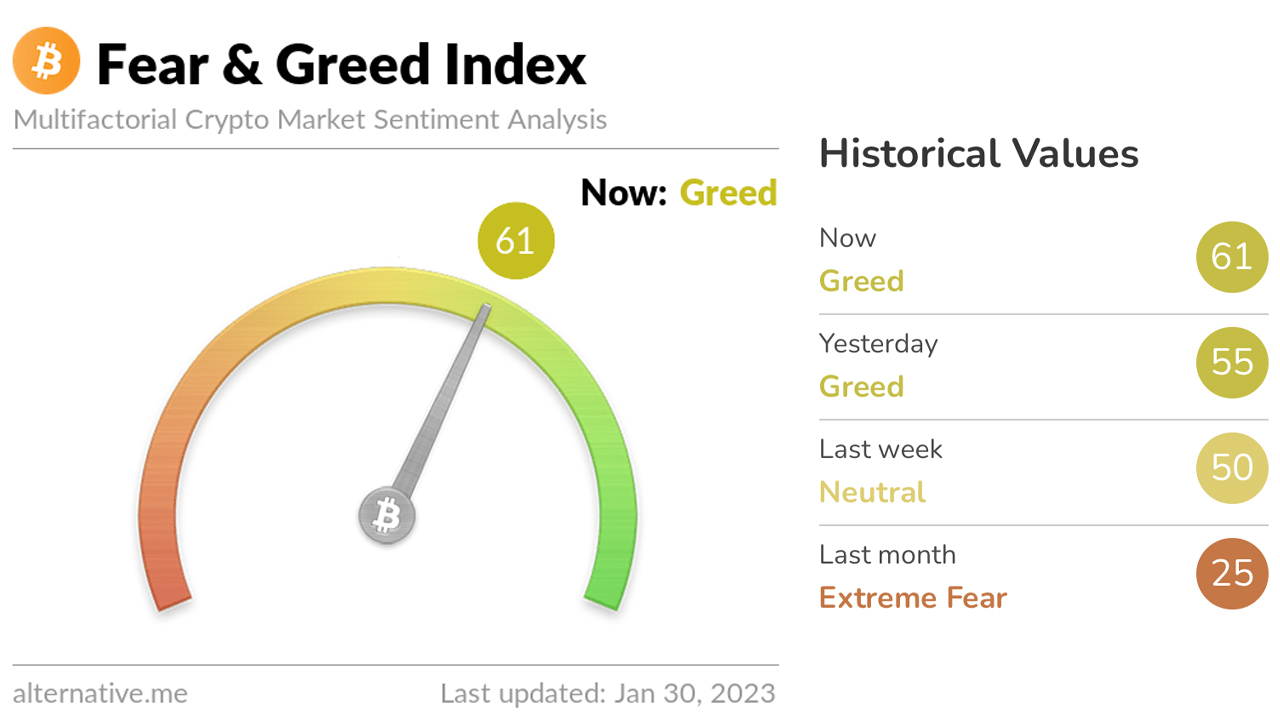

Last month, data revealed that the Crypto Fear and Greed Index (CFGI) had a rating of 25, showing “severe fear.” Thirty days later on, with a 39% boost in bitcoin rates versus the U.S. dollar, the existing CFGI rating on Jan. 30, 2023, is 61, showing “greed.”

Crypto Fear Index Jumps to ‘Greed,’ Etoro Market Analyst Attributes Bitcoin’s Rise to Shift in Investor Expectations

Records program bitcoin (BTC) saw considerable worth development in the first month of 2023, with a 39% boost versus the U.S. dollar. On Jan. 29, 2023, BTC reached a 30-day high of $23,954 per system, with rates varying from that worth to a low of $22,988 over the previous 24 hr. This rise has actually considerably raised the Crypto Fear and Greed Index (CFGI) hosted on alternative.me, moving it from the “severe fear” zone to the “greed” variety in the course of the month.

Last week, CFGI records revealed a rating of around 50, showing “neutral,” according to alternative.me. Seven days later on, the CFGI rating increased to 61, suggesting “greed.” The site specifies that when crypto financiers end up being too greedy, it signifies the marketplace is due for a correction. The CFGI rating has actually stayed above the neutral variety of 50 given that Jan. 23, 2023, after investing a substantial quantity of time below 45 previous to Jan. 14, 2023. On Monday, bitcoin (BTC) rates saw weak point versus the U.S. dollar as traders took earnings.

In a note sent out to Bitscoins.net News, Etoro’s market expert, Simon Peters, associated the stop in crypto cost decreases to a modification in financier expectations concerning inflation and rates of interest walkings from the Federal Reserve. Peters also kept in mind that banks Goldman Sachs “released a favorable note on Bitcoin,” pointing out a market efficiency sheet that was just recently released, which reveals Bitcoin surpassing all other significant property classes, consisting of gold, realty, and emerging markets.

“Bitcoin has actually carried out exceptionally well up until now in 2023, increasing almost 43% given that 1 January on the eToro platform. From its floor in the previous year – $15,523 – reached on 9 November, it’s up simply over 50%,” Peters composed. “With inflation and rates of interest expectations now turning, a lot of property classes have actually stopped the decreases experienced in 2022 as financiers start to believe ‘where next’ for their portfolios beyond the 2022 rate walking crash,” the Etoro market expert included.

What do you believe is driving the boost in bitcoin rates and the shift in the Crypto Fear and Greed Index towards ‘greed’? Share your ideas in the comments below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.