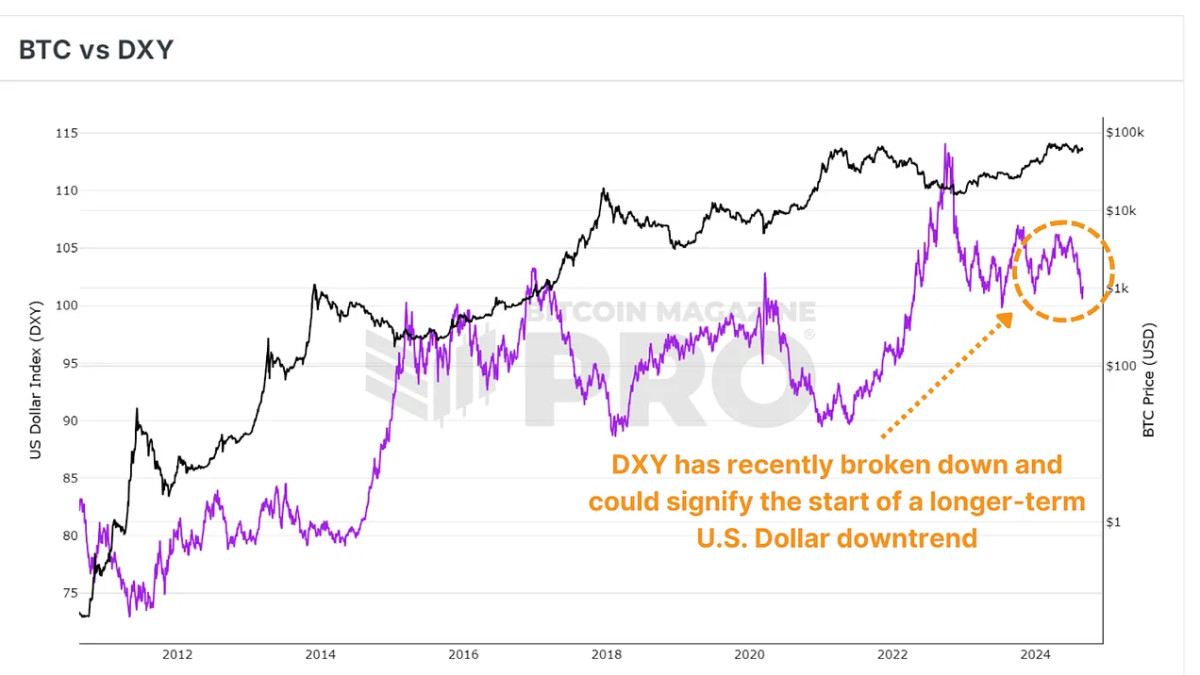

Bitcoin and the U.S. dollar have an enduring inverted connection, significantly when observing the Dollar Strength Index (DXY). When the dollar deteriorates, Bitcoin frequently acquires strength, and this vibrant may now be setting the phase for rebooting the BTC bull cycle.

DXY

The Dollar Strength Index (DXY) determines the worth of the U.S. dollar versus a basket of other significant worldwide currencies. Historically, a decreasing DXY has actually frequently accompanied considerable rallies in Bitcoin’s cost. Conversely, when the DXY is on the increase, Bitcoin tends to get in a bearish stage.

We have actually just recently seen a substantial decrease in the DXY, which might be indicating a shift towards a more risk-on environment in monetary markets. Typically, such a shift agrees with for possessions like Bitcoin. Despite this slump in the DXY, Bitcoin’s cost has actually stayed reasonably stagnant, raising concerns about whether BTC may quickly experience a catch-up rally.

Sentiment Shifting

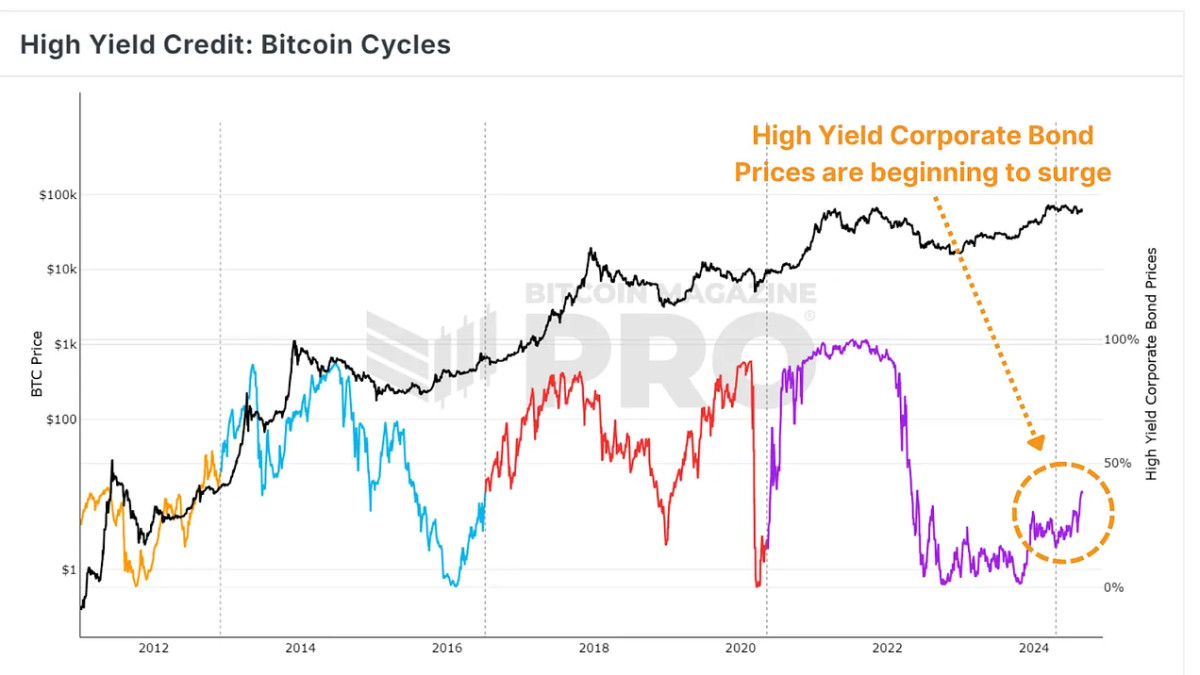

Coinciding with the reduction in need for the U.S. dollar, the high-yield credit information recommends increasing need for higher-yielding business bonds. This suggests that financiers are more excited to acquire outsized returns, and traditionally this hunger has actually led to more considerable capital inflows and greater costs as an outcome for Bitcoin.

Lagging Behind?

In contrast, the S&P 500 has actually seen significant development in current weeks, while Bitcoin has actually stayed reasonably stagnant. However, the increasing connection in between Bitcoin and the S&P500 recommends that Bitcoin may quickly follow the upward pattern we’ve seen in standard equities.

Conclusion

In summary, while Bitcoin has actually been sluggish to respond to the current decrease in the DXY, the more comprehensive market conditions recommend a potential for a bullish stage in our present cycle. We’ve seen a shift in belief among standard market financiers and, consequently, a duration of outperformance for the S&P500.

Whether the marketplace is overstating the effect of the dollar’s decrease stays to be seen, however the potential for a rally exists.

For a more thorough check out this subject, take a look at a current YouTube video here: The United States Dollar Decline Will Be the BTC Bull Market Catalyst

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.