The creator and primary financial investment officer of Bridgewater Associates, the world’s biggest hedge fund company, has actually cautioned that the government could “impose restrictions versus capital motions” into properties such as bitcoin. He included that regulators might also impose modifications in taxes that “could be more stunning than anticipated.”

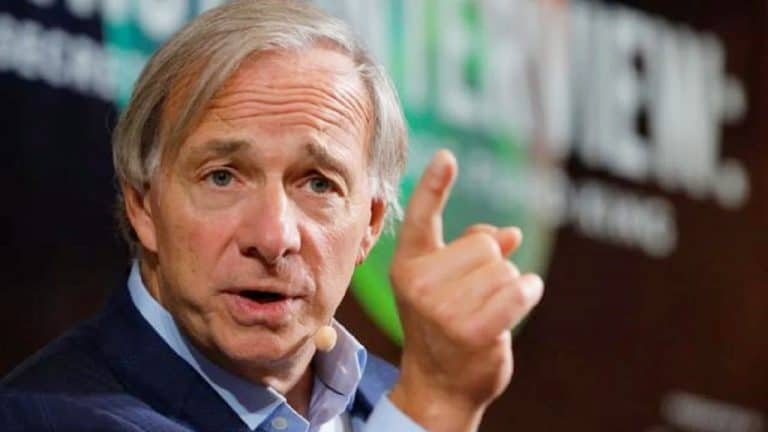

Ray Dalio Warns About Government Prohibitions and Taxes

Ray Dalio, creator and primary financial investment officer of Bridgewater Associates, composed a post on Linkedin recently entitled: “Why in the World Would You Own Bonds When…”

He mentioned that the bond markets presently provide “extremely low yields,” which “do not fulfill these property holders’ financing requirements.” The executive composed, “There is now over $75 trillion of United States financial obligation properties of differing maturities,” including that their holders will at some time wish to offer them to get money to purchase products and services with.

However, Bridgewater’s primary financial investment officer approximates that “at existing appraisals, there is method excessive cash in these monetary properties for it to be a sensible expectation that any substantial portion of that bond cash can be developed into money and exchanged for products and services.” He elaborated: “It needs to be accommodated … by means of printing a great deal of cash and cheapening it, and reorganizing a great deal of financial obligation and government financial resources, normally consisting of big boosts in taxes.”

Dalio discussed: “Based both on how things have actually worked traditionally and what is taking place now, I am positive that tax modifications will also play a crucial function in driving capital streams to various financial investment properties and various places, and those motions will affect market motions.”

The billionaire fund supervisor stressed that “If history and reasoning are to be a guide, policymakers who lack cash will raise taxes and won’t like these capital motions out of financial obligation properties and into other storehold of wealth properties and other tax domains,” caution:

They could extremely well impose restrictions versus capital motions to other properties (e.g., gold, bitcoin, etc.) and other places. These tax modifications could be more stunning than anticipated.

if (!window.GrowJs) { (function () { var s = document.createElement(‘script’); s.async = real; s.type=”text/javascript”; s.src=”https://bitcoinads.growadvertising.com/adserve/app”; var n = document.getElementsByTagName(“script”)[0]; n.parentNode.insertBefore(s, n); }()); } var GrowJs = GrowJs || {}; GrowJs.ads = GrowJs.ads || []; GrowJs.ads.push({ node: document.currentScript.parentElement, handler: function (node) { var banner = GrowJs.createBanner(node, 31, [300, 250], null, []); GrowJs.showBanner(banner.index); } });

The Bridgewater Associates creator utilized Elizabeth Warren’s proposed wealth tax as an example, mentioning that it “is of an unmatched size.” Citing his research study of “wealth taxes in other nations at other times,” he anticipates this proposition “will probably result in more capital outflows and other transfer to avert these taxes.”

Consequently, “The United States could end up being viewed as a location that is unwelcoming to commercialism and capitalists,” Dalio believed, highlighting that “the opportunities of a large wealth tax expense passing over the next couple of years are substantial.” In conclusion, the Bridgewater executive warned:

One ought to bear in mind tax modifications and the possibility of capital controls.

Dalio has actually been studying bitcoin over the current months. In November in 2015, he confessed that he might be incorrect about bitcoin however was however stressed over federal governments banning cryptocurrency. In December, he stated bitcoin could “act as a diversifier to gold and other such storehold of wealth properties.” Then, in January this year, he stated that “bitcoin is one hell of a development,” exposing that his company looking carefully at the cryptocurrency.

What do you think of Ray Dalio’s alerting? Let us understand in the comments area below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.