets of the 144A shares might be redeemed after the general public registration,” Vaneck explained, including that “The public shares will have a different, ‘unlimited’ CUSIP number.”

After the general public registration, holders of existing 144A shares might continue to hold their shares as is for the next 12 months, or offer them into the general public market where their shares will end up being fungible with the general public shares. The business elaborated, “Twelve months from the date of registration, the limited CUSIP for the 144A shares will transform to the CUSIP for the general public shares,” including:

Anyone holding 144A shares at the twelve-month anniversary will then be holding show the general public CUSIP. Holders have the capability, however not the responsibility, to offer their shares.

Regulation A, D, and S Exemptions

Other than Rule 144A for resale of limited securities to certified institutional purchasers, there are other exemptions from SEC registration which business can make the most of. Among them are Regulation A, Regulation D, and Regulation S.

Regulation A supplies exemptions for 2 tiers of offerings. Among other guidelines, Tier 1 enables securities offerings of as much as $20 million in a 12-month duration, while Tier 2 enables as much as $50 million within the exact same period. The Jobs Act embraced by the SEC also broadened exemptions supplied by Regulation A. The resulting last guidelines are typically described as Regulation A+.

The SEC green-lighted 2 token offerings under Regulation A+ for the very first time in July, as news.Bitscoins.internet reported. One was for Stacks tokens by Blockstack PBC, and the other was for Props tokens by Younow, a live streaming app which declares to have 46 million users. Muneeb Ali, co-founder of decentralized app community Blockstack and CEO of Blockstack PBC, commented at the time that “This is the very first time in U.S. history that a crypto token offering has actually gotten SEC credentials.”

Regulation D also uses a variety of exemptions, each with particular requirements that the company should fulfill. For example, Rule 504 of Regulation D allows particular companies to offer and offer up to $5 countless securities in any 12-month duration, while Rule 506 supplies 2 unique exemptions from registration. Blockstack utilized this technique prior to it was authorized under Regulation A+.

There is also Regulation S, which supplies safe harbor treatments for overseas sales of equity securities of U.S. companies. Blockstack is also making the most of this exemption to offer its tokens to non-U.S. individuals, according to the business’s using circular submitted with the SEC.

What do you consider business making the most of some exemptions while they await the SEC to decide on their bitcoin ETF? Let us understand in the comments area below.

Did you understand you can purchase and offer BCH independently utilizing our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The Local.Bitscoins.net market has countless individuals from all around the world trading BCH today. And if you require a bitcoin wallet to firmly save your coins, you can download one from us here.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.