Death and taxes and 21 million Bitcoin. That is what we understand to be specific. The rest is opinion. Today I wished to share my huge bets on the next halving. I make sure I will flinch in 4 years at a few of these “prophecies” however a few of them will come to life. I don’t have a lots of information to support these forecasts, some are suspicion, others are random. All I understand is that the future is strange.

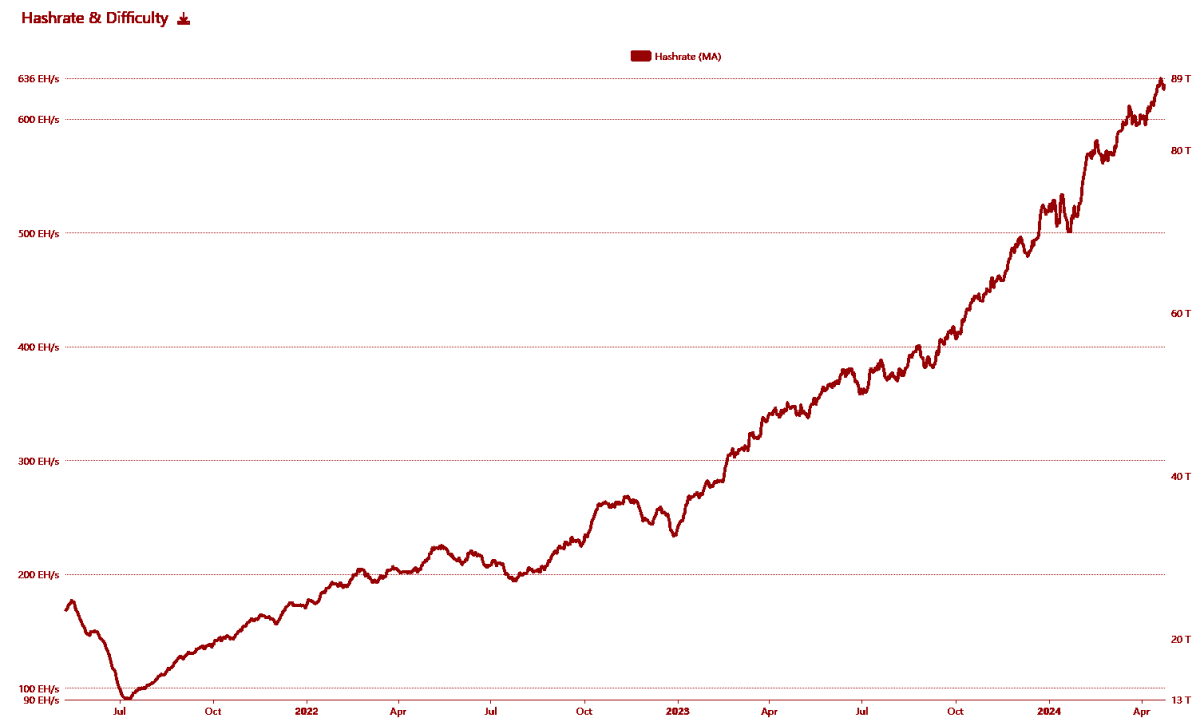

3 Zeta Hash Mining

Based on my experience mining throughout the previous cycle, I discovered an important lesson in attempting to approximate hashrate, believe log not direct. The existing hashrate surpassed my expectations by a long shot, so I I am going additional long on the next cycle. We are visiting more nation-states embrace and it is going to rip up. This is the method we dominate the stars.

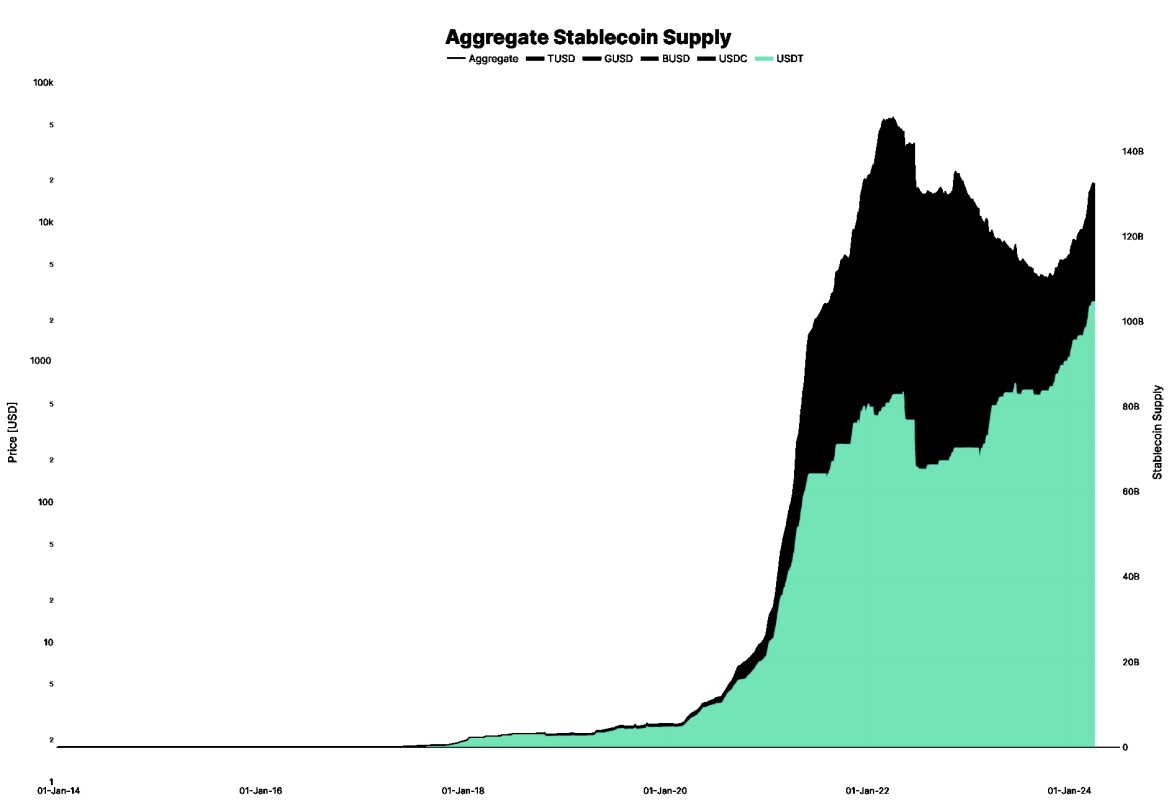

5 Countries in Western Hemisphere Declare USDT Legal Tender

Nations with high inflation and unsteady currencies are checking out cryptocurrencies as legal tender, following El Salvador’s example. Political motions in nations like Argentina and Venezuela reveal increasing public and legal interest in digital currencies. Economic reports recommend that embracing digital currencies can lower deal expenses and increase monetary inclusivity.

Apple incorporates Stablecoins into wallet

Apple has actually traditionally embraced brand-new monetary innovations (gradually), nevertheless there’s substantial user interest in accessing stables together with conventional banking in mobile wallet apps. Recent employs and patents by Apple in cryptocurrency and blockchain recommend future item offerings consisting of digital currencies.

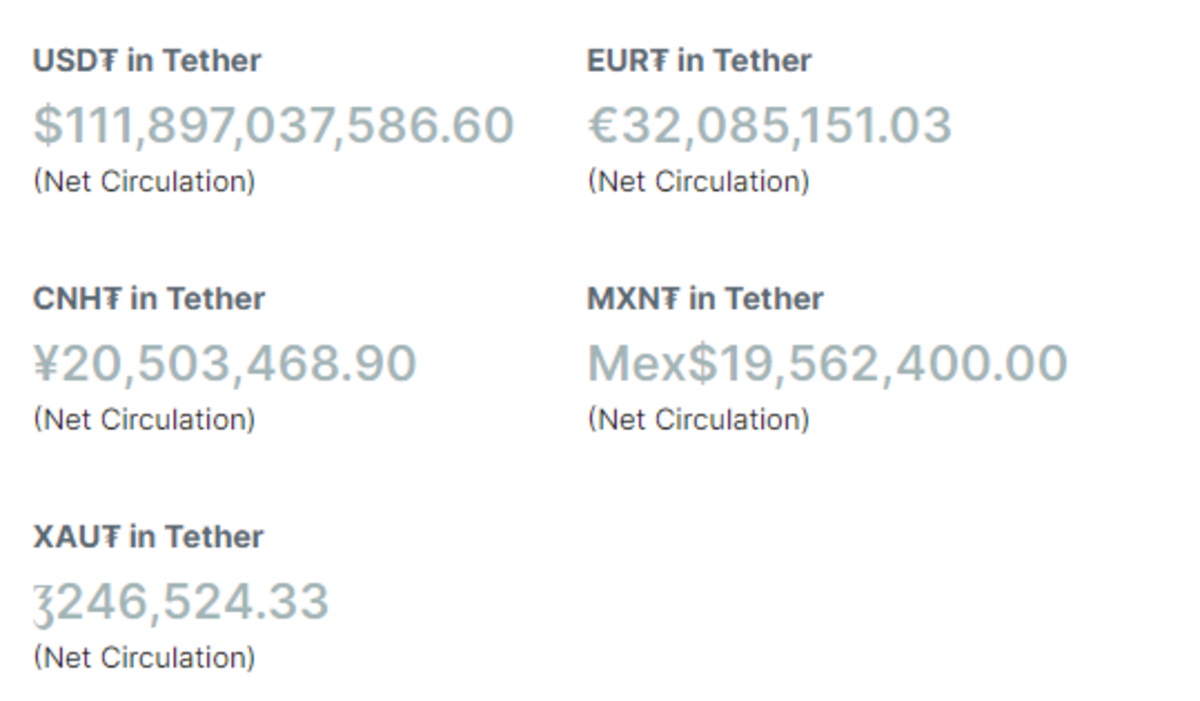

Liquid’s Growth Fueled by USDt

Liquid Network’s overall everyday deal volume is absurd today at the halving however as stablecoin guideline is put in location we will se an outrageous boost in need for tether which will sustain Liquids development. As these days, USDt on liquid is ~ $36,500,000 or 3.17% of overall USDt supply. ($111,897,000,000). I anticipate > $1b to be provided on Liquid by next halving or > 2,600% boost. This is a wild guess which I am making based upon the presumption that USDt dominoes forming on the other prophecies.

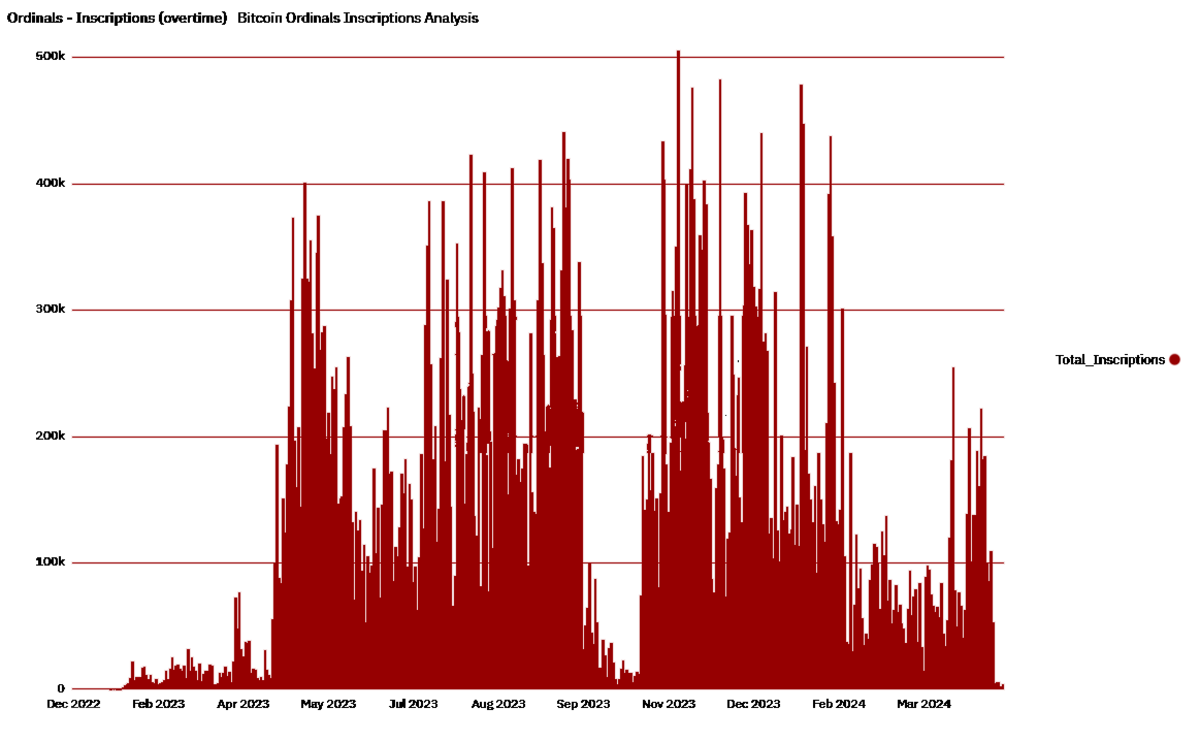

Ordinals Still Thriving

The degenerate NFT market has actually revealed constant interest in “blockchain-based ownership verification”, showing a strong future for tasks like Ordinals. Initial uptake by digital artists and collectors at Ordinals’ launch mean long-lasting practicality. Technological improvements in blockchain scalability are making it practical to handle substantial information like that utilized in Ordinals.

Fees Carry Mining Revenue at 2:1 Subsidy

As obstruct benefits cut in half, deal costs are ending up being a more substantial part of miners’ earnings, noticeable in the last 2 halvings. Economic designs anticipate collected costs will end up being the dominant reward for miners as deals increase. Historical information reveals increasing charge percentages relative to obstruct benefits with each cutting in half occasion. I am a charge maxi.

LN Will Be 90% Centralized and Compliant

The Lightning Network’s development is supported by significant banks looking for scalable options, resulting in possible centralization. Regulatory pressures are forming crypto innovations to prefer centralization for much easier oversight. Studies on network nodes reveal a pattern towards centralization as significant gamers develop dominant positions.

E-Cash Finds Market Fit with Miner Payouts

The require for effective miner payment techniques is driving the adoption of e-cash options that provide instant, low-fee payments. Pilot tasks reveal appealing outcomes for incorporating e-cash into mining operations. Economic analyses recommend that e-cash can lower volatility and enhance liquidity for miners.

Challenges in Seed Phrase Security Due to Neuralink

Neuralink and comparable tasks check out direct brain-computer user interfaces, making complex conventional cryptographic practices. All your seeds are come from makers. New techniques to produce seeds without exposing to makers ends up being crucial.

Oil Contracts Settled on Chain

Bitcoin usage in product trading is broadening with effective pilots for petroleum trading on-chain. Countries crucial of the United States dollar’s supremacy are checking out Bitcoin options to prevent conventional monetary systems. Bitcoin innovation enhancements have actually improved its capability to manage massive, complicated agreement settlements.

Bitcoin ETF Surpasses Gold ETF Market Cap

Rapid growth in the Bitcoin financial investment market and the launch of Bitcoin ETFs in several nations show a growing market. Bitcoin’s market cap periodically going beyond significant business (FAANG) and conventional properties. Bitcoin is significantly deemed a “safe haven” possession, driving ETF financial investments. RIP Gold.

Assassination Markets Settled by Decentralized Oracles

Over $100 billion is secured “DeFi platforms”, engaging with “decentralized applications”. Decentralized oracles’ practicality in settling bets on real-world occasions. We will see assassination markets on chain irl. Probably performed by drone swarms.

Reorg for Epic Sat

We desired fireworks last halving and we didn’t get them. Next halving we get them The worth of the Epic Sat will be huge next halving and mining swimming pools who don’t take part will be mocked.

SV2 Only Captures 20% of Hashrate

No one care’s regretfully. The huge swimming pools are not incentivized to embrace SV2. Big swimming pools will continue to discover ingenious methods to generate income from blocks, which doesn’t consist of SV2.

A US State Invests in Bitcoin

States like Wyoming and Texas have actually enacted blockchain-friendly laws, laying legal foundation for such financial investments. Diversifying state treasuries with Bitcoin might hedge versus inflation, especially with changing USD strength. Several state treasurers have actually revealed interest in checking out digital properties as part of monetary techniques.

AI Becomes Sentient and Demands Bitcoin

The device(s) desire Bitcoin, not shitcoin.

China Unbans Bitcoin Mining

China’s previous Bitcoin mining restriction considerably affected the worldwide hash rate and mining landscape. Reinstating Bitcoin mining will boost China’s commercial and technological sectors financially. They will no longer neglect the value of hashing.

Great Replacement Becomes Reality, Leading to Mass Deportations

Nationalist motions in Europe have actually utilized the Great Replacement theory to affect migration policy. Demographic research studies anticipate substantial population shifts, possibly underpinning extreme policy modifications. Political gains for celebrations backing these theories show possible relocations towards more extreme market policies.

Bukele Continues as President

Bukele’s appeal in El Salvador is buoyed by his bullish bitcoin financial policies, showing possible for extended management. Surveys in El Salvador reveal high approval scores for Bukele, specifically amongst tech-savvy demographics. Constitutional or legal modifications will assist in prolonged terms or duplicated re-elections.

The Bitcoin-Dollar is a Documentary

Financial experts’ designs task Bitcoin’s worth might surpass $1 million per coin within the years, thinking about supply and need characteristics. Bitcoin’s rate has actually traditionally risen post-halving, supporting future rate boost forecasts. Institutional financial investment is increasing, with significant companies assigning portfolios to cryptocurrency, enhancing its authenticity and need.

Scaling BIP Activated

CTV, LNhance. OPCAT, some BIP is triggered.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.