With the SEC’s bitcoin ETF rejection simply days behind the market, bitcoin merchants noticed a well-known subject return right this moment – the expertise’s lengthy simmering scaling debate.

After two years of debating one of the best ways to deal with the challenges related to bitcoin’s 1 MB block size, the digital currency’s neighborhood has up to now failed to develop the consensus for any explicit answer.

While Segregated Witness is now out there for miners and nodes to vote on, the proposal (one lengthy favored by its improvement crew) has so far failed to acquire the signaling wanted for approval from miners. This has taken place as the variety of transactions on the community has surged, main a vocal contingent of the enterprise neighborhood to aggressively search options.

Yet, the scenario took a decisive flip earlier right this moment when Bitmain, the operator of Antpool, the world’s largest bitcoin mining pool, announced that it will change its complete mining pool to Bitcoin Unlimited, a bitcoin implementation that might aggressively broaden the block dimension.

Following this announcement, analysts have grown more and more involved that the bitcoin community might endure a tough fork – a improvement that, if dealt with poorly, might create two separate bitcoin belongings.

As such, merchants voiced concern concerning the concern, with investor and Civic CEO Vinny Lingham stating merely:

“The next big milestone will be ensuring that a hard fork does not happen.”

Two bitcoins

Among merchants, the prevailing worry is scenario might come up whereby one facet is successfully ready to enact a change that might discover community nodes and miners break up into two variations of the blockchain historical past, divided by different options.

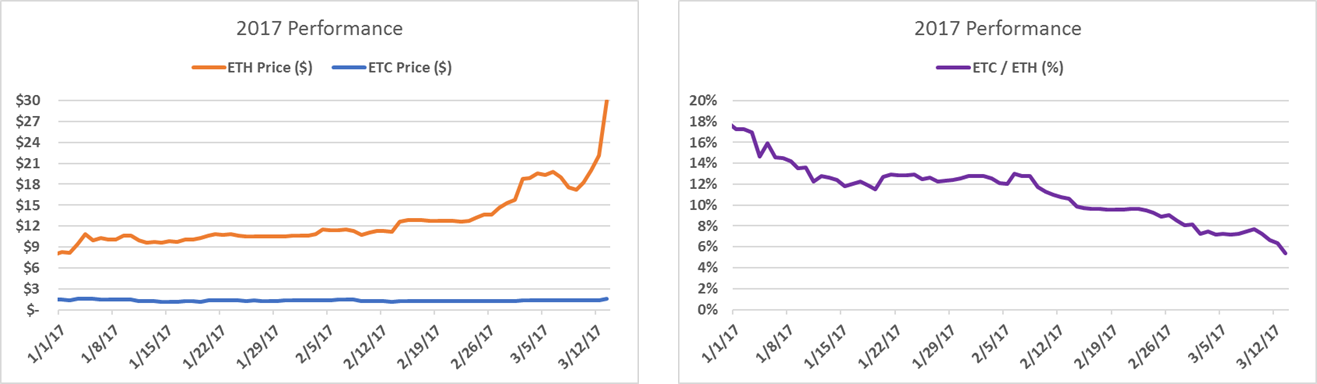

Such a scenario just isn’t with out precedent. Last summer time, the ethereum blockchain skilled a controversial arduous fork, a improvement that resulted in a minority of customers creating the choice ethereum basic blockchain.

Henry Brade, co-founder of bodily bitcoin provider Denarium, went up to now as to advocate that trades liquidate their holdings within the occasion of such a improvement.

“If bitcoin splits, I recommend selling everything and buying back later. It’s a trust failure much larger than MtGox. Big haircut expected,” he wrote on Twitter.

Lingham later expanded on his assertion, espousing his belief the scenario will finish poorly ought to a fork happen.

Adding to uncertainty is that the long-term affect of a fork just isn’t properly understood, although information from ethereum’s two blockchains supplies some perception.

Rangebound bitcoin costs

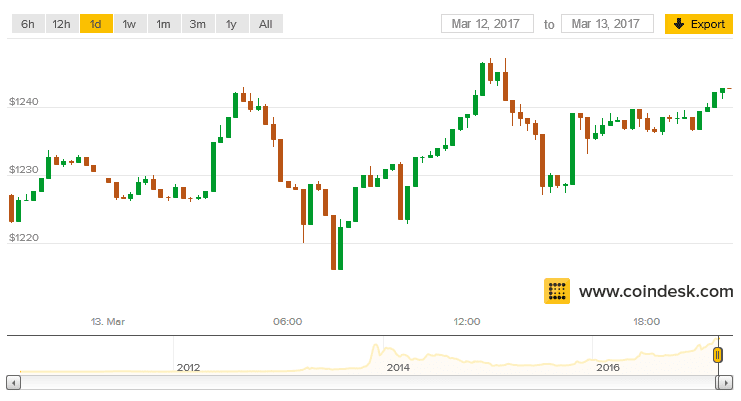

Amid this uncertainty, bitcoin costs have fluctuated inside a fairly tight vary right this moment, buying and selling between $1,216.31 and $1,247.26, in accordance to the CoinDesk Bitcoin Price Index (BPI).

At the time of report, bitcoin was buying and selling at $1,239.83.

Bitcoin hedge fund operator Tim Enneking summed up the scenario as one the place numerous events within the technical and enterprise neighborhood are starting to get “impatient” for an answer that might enhance scalability.

He prompt the market is now in wait-and-see mode, however that there might advantages to one technical answer profitable out, as lengthy as two bitcoin belongings do not emerge.

“A resolution (regardless of who prevails) will almost certainly push the price to new highs,” he stated.

This relative calm contrasts with the sharp volatility that bitcoin costs skilled within the final a number of days, as the digital currency reached an all-time excessive of greater than $1,325 earlier than the SEC’s ruling on the proposed bitcoin ETF.

Prices then plunged practically 30% to roughly $1,022 when the federal government company rejected the plan, although the digital currency has since recovered.

Decision image through Shutterstock

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.