Thecryptocurrency market is a sea of red today, an advancement doubters will no doubt rapidly utilize to make the case versus bitcoin as a 21 st century gold.

Intimes of political or financial tension, financiers choose to hold safe house properties, and while lots of specialists think bitcoin is the new safe haven, today’s depressing efficiency opposes such claims. The cryptocurrency dropped 5 percent over the last 24 hours, even while North Korea’s nuclear test and increased geopolitical stress rose standard safe house properties like gold, Japanese Yen.

Overall, bitcoin (BTC) clocked an intraday low of $4,253earlier today, and was trading around $4,335levels onnews China has banned initial coin offerings, among the primary patterns powering this year’s boom.

Still, the price decrease comes in the middle of an uptick in trading. CoinMarketCap information reveals volumes on Bitfinex, which uses trading in the BTC/USD set, are up 7.11percent.

Ethereum(ETH) was the most significant loser amongst the top 10 cryptocurrencies, down 12.14percent in the last 24 hours, as it stays the platform of option for many ICOs. Bitcoin Cash (BCC) had actually likewise shed around 3.7 percent and was last seen trading around $554

Limitedeffect

So, exactly what should we make from the day’s advancements?

Asthe December2016 close on the CoinDesk BPI was simply under $1,000, the cryptocurrency has actually still rallied more than 400% this year.

Followinga rally of such enormous percentage, a healthy correction is much required as it serves 2 functions:

- Itwill relax market nerves— Pundits have actually begun comparing bitcoin mania to the 16 th century Tulip bubble. A correction here would relax market nerves and assist bring back self-confidence in the bitcoin rally.

- Isincreased interest genuine? Theoutstanding rally in bitcoin resulted in increased interest about bitcoin and crypto area in basic. Investors who lost out on the rally would wish to board the bitcoin freight train throughout a technical pullback. Strong dip need would show the increased interest is genuine … financiers are not simply curious but want to assign a part of their portfolio to virtual currencies. Weak dip need or lack of dip need would be bad news.

Biggeruptrend is still intact

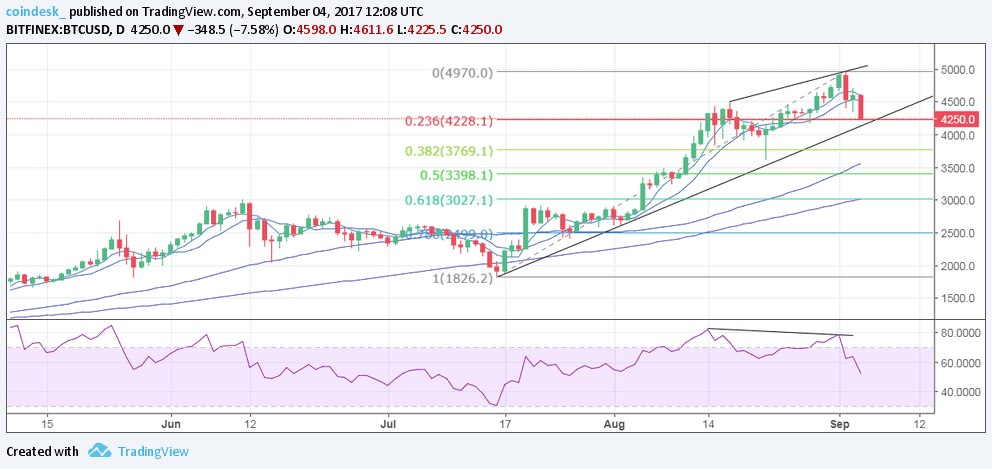

Dailychart

< img class =-LRB- *************) src =-LRB- **************) alt =-LRB- ***************) width =-LRB- ****************)

< img class =-LRB- *************) src =-LRB- **************) alt =-LRB- ***************) width =-LRB- ****************)

- Theincreasing pattern line from theJuly16 low is still intact and might use assistance at$ 4,133levels.

- Thebearish price RSI divergence recommends a short-term top in location around $5,000, although just an end-of-day close listed below $4,133today would terminate the bullish view and signal capacity for more losses to $3,769(38.2 percent Fibonacci retracement).

- A possible for a review to tape-record highs around $5,000exists if the rates increase above the everyday high of $4,6116.

- Biggains above $5,000levels can not be dismissed if we see a sharp rebound over the next couple of days from the increasing pattern line assistance.

Thechart above programs a bearish price RSI divergence, which is formed when rates form greater highs while the oscillator (in this case an RSI) forms substantially lower highs.

Disclaimer: Thisshort article must not be taken as, and is not meant to offer, financial investment guidance. Please perform your very own extensive research study prior to purchasing any cryptocurrency.

Toy airplane imagethrough Shutterstock

Source link

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.