An experimental metric used to gauge the quantity and quality of activity on bitcoin’s network clocked a 28-week high last Saturday, signaling the cryptocurrency’s latest price rally may be more fundamentally driven than many expect.

The Transaction Amount to Active Addresses Ratio (TAAR), first proposed by CoinDesk Contributor and Pugilist Ventures Founder Chris Brookins, divides bitcoin’s 24-hour adjusted transaction volume (USD) by the number of its active addresses to identify how much each active address spends in transactions per day on average.

If TAAR is high, then it means each user (active address) is transacting in high notional values, in other words, the network “quantity” (how much is being spent i.e. transaction volume) is high per the “quality” (how many users are spending the funds i.e. active addresses).

When the quantity and quality of bitcoin’s network are high, then one would expect a positive reaction in bitcoin’s market and vice versa when the ratio is low.

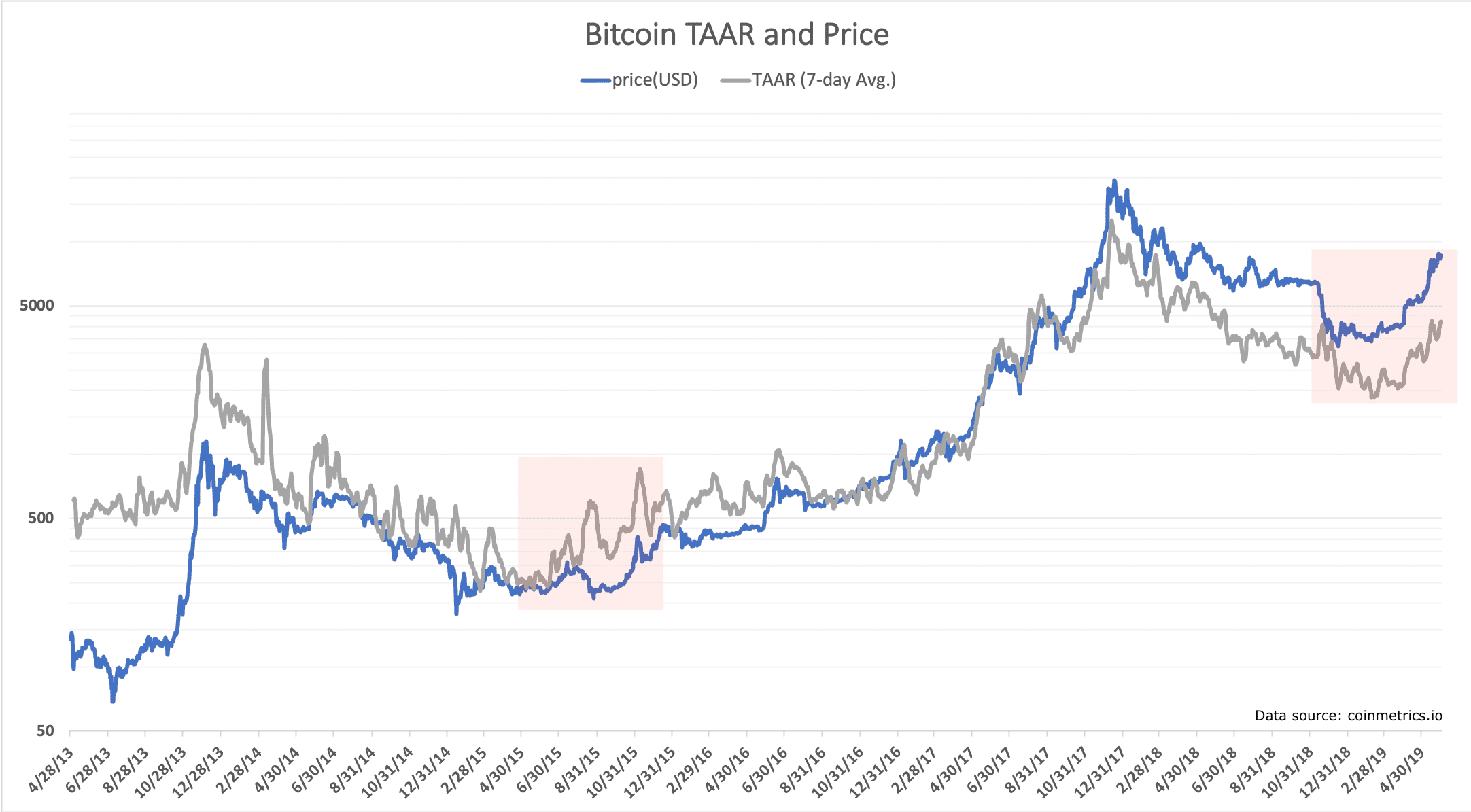

Since April of 2013, the oldest data point available via Coinmetrics, this has proven to be the case as it has been made clear bitcoin’s price only enters sustainable trends when it is accompanied by a TAAR trend in the same direction.

Bitcoin’s TAAR and Price

As is shown above, bitcoin was only able to escape its bear market in 2015 once its network activity picked up pace, made evident by the TAAR finally failing to set new lows along with bitcoin’s price and beginning to trend upwards (highlighted in the red square).

This, in a sense, added fundamental validation to bitcoin’s price growth at the time, which often falls victim to pure speculation.

Interestingly, bitcoin’s TAAR is once again clearly rising along with its price in a similar fashion to that seen at the end of the previous bear market, potentially suggesting bitcoin’s latest price growth may be sustainable as long as the network activity continues to rise. Corrections in price should be expected, but according to this model, bulls should only be concerned when TAAR loses significant altitude.

Now, the sample size is small spanning just six years, so combining this metric in analysis with other metrics would be fruitful in order to avoid outlier signals, but nonetheless, the TAAR does show an increase in bitcoin’s network activity not seen in several months regardless of its connection to prices.

Disclosure: The author holds several cryptocurrencies. Please see his author bio for more information.

Bitcoin image via Shutterstock

Source link

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.