This is a viewpoint editorial by Shane Neagle, the editor-in-chief of “The Tokenist.”

Time and time once again, we see the mainstream media benefiting from Bitcoin’s viewed make use of: energy usage. For the Bitcoin network, this course has actually ended up being all too familiar.

Just take a look at what took place in May 2021, when Elon Musk successfully “broke” bitcoin’s cost as Tesla announced it would no longer accept BTC as payment, mentioning ecological issues. The cost of a single bitcoin stopped by almost $8,000 in the 2 hours following the statement. There are many comparable cases also.

But the takeaway is this: It’s really clear that the understanding of Bitcoin’s basics goes far beyond the security of the network, the stability of the code and the property’s restricted supply. Bitcoin’s energy usage contributes, too. So huge of a function, that it considerably affects not simply the cost of bitcoin, however its regulative structure also. For much better or for even worse, this truly can’t be argued.

But what if Bitcoin’s energy usage was actually an advantage? What if Bitcoin operated as a “store of energy” that supplies an exceptional option to any financial system we’ve ever seen?

Fortunately, the idea of an energy-backed currency is not as extreme or unique as individuals might believe — it has actually been around for more than a century. But the needed conditions (i.e., the innovation) did not yet exist to help with such a game-changing advancement for civilization.

That innovation now exists, nevertheless, and it’s called Bitcoin. Let me describe.

Money And ‘Life Energy’

The advancement of human civilization mainly focuses upon the resolution of one crucial concern: How do we evaluate the real worth of products and services?

More particularly, how do we evaluate such worth in the most consistent and uncomplicated way possible?

Consider the period of ancient barter systems, when a uniform system of fiat currency had yet to be developed. Exchanging crops or animals for services was prevalent. However, this system was laden with ineffectiveness, as it was greatly dependent on the shared coincidence of desires. Consider an angler seeking to trade his fish — however just for salt which he required to protect his future catch from ruining. Any private seeking to trade for fish, should now have exactly what the angler desired: salt.

In such a circumstance, it’s simple to see how the concept of supply and need is manipulated.

Determining a fair exchange for distinct, non-fungible products positions an unique obstacle. How do we make sure that both celebrations are appropriately rewarded for the energy they’ve invested — their “life energy” — in producing the services or product they’re offering?

This idea of “life energy” describes the time, effort and innovative energy that people put into their work. Every human has a limited time period that they transform into concrete, efficient output — a quantifiable kind of energy.

But in this system of bartering, life energy isn’t properly represented. Rather, external elements greatly affect the worth of a services or product — regularly to the hinderance of the life energy committed to its production.

Ideally, we require a system that enables the build-up and storage of this expense of energy — which we can describe as “surplus energy” — and its associated worth.

The benefits here go far beyond the person who used up such energy. The metaphorical lifeline of any economy is this idea of “surplus energy.” If this circulation is restrained or embolisms, it causes a less dynamic, stagnant economy. If it’s appropriately saved and fluid, it can cause development and advancements which benefit the society at big.

If we do not develop precise systems, catching and keeping surplus energy or worth ends up being difficult.

Hence, it ends up being essential to determine this energy output in the most structured way possible, to make sure reasonable settlement for — and capability to profit from — the energy used up. In this regard, a considerable landmark in civilization’s journey was the advancement from bartering to product cash, ultimately resulting in using portable, interchangeable and standardized metal coins.

A Historical Devaluation Of Life Energy

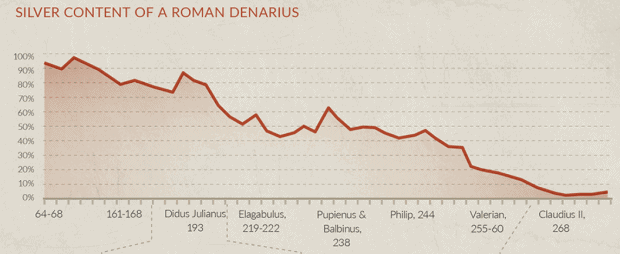

The Roman Empire constructed itself on financial performance by reducing cash friction. Its blood was the denarius currency, formed out of the restricted supply of rare-earth elements. The restricted nature of the denarius permitted it to work as a store of worth.

Concurrently, the denarius’ mobility as a store of worth permitted it to spread out throughout every corner of the empire, quickly carried and traded by numerous merchants. Consequently, the financial circulatory system overruned with energy. As the friction within the exchange of products and services was decreased, brand-new specialized labor markets might form, which increased efficiency and development.

In financial terms, all was great. The Roman civilization attained a product currency which helped with financial growth. Such a standardized currency, portable and restricted as it was, saved and effectively caught Roman energy into efficiency and financial development.

Until it didn’t, by decree.

As each Roman emperor wanted to use up more energy than the currency permitted, they began to wear down the denarri’s store of worth.

The denarius stayed portable and fungible, yet it started to fail in its capability to properly represent individuals’s life energy outputs. The silver material of each denarius lessened and smaller sized, deteriorating the currency’s capability to preserve worth and, eventually, acquiring power.

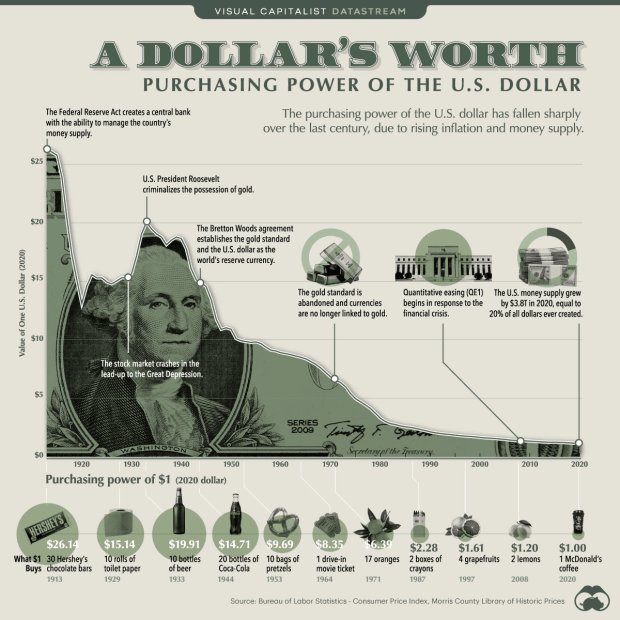

Today, we comprehend this as inflation. With each currency debasement cycle, individuals lost self-confidence that their life’s energy output was appropriately determined, rather comparable to what’s occurring today:

The United States remains in a strange historical position in which it can export domestic inflation thanks to the status of the dollar as the worldwide reserve currency (GRC). Therefore, incomes can keep growing at an inflationary rate. But, as financial obligation ceilings have actually ended up being financial obligation ladders, nobody understands for sure for the length of time this will be sustainable.

And it is absolutely not sustainable in numerous other nations with double- and even triple-digit inflation rates.

Money: What Needs To Be Fixed?

So, what patterns can we observe from our financial history?

First, to appropriately determine life’s energy outputs, the gauge requires to be fungible and standardized, assisting in a practical computation of the worth of nonfungible products and services. Second, the gauge requires to concurrently store worth and be portable.

These standard components supply individuals with a tool to properly change their restricted energy and time — life energy — into an efficient, well-compensated energy output.

When we take a look at all modern-day fiat currencies, their shops of worth rest on unsteady premises. The issue is, reserve banks have actually changed emperors — however their decrees are no less disruptive.

At an essential level, the exchange of funds in between companies and staff members is the exchange of energy. But neither companies nor staff members manage this countervailing energy’s existing(cy). That energy’s existing is supplied through currency — and it’s completely managed by reserve banks.

Thus, it is reserve banks that distinctively have the authority to customize that energy existing gradually, echoing the practice of ancient Roman emperors.

The most significant impact on a currency’s store of worth is its supply and issuance schedule. Central banks and Roman emperors alike have tended to significantly alter offered supply, adversely affecting this characteristic.

In turn, this adversely affects individuals’s capability to profit from their used up energy.

Energy Currency As New Milestone Technology

From bartering and products, to metal coins and fiat paper currency, history’s financial experiments have actually provided actionable conclusions.

Alongside mobility, preserving the stability of the currency’s store of worth is of the utmost value. For this to be possible, it should not count on approximate decrees.

And this is exactly the transformation Satoshi Nakamoto brought with his Bitcoin white paper. The trust should be eliminated from the central entities which have total control over financial systems — and the capability for people to profit from their used up energy through labor: “an electronic payment system based on cryptographic proof instead of trust,” as Nakamoto put it.

The concern then moves to: How do we safe that brand-new part of trust?

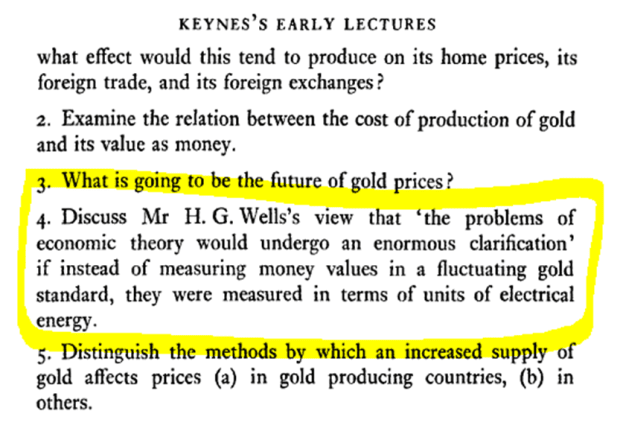

Past intellectuals have actually argued for backing cash with systems of energy. Namely, in John Maynard Keynes’ lectures of 1912 to 1913, which supplied the intellectual structure for a way of determining cash “in terms of units of electrical energy.”

Ever ahead of the times, American industrialist titan Henry Ford actually proposed an energy currency right after, in 1921. Ford’s “units of power,” produced from the world’s biggest power plant, were to fix the issue of “the international banking group to which we have grown so accustomed that we think there is no other desirable standard.”

Bitcoin: An Energy-Secured System Of Energy Transference

In the case of Bitcoin, that brand-new part of trust is protected through energy.

Bitcoin is not just portable however digitally portable, matching our digital period. It’s not simply limited, however its shortage is specified in an energy-agnostic method. This links back to Ford’s imagine an energy-backed currency, however with an essential distinction. Ford’s pictured energy currency, connected to the world’s biggest power plant, would have been prone to vulnerabilities connected with centralization. In contrast, Bitcoin leverages energy from any source offered.

The decentralized nature of calculating power produces a durable and robust system. It is through this energy itself that the Bitcoin network protects this brand-new part of trust — cryptographic evidence.

In this light, it is no coincidence that Michael Saylor paints the vision of Bitcoin as the option to the issue of how to store energy gradually and throughout area.

Returning to among the very first points pointed out, where Bitcoin’s understanding surpasses its own basics, 2 concerns stay: How long lasting should Bitcoin be to external elements? Are there any genuine dangers out there?

Just take a look at brand-new innovation which is establishing at breakneck speeds. Artificial intelligence (AI) is expected to greatly affect the financing world — from long-lasting investing and portfolio management to shorter-term choices trading. Yet with the advancement and mass combination of AI, truth and impression will end up being linked. Separating the 2 will end up being a strenuous job.

How will such substantial developments effect Bitcoin?

Bitcoin is poised to sustain such technological transformations. The immutable nature of the blockchain enables a degree of verifiability which the advancement of AI will develop a higher requirement for. Yet much more significantly, Bitcoin supporters see how Bitcoin represents something of an occupation, instead of a possession simply for speculation and revenue. This kind of “larger than life” assistance will just assist Bitcoin to sustain life-altering developments, political routine changes or any other existential “threat” that might emerge in the future.

Yet there stays a continuous lack of the correct structure when it pertains to Bitcoin’s energy usage, as I’ve attempted to articulate here.

According to a current survey, for instance, 76% of financiers desire BTC to be more “environmentally friendly” — which fizzles when it pertains to the relationship in between Bitcoin’s energy usage (or, to put it simply, its methods of protecting the network) and our capability to successfully profit from the life energy we commit.

With its distinct capability to store and transfer energy, the Bitcoin network repairs this problem.

Not just is the network protected by energy, however it has the prospective to successfully make it possible for people to appropriately profit from using their life energy. This indicates Bitcoin has actually currently ventured into the unmatched area of an energy currency — not simply for the advantage of the person, however of society at big.

History is here and the journey has actually simply started.

This is a visitor post by Shane Neagle. Opinions revealed are completely their own and do not always show those of BTC Inc or Bitcoin Magazine.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.