Larry Fink, the CEO of BlackRock, just recently articulated a speculative perspective recommending that Bitcoin could possibly achieve evaluations as high as $700,000 per BTC. His assertion emerges amid intensifying concerns concerning currency debasement and worldwide financial instability, consequently placing Bitcoin as a prospective protect versus the vulnerabilities present within standard monetary systems. It is very important to keep in mind that Fink’s declaration was not a conclusive recommendation; rather, it showed insights obtained from a current conference with agents of a sovereign wealth fund, who were assessing whether to assign 2% or 5% of their financial investment portfolio to Bitcoin. Fink presumes that if institutional adoption continues to broaden and comparable allotment methods end up being extensive, the dynamic of the marketplace could move Bitcoin towards such amazing evaluations.

In a current interview, Fink stated on this striking assertion, suggesting that Bitcoin’s capability for rapid development is elaborately connected to dominating worries surrounding prospective financial recessions and the decline of fiat currencies. He defined Bitcoin as an “international instrument” efficient in easing localized financial concerns.

SIMPLY IN: $11.5 trillion BlackRock CEO Larry Fink states Bitcoin could increase to $700,000 if there is more worry of currency debasement and financial instability.pic.twitter.com/WOXclAsjDP

— Bitcoin Magazine (@BitcoinMagazine) January 22, 2025

A Message to the Market

With BlackRock supervising a shocking $11.5 trillion in possessions, Fink’s declarations bring extensive ramifications, providing a clear message to both retail and institutional financiers. His point of views extend beyond simple individual viewpoint; they work as a substantial market signal concerning Bitcoin’s prospective trajectory. Bitcoin, typically described as “digital gold,” is viewed as a practical shop of worth that can protect wealth from the erosive results of inflation and financial mismanagement by federal governments. Fink’s recommendation of this story might even more catalyze its adoption amongst standard financial investment circles.

Related: From Laser Eyes to Upside-Down Pics: The New Bitcoin Campaign to Flip Gold

A Timely Forecast

Fink’s forecast comes to a crucial point as worldwide economies challenge rising inflation, intensifying nationwide financial obligations, and geopolitical stress that threaten currency stability. With its capped supply of 21 million coins and decentralized architecture, Bitcoin provides an engaging alternative possession class that stays resistant to inflationary pressures fundamental in fiat currencies. In this context, its worth proposal gains substantial significance.

BLACKROCK IS BACK.

THEY SIMPLY PURCHASED $600 COUNTLESS BITCOIN, THEIR LARGEST BUY UP UNTIL NOW THIS YEAR. pic.twitter.com/QLAm5eaik4

— Arkham (@arkham) January 22, 2025

BlackRock’s Bitcoin ETF: A Signal of Institutional Interest

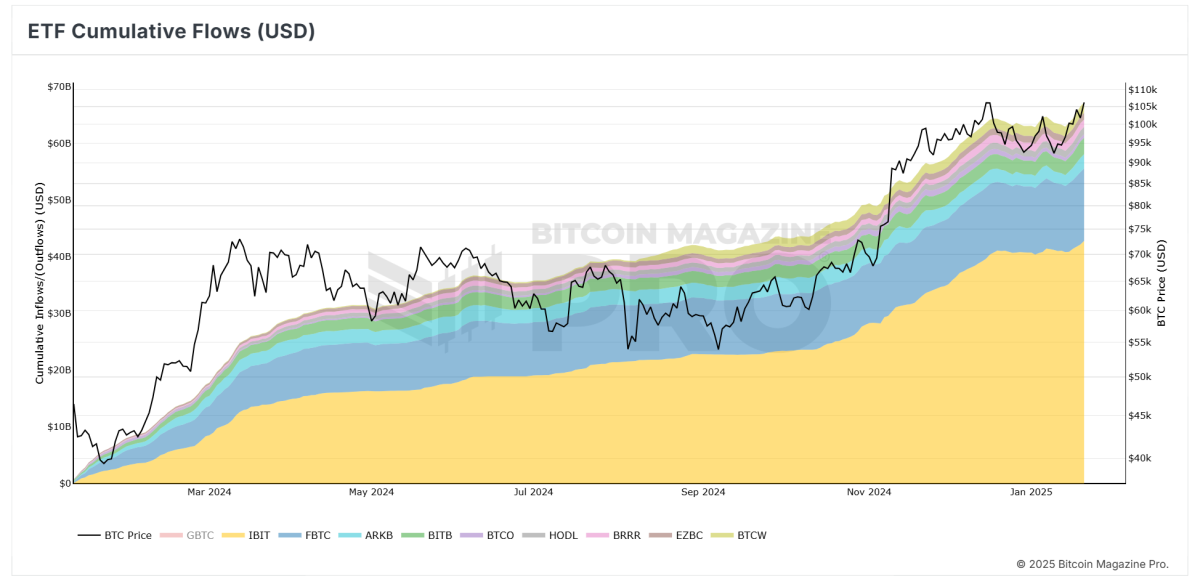

BlackRock’s increasing engagement with Bitcoin marked a substantial accomplishment on January 21, 2025, when the company got $662 million worth of Bitcoin for its exchange-traded fund (ETF), representing its biggest everyday purchase to date this year.

Furthermore, BlackRock’s iShares Bitcoin Trust (IBIT) surpassed the company’s iShares Gold Trust (IAU) in net possessions since October 2024—an amazing accomplishment achieved simply months following IBIT’s beginning in January 2024. This development highlights the blossoming interest in Bitcoin-focused exchange-traded funds.

A Balanced Perspective

While Fink’s forecast might be interpreted as bullish, it stays based on the perseverance of present financial conditions. Should worldwide financial stability enhance or ingenious monetary structures emerge to reduce stress and anxieties surrounding currency debasement, Bitcoin’s rate trajectory might support at a more modest level. Nevertheless, Fink’s prominent commentary serves to strengthen Bitcoin’s emerging status as a genuine possession class.

Related: David Bailey Forecasts $1M Bitcoin Price During Trump Presidency

Bitcoin’s Next Chapter

The change of Bitcoin from a specific niche digital experiment to a mainstream monetary instrument is quickly acquiring momentum. Fink’s observations might suggest a turning point not just for Bitcoin, however also for its more comprehensive approval within standard monetary communities. For financiers and lovers alike, this works as more than simple recognition; it represents that the combination of Bitcoin into the worldwide monetary landscape is not just most likely however currently in development.

As worldwide observers keep track of the circumstance, Bitcoin’s function in redefining financing is progressively amplified. Fink’s forecasts highlight the awareness that Bitcoin is moving beyond its preliminary fringe status, becoming a substantial gamer in the future of currency.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.