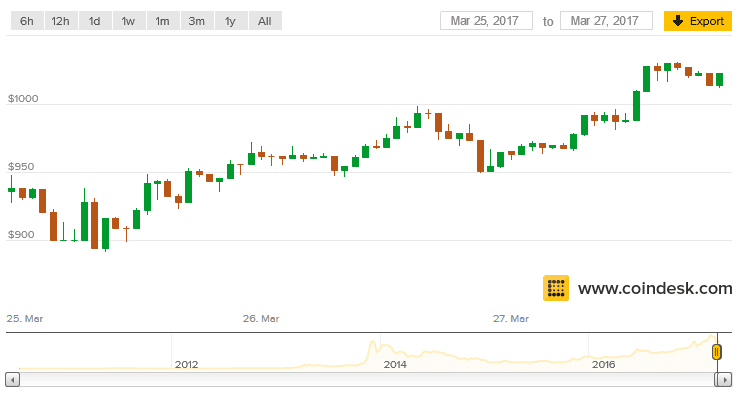

After falling to their lowest stage in additional than two months this weekend, bitcoin costs breached $1,000 once more at the moment.

Overall, the digital currency rose as a lot as 7.5% through the session, climbing from a low of $958.77 to as a lot as $1,030.78, in accordance to the CoinDesk Bitcoin Price Index (BPI). At the time of the report, bitcoin was buying and selling at $1,023.95.

For bitcoin, the turnaround adopted its decline to as little as $891.51 on 25th March, its lowest common value since 25th January, BPI figures present.

Notably, the determine was almost 50% under the all-time excessive of greater than $1,300 that the cryptocurrency reached earlier this month, then fueled by anticipation for the SEC’s ruling on a proposed bitcoin ETF.

When explaining bitcoin’s current value strikes, most analysts pointed to the the cryptocurrency’s ongoing technical in-fighting as motive for the volatility.

Should the bitcoin community bear a hard fork, it might doubtlessly break up into two separate blockchains (every with their very own distinct tokens), prompting considerations amongst much less tech-savvy traders.

Such an occasion might show extremely bearish for the worth of each bitcoin tokens, analysts have warned. Investor and Civic CEO Vinny Lingham, particularly, has emphasised the sharp declines bitcoin might endure following a tough fork.

Concerns concerning the rising recognition of Bitcoin Unlimited, another software program implementation and developer group that might push the transfer helped convey concerning the plunge, in accordance to Petar Zivkovski, COO for leveraged digital currency buying and selling platform Whaleclub.

He informed CoinDesk:

“As Bitcoin Unlimited dominated social media conversation and the odds of a hard fork rose, BTC/USD price plummeted.”

Harry Yeh, managing companion of funding supervisor Binary Financial, took a unique strategy by taking a look at market dynamics.

He causes that sensible cash merely took benefit of this market sentiment, as merchants both caught the bounce and bought or shorted the currency pair.

Still, the markets proceed to be sharply risky amid such strikes, developments that might proceed to stoke fears amongst informal bitcoin holders and customers.

Such uneven waters, these surveyed prompt, might turn out to be the norm ought to bitcoin’s scaling uncertainty proceed.

Inflatable castle by way of Shutterstock

Source link

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.