Bitcoin’s current cost action has actually been a rollercoaster of low and high. However, although bitcoin has actually set a brand-new all-time high and had 2 years of a near-constant favorable trajectory, we’re yet to see a constant increase of retail financiers. The capacity for a rise in retail involvement and the possibility of raising the bitcoin cost to extraordinary levels are potential customers that lots of financiers are anxiously preparing for. In this post, we’re going to check out when we may see these retail financiers dive back into the bitcoin swimming pool and whether their return might undoubtedly move BTC to even higher heights.

Active Address Growth and its Impact

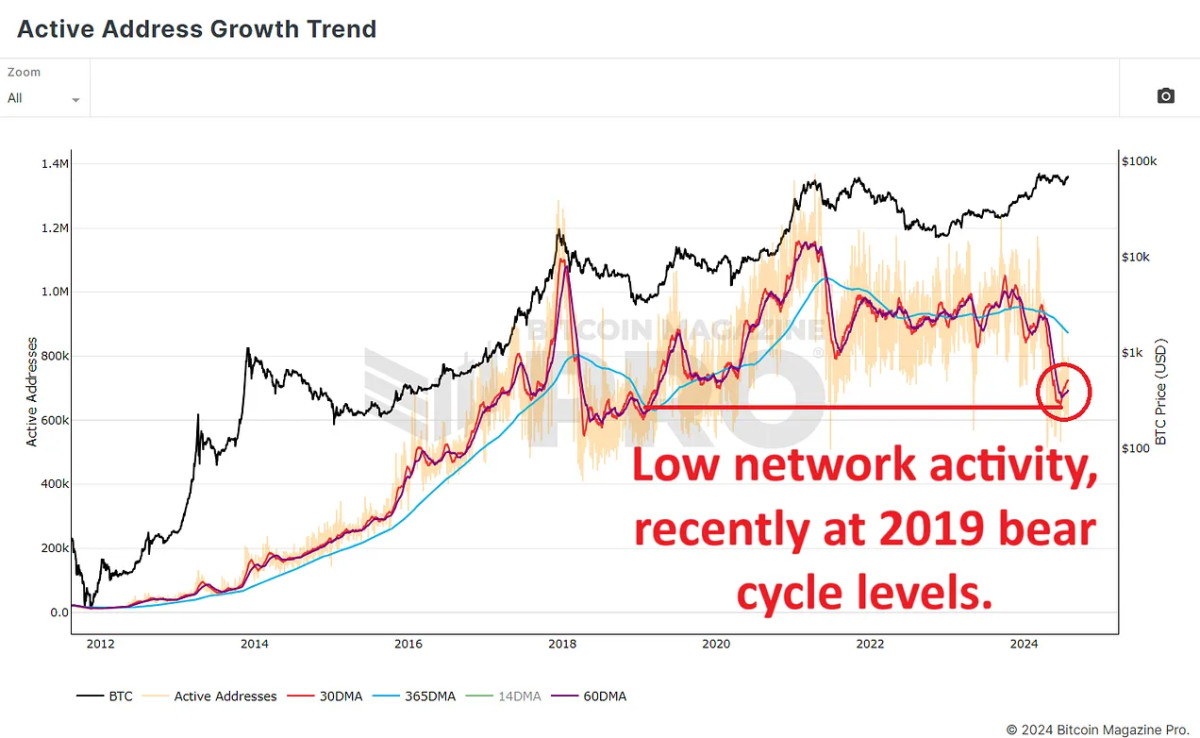

To expect this possible retail wave, it is very important to inspect the pattern of active address development. Data sourced from Bitcoin Magazine Pro recommends a down swing in the variety of active network individuals in current months. The 365-day moving average (blue line), together with the 60-day (purple line) and 30-day averages (red line), inform a tale of reduced network activity. This drop takes the count of active users back to levels similar to early 2019, following bitcoin’s bear cycle, when rates hovered in between $3,500 to $4,000.

This decrease in active network users raises eyebrows about bitcoin’s upside capacity in the existing cycle. Interestingly, in spite of bitcoin striking a brand-new record of approximately $74,000, there was no matching continual uptick in network users, a plain departure from previous cycles.

The Necessary Inflow of New Capital

This pattern might be a reflection of Bitcoin’s progressing identity. Originally a digital peer-to-peer currency, Bitcoin is significantly viewed as a shop of worth. As an outcome, less individuals are utilizing it for daily deals and are rather putting capital into bitcoin as a long-lasting property.

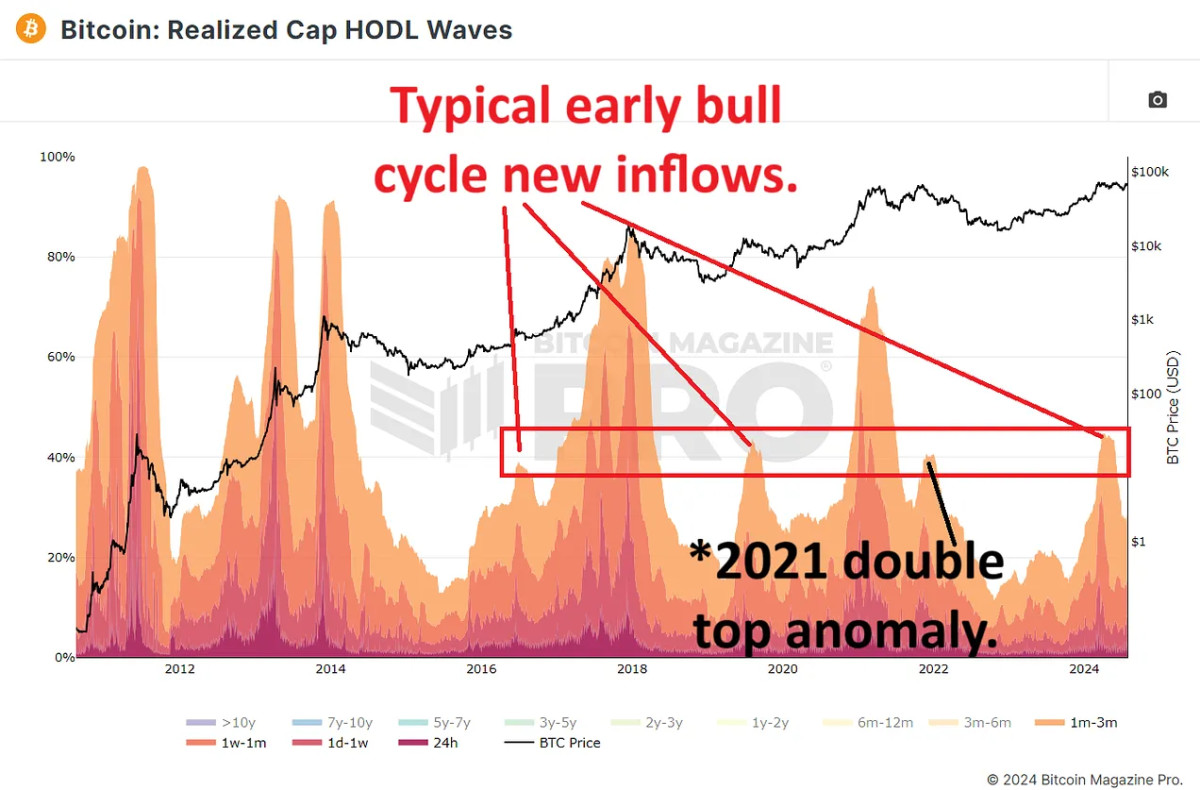

The Bitcoin HODL Waves & Realized Cap HODL Waves clarified this shift. These metrics group Bitcoin network users based upon the period they have actually held their coins, in addition to revealing their impact on the build-up cost of BTC. Recent information exposes that about 20% of bitcoin has actually been held for 3 months or less, suggesting that brand-new users are going into the marketplace, however as we can see from the typical active addresses in the above information, not utilizing Bitcoin as regularly as in the past.

The effect of these brand-new users on the recognized cap (the typical build-up cost of all BTC) is substantial, with over 40% of current impact originating from users holding Bitcoin for 3 months or less (shown by the warmer red/orange colors in the chart below). This recommends that users are going into the marketplace at greater rates and are acting in a way constant with previous cycles (we’re just recently seen the preliminary early bull cycle inflows at similar levels to previous cycles, shown by the red box), simply not as regularly as we have actually formerly seen.

Understanding Market Forces and Retail Involvement

A take a look at Bitcoin’s previous cycles reveals that a rise in retail activity typically precedes market peaks. For example, in the 2017 and 2021 bull runs, retail interest surged around 6 months before the cost peaks. The existing lack of a substantial boost in retail interest, as evidenced by Google Trends, recommends we’re experiencing a more determined, and more sustainable market development.

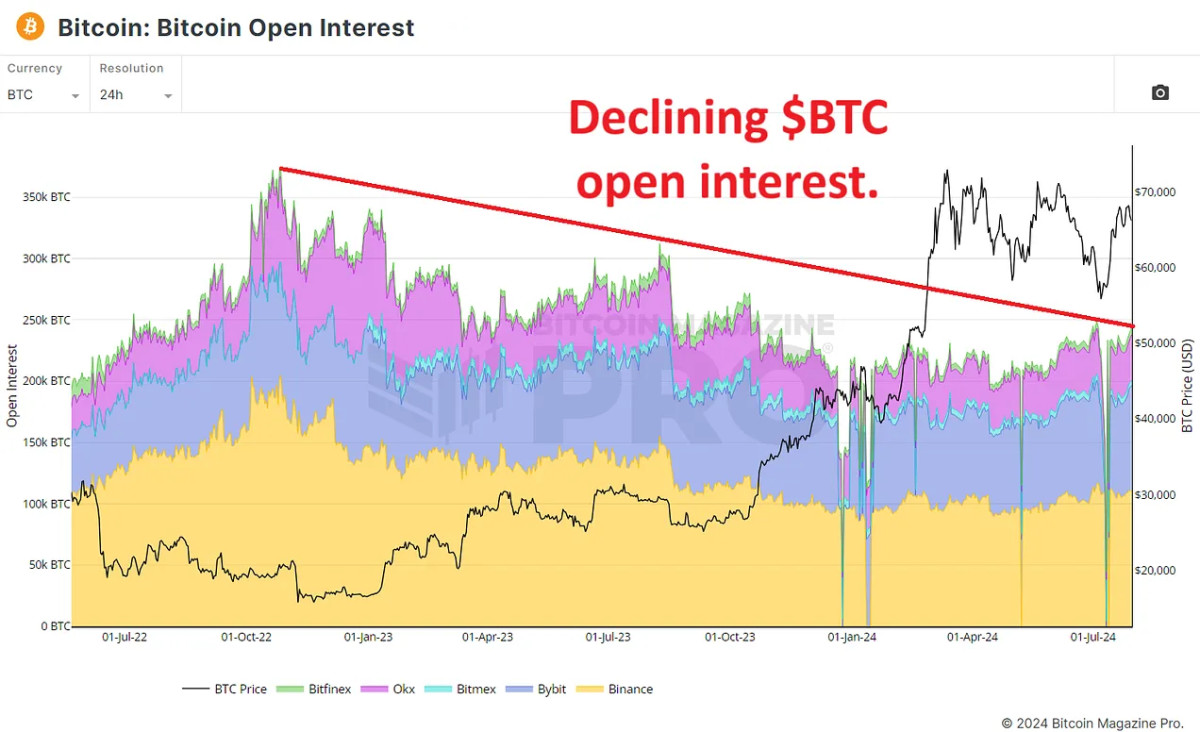

Another essential factor to consider is the Bitcoin Open Interest chart, which determines the overall worth of open bitcoin futures agreements. Since late 2022, this metric hasn’t revealed a substantial boost; in reality, we’ve seen a constant decrease considering that the bear cycle lows (shown by the decreasing red line in the chart below). Revealing that financiers are now choosing to trade real bitcoin instead of simply taking part in derivatives trading. This shows a shift in story where financiers are more thinking about holding bitcoin for the long run instead of going after short-term speculative gains.

Conclusion

Given existing patterns, the absence of a retail craze might be viewed as a favorable indication for the marketplace’s long-lasting potential customers. As bitcoin approaches brand-new record highs, keeping a close eye on the arrival of retail financiers will be vital. If retail financiers begin going into the marketplace in great deals, will they fall back into old practices of pure FOMO purchasing, or will they continue to prefer long-lasting holding?

In short, in spite of a fall in Bitcoin’s active user metrics, the marketplace reveals indications of stability and long-lasting financial investment. The lack of instant retail interest may appear bearish, however it’s most likely to be bullish as it shows a more determined and sustainable development trajectory.

For a more extensive check out this subject, have a look at a current YouTube video here:

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.