Afterdropping to a low of $1,836this weekend, the bitcoin price is when again climbing up back towards all-time highs.

Accordingto CoinDesk’s Bitcoin Price Index, the price of bitcoin rebounded to $2,730today, the greatest worth observed on the BPI considering that June 23 and simply $300off its all-time high of $ 3,025, set on June 11.

So, exactly what’s owning traders?

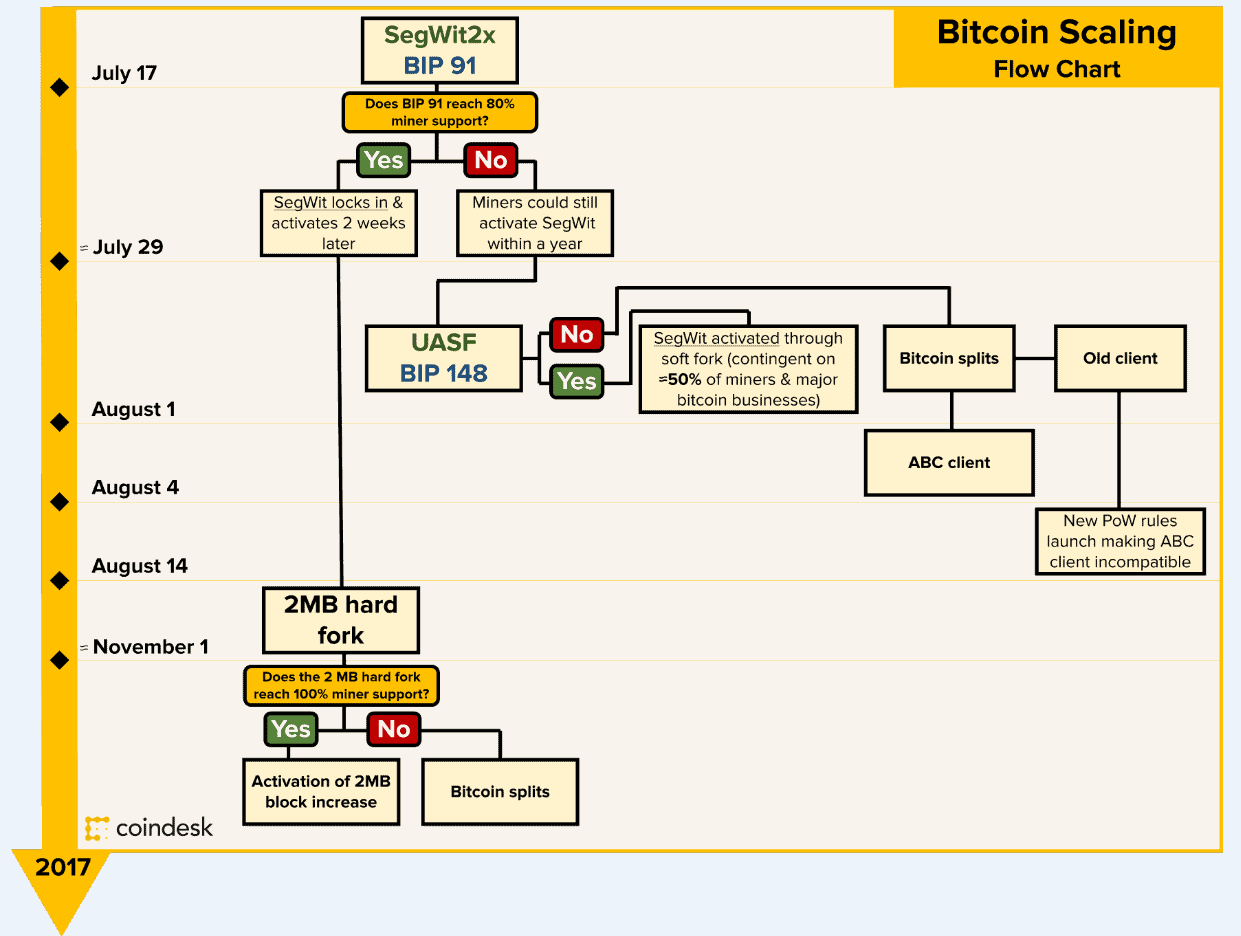

Overall, experts are reporting that the healing is mainly due to the enhancing outlook for bitcoin’s innovation roadmap, stimulated by the anticipated ‘lock in’ of a code upgrade called BIP 91 today.

Thepiece of code that will set the phase for the very first part of the Segwit2x scaling proposal, BIP 91 might update the bitcoin blockchain to assistance Segregated Witness ( SegWit), consequently increasing the network’s deal capability.

Attime of publication, miners require to continue to signal for BIP 91 for approximately 20 extra blocks in order to lock in the upgrade. At this point, BIP 91 will go into a “grace period” of 336 obstructs, prior to activation.

Complexitiesintensify from there, as it stays possible SegWit may not be triggered under particular circumstances owing to how miners may run the code.

Speculator’s pleasure

Still, the favorable belief provided a break from the doom and gloom of the dispute that has actually shrouded the marketplace for weeks.

Withbitcoin increasing, rates were up likewise throughout the cryptocurrency markets, with all the top 30 by market capitalization publishing gains today. But as traders have a long history of placing financial investments in relation to bitcoin scaling propositions, the run-up in price was possibly not unexpected to numerous.

IqbalGandham, handling director at social trading company eToro, kept in mind that much of the activity is most likely due to favorable belief.

Helikewise kept in mind how it may be rather separated from any strong conviction of exactly what may or may not happen.

“Segwit, block size increases and the various mechanisms by which to deliver this have been difficult to understand for traders, and they are at the point where they just want clarity and a clear direction,”he stated. “We may now have one.”

Inin this manner, Kevin Zhou, a trader and market expert with crypto trading fund Galois Capital, credited the improvement of BIP 91 with the run-up in price.

Inspecific, he stated, traders are reacting to the reducing possibility that bitcoin might divide into 2 contending properties (though this is still possible later on this year), and the boost in capability SegWit would bring.

“It’s not just reduced uncertainty over whether there will be a chain split, but also less uncertainty over how exchanges will handle a chain split and the issues that come with it (e.g. replay attacks, reorg risk, margin positions, etc.),”he stated.

Splitspectre stays

Still, while less possible, stress in the scaling dispute might just enter into hibernation, just to reemerge later on this year.

Withsignificant miners threatening to fork off onto a separate blockchain must the block size not be raised, it stays possible this dispute will lie inactive till fall, at which point, stress might reemerge.

Underthe Segwit 2x proposition, a big group of miners and start-ups concurred to a 2 MB tough fork that would happen 3 months after Segwit is enacted.

Developershave actually mainly looked for to minimize the concept as harmful and dangerous.

< img class =-LRB- ********************) src =-LRB- *********************) alt =-LRB- **********************) width =-LRB- ***********************) height =-LRB- ************************) / >

< img class =-LRB- ********************) src =-LRB- *********************) alt =-LRB- **********************) width =-LRB- ***********************) height =-LRB- ************************) / >

(************************************* )Howconscious the marketplace is of this truth staystobe seen, though some looked fortotension the short-term positivity and its effect.

“We still have to worry about whether the market will accept the ‘2x’ half of Segwit2x, but at least there likely won’t be an initial split for the SegWit half,”Zhoumentioned.

Likewise,ArthurHayes, CEO ofbitcoinleveraged trading company BitMEX, presumedas(************************************************************************************************************************************************************** )forecastbitcoinmight when again test all-time highs must the network enact SegWit in the coming days.

“The reason why we didn’t surpass $3,000 earlier this summer was the specter of UASF [and a bitcoin split]. With that roadblock removed and Segwit activated, money will pour into the system,” he stated. (************************************** )

Hayes concluded:

“Those who sat on the sidelines due to reservations about how bitcoin would scale now will rush back in with a vengeance.”

Bitcoin imagethroughShutterstock

(*********************************** )Source link

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.