A university education is regularly considered as the most reliable path to boosted life time profits and financial self-reliance. Empirical information appears to strengthen this point of view. According to research study performed by the Federal Reserve Bank of San Francisco, people with a four-year degree tend to collect around 75% more earnings over their life times compared to their equivalents without such a degree. However, this conventional path must be assessed versus alternative chances. Bitcoin has actually become an appealing investment, boasting a remarkable typical substance yearly development rate (CAGR) of 71% over the previous years. The exceptional development trajectory of Bitcoin provides a practical option to accomplishing financial flexibility. This raises the concern: what if one were to buy Bitcoin rather of committing time and resources to a university education? Which alternative would eventually yield a greater return throughout a profession?

Assessing the Value of a University Education

The expense of university education has actually considerably overtaken inflation, with tuition rates increasing by more than 250% in inflation-adjusted dollars over the previous 4 years and by 830% in small terms. Additionally, it has actually been presumed that universities have actually progressively moved their focus towards politicization and constraint of complimentary speech, instead of focusing on quality education and intellectual engagement. This has actually led lots of moms and dads and trainees to question the worth of a university degree. Indeed, self-confidence in college has actually plunged from 57% in 2015 to a simple 36% in 2023. Concurrently, college registration amongst current high school graduates in the U.S. has actually reduced from a peak of 70% in 2009 to 61% in 2023, showing a growing look for alternative paths.

Even the extensively pointed out college wage premium of 75% might be deceptive. It is very important to acknowledge that the accomplice of trainees who effectively obtain a four-year degree frequently display greater levels of intelligence and work principles than those who select to go into the labor force instantly after high school. Consequently, this figure does not effectively show the prospective wage premium for a specific trainee who has the capability to total a four-year degree however decides not to pursue it.

In his book The Case Against Education, Bryan Caplan argues that the college wage premium decreases considerably when seen through the lens of specific accomplishment instead of group averages. His comprehensive analysis shows that the wage premium for a specific similar in capability is more detailed to 38%. For circumstances, a person anticipated to make $1 million over a life time without a degree would likely make around $1.38 million with one.

Furthermore, Caplan approximates that approximately 80% of the college wage premium can be associated to signaling—basically showing to companies that the specific has the qualities needed to obtain a four-year degree and prosper in the work environment—leaving just 20% as real academic worth.

In addition to the expense of tuition, trainees also sustain a substantial chance expense, compromising 4 years of prospective earnings and the acquisition of important abilities that might boost their market competitiveness post-graduation.

Evaluating Bitcoin as an Investment

Bitcoin presents an unique possession class—a digital possession identified by its outright shortage, untouched by changes in need. In light of federal governments’ propensities to broaden loaning and print extra fiat currency, both critical financiers and the basic people look for a property insulated from inflationary pressures enforced by people, federal governments, or banks. As the international understanding of Bitcoin develops and its adoption boosts, the fundamental shortage is most likely to contribute to a long-lasting upward rate pattern. This assertion is supported by Bitcoin’s efficiency record, which has actually exceeded all other standard possession classes in 11 out of 14 years. Over the previous years, Bitcoin’s CAGR of 71% has actually significantly exceeded the S&P 500’s 11% return throughout the exact same timeframe.

Bitcoin’s characteristics of remarkable shortage, mobility, and verifiability, integrated with very little ownership expenses and lowered jurisdictional danger, position it positively compared to conventional possessions like gold. Additionally, Bitcoin shows a degree of resistance to regulative threats dealt with by other financial investments. The qualities of Bitcoin recommend that it will progressively take on present shops of worth such as gold, bonds, property, and stocks.

Michael Saylor has actually just recently provided a 21-year rate projection for Bitcoin, which approximates a 21% CAGR in a bearish circumstance, a 29% CAGR under standard conditions, and a 37% CAGR in a bullish outlook. Given these forecasts, it is important for trainees and moms and dads to thoroughly think about Bitcoin as an option before buying university tuition and passing up prospective earnings and ability acquisition over 4 years.

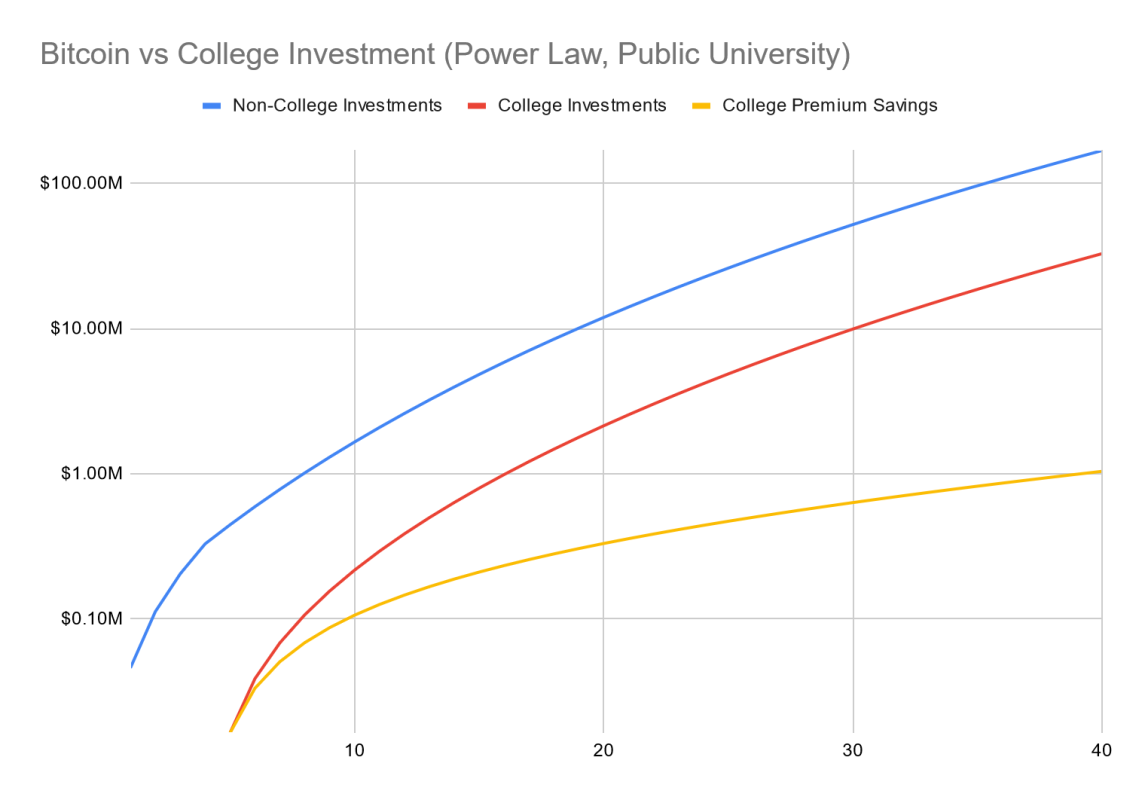

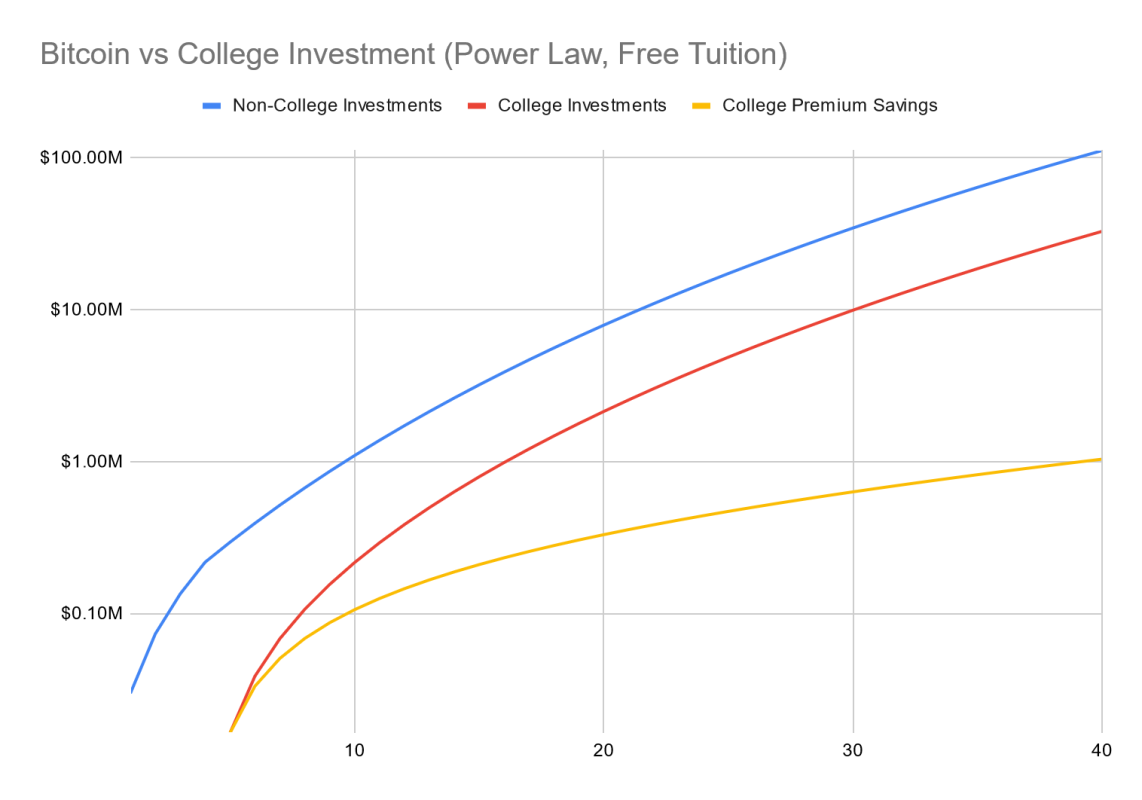

Another prices design, the power-law design promoted by @Giovann35084111 and others, has actually shown exceptional precision in anticipating Bitcoin’s rate history. This design prepares for sped up development in the early years, with a progressive decrease in returns as Bitcoin develops. It presumes that, typically, the rate of Bitcoin associates with time raised to the 6th power, where time represents the overall period given that the genesis block. Current forecasts recommend about a 45% CAGR in the coming year, tapering to around 25% over the next years.

Comparative Analysis of University Education and Bitcoin Investment

This analysis approaches both university education and Bitcoin investment through the lens of capital release—seeing a university education as an investment in human capital and Bitcoin as an investment in a valuing possession.

The expense connected with getting a university education includes both direct financial commitments and chance expenses: 1) the payment of 4 years’ worth of tuition and 2) the forfeit of 4 years of earnings and relevant work experience. The anticipated return on this investment is a wage premium of 38% over a profession. Conversely, a method of buying Bitcoin from the beginning, making use of funds initially allocated for tuition, is taken a look at here. For the contrast, it is presumed that moms and dads cover living expenditures in both situations. As such, living expenses are omitted from the university course’s overall cost and do not decrease earnings for the non-university course. Instead, all net wage accumulated will be assigned to Bitcoin purchases at the end of each year, matching to the 4 years throughout which adult assistance would have supported the trainee’s education.

Furthermore, it is presumed that incomes will increase by 3% yearly, showing both inflation and genuine development. The financial worths and designs used are thought about in small terms and are not changed for inflation, as both situations are contrasted over the exact same timeframe, therefore decreasing the effect of inflation on relative efficiency.

Tuition expenses differ considerably throughout various kinds of organizations. For the scholastic year 2024-2025, in-state tuition for a ranked public university in the U.S. averages $11,000 annually, while out-of-state tuition intensifies to around $25,000 yearly. Students going to personal colleges might deal with expensive costs balancing $44,000 annually, and Ivy League tuition varies up to $65,000 yearly. Community colleges, on the other hand, usually charge considerably lower tuition rates. Additionally, some trainees might receive scholarships or financial assistance, while others might live in jurisdictions where tuition is supported.

To highlight the financial ramifications, 2 situations are thought about: registration in an in-state public university and the alternative of complimentary tuition. In the Bitcoin investment option, the yearly tuition quantity is assigned towards buying Bitcoin, efficiently embracing a dollar-cost averaging method to alleviate market entry threats.

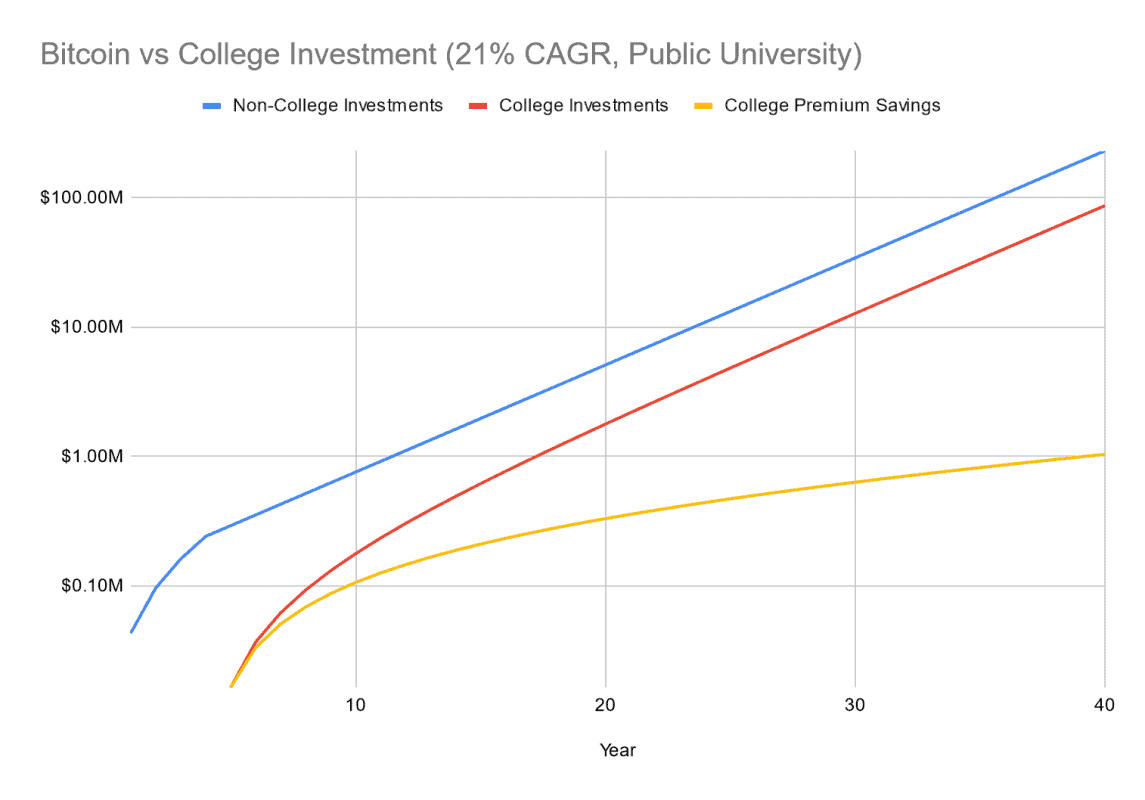

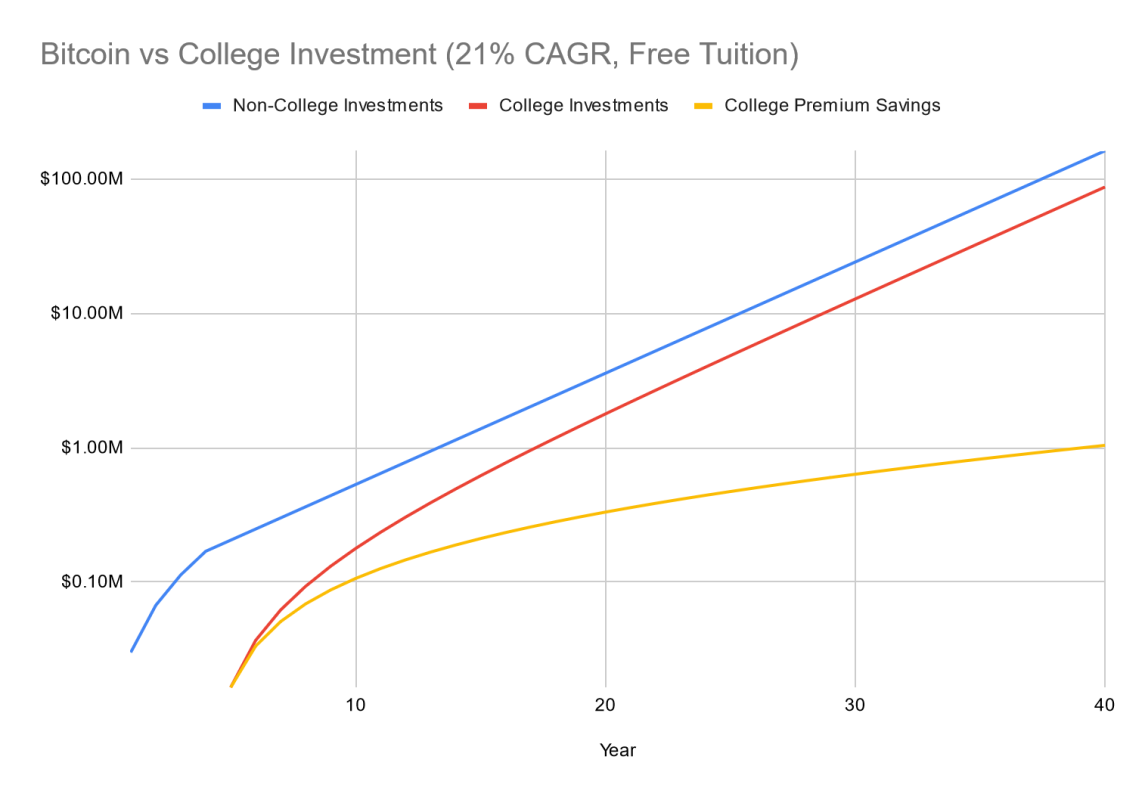

The Bitcoin rate design is examined under 2 situations: the Saylor bear case (21% CAGR) and the previously mentioned power-law design, which prepares for greater preliminary returns that reduce with time, in line with Bitcoin’s historic efficiency.

Results are evaluated over a 40-year profession period (4 years of university integrated with 36 years of expert work) and presume a base non-college take-home wage of $30,000 annually, with the college wage premium structured to yield an overall life time premium of 38%. The non-college path is presumed to stockpile Bitcoin collected from tuition cost savings and profits throughout the preliminary 4 years, while the college path invests Bitcoin originated from the wage premium in addition to keeping comparable net pay as the non-college circumstance.

The analysis consists of 3 essential financial metrics:

- Non-College Investments: The cumulative worth of Bitcoin originated from tuition cost savings and early profession profits.

- College Investments: The cumulative worth of Bitcoin created from investing the yearly wage premium post-college.

- College Premium Savings: The cumulative worth of cost savings accumulated from the college wage premium (not bought Bitcoin).

To supply the college alternative with the most beneficial conditions, it is presumed that the college wage premium is also bought Bitcoin yearly.

Results Overview

Even under the Saylor bear case circumstance (21% CAGR), investing tuition and preliminary earnings into Bitcoin significantly surpasses the returns from the college wage premium over an individual’s profession. The college wage premium stops working to capture up after 40 years. If financial self-reliance is specified as collecting $5 million in Bitcoin cost savings, this target is reached in simply twenty years on the non-college course, compared to 25 years for the college path. Conversely, simply conserving the wage premium in fiat currency without buying Bitcoin yields minimal returns—less than 1/200 of the non-college trajectory and around 1/100 of the college course including Bitcoin investment.

In a circumstance where the trainee take advantage of complimentary tuition, whether by means of scholarships or government-provided help, the non-college path preserves its benefit through 4 years of earnings prior to accomplishing comparable conditions as the college course.

The results regularly show that, even under these conditions, the non-college path supplies remarkable returns, mainly due to the capability to invest 4 years’ worth of wage instead of postponing profits for 4 years.

If the Bitcoin power law continues to line up with Bitcoin gratitude, analyses will think about both public university and tuition-free situations.

In situations where the power law design uses, the non-college path considerably surpasses the college path, despite whether tuition is supported. Under the general public university tuition option with the power law used, accomplishing financial self-reliance ($5 million) takes place within simply 15 years post-high school, at an age of 33.

Alternative Scenarios

What ramifications emerge if these situations are extremely positive concerning Bitcoin’s efficiency? Should the Bitcoin CAGR fall to 10% for the general public university case, the 2 situations basically yield similar results. At a CAGR of 5%, the college course still needs 18 years to accomplish parity with the non-college alternative.

It is also sensible to think about the circumstances where the college course prepares trainees for high-earning occupations such as engineering, medication, or law. In such cases, where a college education might be obligatory for pursuing these professions, the prospective wage premium might surpass expectations. For circumstances, under the general public university circumstance with a 21% CAGR in Bitcoin gratitude, a college wage premium of 113% would be needed to reach break-even over a 40-year profession.

However, this analysis does not include the totality of the story. Medical and legal occupations need extra years of education, leading to significant tuition expenses and extended durations of deferred earnings compared to a four-year degree. Assuming 8 years of postponed salaries and tuition (a conservative quote for medical or law school tuition), the necessary wage premium expands to an amazing 300% simply to obtain break-even status. Engineering appears to provide a beneficial balance—supplying an expert profession in 4 years together with a larger-than-average predicted wage premium. Yet, even in this context, the needed breakeven premium of 113% positions a significant obstacle.

For those thinking about checking out alternative variables, there is a Google Sheet offered for users to evaluate various criteria and observe the solutions utilized for these estimations.

Broader Considerations

This analysis mainly concentrates on the financial implications of a capital expense, leaving out elements such as individual complete satisfaction originated from divergent courses, inspiration, networking advantages connected with a university education, or the capacity for individual development when compared to getting in the labor force straight after high school. Moreover, it does not consider the volatility connected with Bitcoin, which might provide unpredictability and extra psychological concern.

If the properties surrounding Bitcoin’s gratitude apply, these findings recommend that pursuing a non-university course with a Bitcoin investment method might provide greater financial benefits compared to the conventional university education path. Such conclusions empower trainees and moms and dads to ponder other paths that might resonate more carefully with their specific worths, choices, and goals. Beyond financial flexibility, Bitcoin also supplies a chance for greater autonomy in profession choices, less affected by scholastic or financial restrictions.

This is a visitor contribution from Stan Reeves. The viewpoints revealed herein are entirely those of the author and do not always represent the views of BTC Inc or Bitcoin Magazine.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.