Jurrien Timmer, Fidelity’s Director of Global Macro, just recently made a significant declaration about Bitcoin, explaining it as “exponential gold” and an emerging gamer on the “store of value” group. Timmer’s comments were shared through a series of posts, where he elaborated on Bitcoin’s developing function in the monetary environment.

In my view, bitcoin is exponential gold and a hopeful gamer on the shop of worth group. My work recommends that the cost of bitcoin is driven mostly by the development in its network, which is in turn driven by bitcoin’s distinct shortage function, in addition to the financial and financial…

— Jurrien Timmer (@TimmerFidelity) June 13, 2024

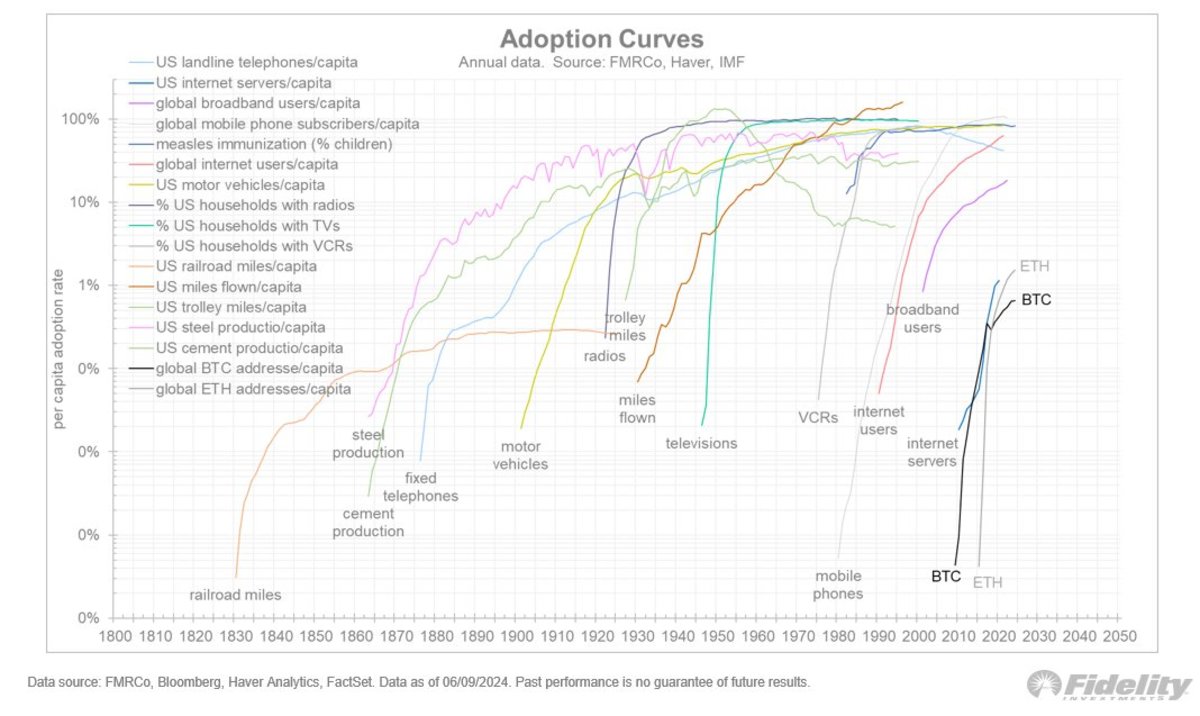

Timmer highlighted Bitcoin’s distinct position in the market, and compared its development trajectory to the exponential adoption curves seen in innovations like the web and smart phones. He highlighted that Bitcoin’s shortage and growing approval as a digital property add to its possible as a long-lasting shop of worth, comparable to gold.

Jurrien Timmer

In his posts, Timmer recommended that its adoption rate and network development are crucial consider its appraisal. He kept in mind that while Bitcoin is still in its early phases compared to conventional properties, its adoption is speeding up at an exponential rate, supporting the thesis that Bitcoin might end up being a considerable shop of worth in the future.

“The chart below shows Bitcoin’s growing network along a simple power curve. The number of non-zero addresses has converged towards this power curve, with Bitcoin’s price oscillating around it like a pendulum,” he stated. “Such is Bitcoin’s unique series of boom-bust cycles.”

Jurrien Timmer

Timmer’s recommendation lines up with a more comprehensive pattern amongst institutional financiers acknowledging Bitcoin’s capacity. His viewpoint strengthens the growing authenticity of Bitcoin within the monetary market, recommending that it might play an important function in future financial investment techniques.

“The growth of Bitcoin’s network has slowed in recent months, while its price has continued to gain,” he concluded. “In my view, this divergence between price and adoption could explain why Bitcoin has slowed down a bit along its path to potential new all-time highs. The pendulum will only swing so far. For the new highs to continue, the network may have to accelerate again.”

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.