The path ahead for bitcoin costs is not clear, market analysts say.

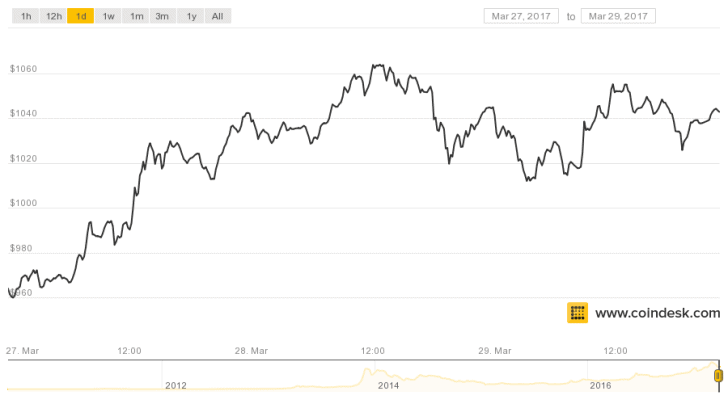

While some described the market to CoinDesk as bearish total, different observers supplied a extra optimistic stance about the prospects for future value developments. Their enter comes as bitcoin costs have largely traded rangebound in the previous couple of days, fluctuating between $1,010 and $1,060, in keeping with the CoinDesk Bitcoin Price Index (BPI).

While bitcoin costs reached an all-time excessive of greater than $1,300 earlier this month in the lead as much as the US Securities and Exchange Commission ruling on the bitcoin ETF proposed by buyers Cameron and Tyler Winklevoss twins, they’ve fallen since. Interestingly sufficient, bitcoin costs have been little modified when the SEC shot down a bitcoin ETF proposed by SolidX.

Others highlighted that sentiment has, for higher or worse, modified in latest days. Much of the consideration appears to have squared on the prospects of a possible bitcoin hard fork – and the resulting tension that has taken maintain.

“The market has seen a switch in sentiment from hope of ETF approval to the ugliness of internal fighting,” mentioned Charles Hayter, founder and CEO of CryptoExamine.

Fork blues?

Some analysts pointed to this ongoing dilemma when offering their total bearish views of the market. One lingering concern is fork might drive down costs sharply, prompting some to hedge their bets forward of any doable disruption.

According to Jacob Eliosoff, a cryptocurrency fund supervisor, the state of affairs is changing into a key driver of that bearishness.

He advised CoinDesk:

“Bitcoin is a very fundamental market right now: the price is going down because the dev project is imploding in near civil war.”

Not all agreed with this evaluation, nevertheless. OTC dealer Harry Yeh struck a extra sensible outlook, arguing that bitcoin’s upside has been restricted consequently.

“We see this as being priced in now and don’t foresee major prices moves past $1,200 in the near term,” he mentioned.

Tim Enneking, chairman of Crypto Asset Management, supplied comparable sentiment, telling CoinDesk that “hard fork concerns are capping upward movement”. However, he additionally emphasised that “solid BTC fundamentals, interest and growth potential” have been making a ground for costs.

While Enneking supplied a average evaluation of the state of affairs, a handful of analysts insisted that bitcoin’s long-term pattern was bullish. Arthur Hayes, co-founder and CEO of leveraged bitcoin buying and selling platform BitMEX, said that the digital currency’s latest pullbacks in value signify a “healthy correction”.

“The additional uncertainty surrounding the potential hard fork also acts as a price dampener,” he added.

Image through Shutterstock

Source link

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.