In numerous parts of the world, access to electrical power is a high-end that we typically consider given. Sub-Saharan Africa (SSA), for instance, deals with an extreme electrical power deficit, with over 600 million individuals without power. This deficit results in financial stagnancy, minimized food production, hardship, and even civil discontent. The connection in between electrical power gain access to and financial development is indisputable, and areas with less than 80% electrification rates regularly experience minimized GDP per capita. The obstacle depends on broadening electrical facilities to these underserved locations, which is capital-intensive and typically economically impractical for federal governments with minimal resources. This is where Bitcoin mining is a possible service that can use a path to amaze areas that have actually long lacked access to electrical power.

Bitcoin mining has actually long been a topic of much debate, with critics typically concentrating on its viewed ecological effect. However, below the spectacular headings and traditional media stories, lies a story of prospective humanitarian advantages, and energy development. By utilizing stranded energy in remote places, Bitcoin mining can offer a source of income for brand-new power plants and therefore support the building and construction of electrical grids.

Despite the continuous mudslinging project versus Bitcoin mining, understanding of the significance of utilizing stranded energy for Bitcoin mining is gradually acquiring traction. In reality, this is the story that is wonderfully caught in the freshly launched and acclaimed documentary, Stranded: A Dirty Coin Short by Alana Mediavialla Diaz, which showcases how Bitcoin miners in locations like SSA ingeniously repurpose stranded power, breathing life into both Bitcoin and forgotten power facilities.

In this post, we will check out the ignored favorable elements of Bitcoin mining, compare its energy intake to other markets, and make a case for how Bitcoin mining might possibly incentivize the discovery of brand-new sources of energy and the construct out of brand-new energy facilities.

What Is Stranded Energy Anyway?

Stranded energy describes energy sources that exist in a place however are not efficiently used or utilized for efficient functions. It’s basically energy that is separated or “stranded” in a particular area due to different factors, like absence of facilities to transfer it or an inequality in between the area of energy production and need.

For circumstances, when brand-new electrical grids are being established, specifically in remote locations, the energy facilities might remain in location before the need for it captures up. Which suggests that, up until customers are linked to the grid, the energy produced is more than what is right away required, making it “stranded” and eventually lost up until more users link. This is a substantial issue that Bitcoin mining can assist to resolve, and this location in specific is among the significant advantages of mining that Stranded checked out in excellent information.

In an interview Alana highlighted how Bitcoin mining, by generating income from excess energy in areas doing not have standard need, serves as a monetary driver for building crucial grid facilities, consequently altering lives and challenging our understandings of energy’s social effect. She elaborated on this more by stating, “The concept of how a grid grows through demand, was not something I ever thought about. In the film i wanted to capture that it is a great privilege to have access to electricity and that mining is able to finance new grid infrastructure in places that have never had it before”

Take Ethiopia, for example. It has the prospective to produce more than 60,000 megawatts (MW) of electrical power from “renewable” sources, however presently has just 4,500 MW of set up capability. 90% of its electrical power is produced from hydropower, with geothermal, solar, and wind comprising the distinction. However, the nation still experiences severe energy scarcities, with only 44% of its 110 million individuals having access to electrical power. With jobs like the Grand Ethiopian Renaissance Dam (GERD) under building and construction, which is forecasted to produce an extra 5,150 MW, the federal government anticipates to have an overall of 17 000 MW of set up capability in the next ten years. The intro of Bitcoin mining has the prospective to money these electrical power facilities jobs.

Dispelling Misconceptions About Bitcoin Mining

One of the most typical mistaken beliefs surrounding Bitcoin mining is the idea that it takes in an outrageous quantity of energy, going beyond the energy intake of whole nations. Critics typically indicate reports recommending that Bitcoin mining takes in more electrical power than numerous countries, consisting of Ireland, Nigeria, and Uruguay. The Bitcoin Energy Consumption Index by cryptocurrency platform Digiconomist approximates a yearly energy use of 33 terawatts, on par with nations like Denmark.

However, it is very important to dissect this review and location it in the more comprehensive context of energy intake. While it holds true that the Bitcoin network’s energy use appears substantial, it’s vital to keep in mind that energy intake itself is not naturally bad. This review tends to presuppose that energy is a limited resource which designating it to Bitcoin mining denies other markets or people of this important product.

In truth, energy is an important and expandable resource, and the idea of one use being basically inefficient than another is subjective. All users, consisting of Bitcoin miners, sustain an expense and pay the complete market rate for the electrical power they take in. To single out Bitcoin mining for its energy intake while neglecting other markets is a misconception. As Alana also mentioned, “People hold as typical mistaken beliefs what the media typically repeats about Bitcoin. Nobody is ever considering the energy intake of the markets they communicate with daily.This is not a typical figure that individuals learn about things yet when it pertains to Bitcoin, it sure is filthy due to the fact that of all that energy intake!“

Comparing Bitcoin To Other Energy-Intensive Industries

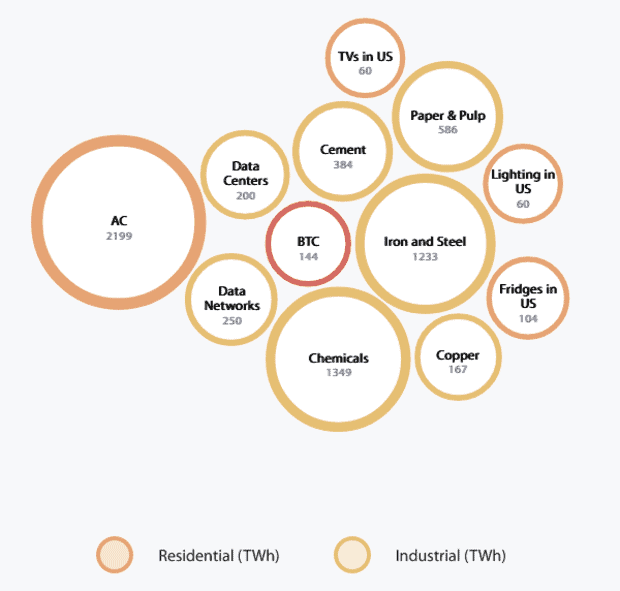

To put things in viewpoint, let’s compare Bitcoin mining to some other energy-intensive sectors that typically leave comparable examination:

I don’t learn about you, however I cannot remember the last time I heard grievances in the media about the paper and pulp market’s high energy intake. In order to counter the misconceptions surrounding “the dangers” of Bitcoin mining and its energy use, a nuanced understanding of energy intake is needed. While it’s vital to analyze the ecological effect of any market, singling out Bitcoin mining for criticism while neglecting other energy-intensive sectors is a problematic method.

What Does The Future Hold?

Unlike any innovation before it, Bitcoin mining incentivizes the expedition of affordable methods to harness energy, regardless of geographical constraints or standard energy restrictions. This monetary incentive might stimulate an energy transformation on a scale not seen because the Industrial Revolution, possibly moving humankind to be a type I civilization. A view also shared by Alana, who when quizzed about her next movie task stated, “The next one is about what it will take us to reach a type 1 civilization using Puerto Rico as our underdog model that is undergoing major infrastructure change. It’s a pivotal moment in the island’s history and it can serve as an example to failing grids around the world.”

As financial rewards push Bitcoin mining to fill the energy sector, a merging is taking place. Energy manufacturers are generating income from surplus and stranded energy through Bitcoin mining, while miners are vertically incorporating to improve competitiveness. In the foreseeable future the most effective miners might end up being energy manufacturers themselves, possibly inverting the standard power grid design.

This is a visitor post by Kudzai Kutukwa. Opinions revealed are completely their own and do not always show those of BTC Inc or Bitcoin Magazine.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.