On November 29 there have been fairly a few bitcoin market spikes, and so-called flash crashes on exchanges, in accordance with merchants on social media and boards. One explicit group of merchants that actually felt the storm when markets received turbulent have been margin merchants on exchanges like Bitfinex. In truth, if one have been to go to the Reddit discussion board /r/bitfinex that day, they’d see a entire bunch of indignant clients who have been burned shopping for bitcoin on a margin.

Buying Bitcoin On a Margin

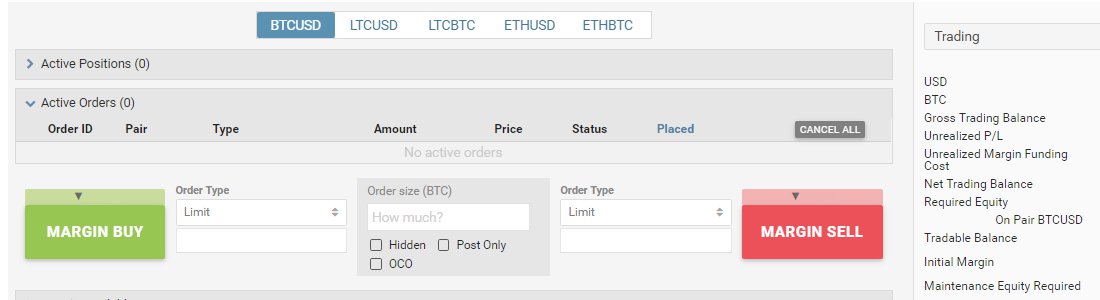

Many folks commerce bitcoin on exchanges and perceive the way to place a purchase or promote order and work together with the buying and selling platform’s operations. However, there are different strategies of alternate on cryptocurrency buying and selling platforms and brokerage services referred to as ‘margin buying and selling.’ Buying on a margin is borrowing cash from the alternate, so you possibly can get hold of a revenue within the quick time period by putting a lengthy or quick guess on a particular digital asset with loaned capital.

Margin buying and selling is way riskier than primary buying and selling. Essentially, people with a restricted quantity of crypto-capital can add leverage to their base funding. For occasion, for those who maintain two bitcoins the alternate permits you to open a margin place with leverage (loaned cash) based mostly in your preliminary capital. Exchanges like Bitfinex, Bitmex, Kraken, Bittrex, and Poloniex all supply most of these trades, and a few of them permit different clients to supply the lending materials. The threat a margin dealer offers with is that they’re playing with loaned cash and the market might not comply with their predictions.

Long and Short, Liquidations, and Stop-Loss Orders

As talked about above merchants who purchase cryptocurrency on a margin place positions (bets) referred to as “long or short.” A protracted commerce is began by buying the digital asset and hoping to promote it for a increased value sooner or later. Short trades include promoting a digital asset and betting the value will drop sooner or later. The web quantity is the market’s worth both purchased or offered; so for those who play a quick place, your base values will probably be destructive. Cryptocurrency exchanges use the estimated highest bid for lengthy positions and the bottom values to comprehend quick bets which in flip can result in ‘liquidation.’

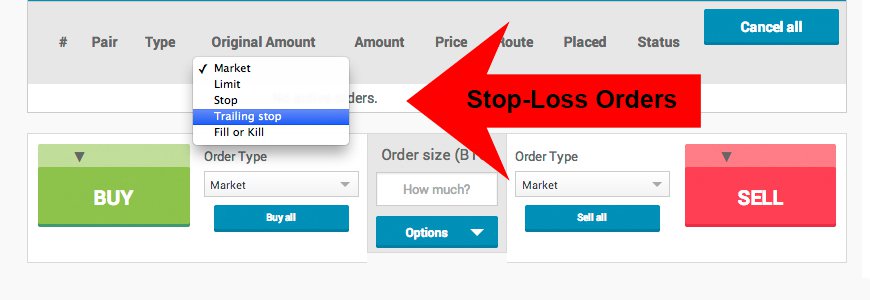

A liquidated margin account means in case your present stability is $1000 USD and a loss on the place is -$500 then you might have misplaced half of your cash. If the loss on the place is manner decrease, at say -$1200, your place will probably be pressured liquidated at that market value. However, merchants can make the most of a instrument referred to as a ‘stop-loss order.’ This means you inform the alternate you need to promote the digital asset when it reaches an approximate value. The concept is to save lots of somebody’s belongings from being pressured liquidated when the market dips or for uncommon events like ‘flash crashes.’ However, a good majority of merchants historically use the stop-loss order setting for lengthy positions. Traders usually overlook to make the most of this instrument briefly positions, and that is when merchants normally get burned.

Traders Getting Burned

In addition to stop-loss orders, cryptocurrency exchanges use what’s referred to as a ‘margin name.’ This is when a buying and selling platform notifies the borrower when the person’s contract worth goes below a particular value. All bitcoin exchanges have totally different formulation to how they execute margin name ranges. Even although these buying and selling security nets are in place, merchants nonetheless complain of points throughout ‘flash crashes.’

“Margin call level is the margin level at which you are in danger of having some of your positions forcibly closed (or “liquidated”),” explains the San Francisco based mostly alternate Kraken. “If this occurs, your positions will probably be closed within the order they have been created, first to final — The variety of positions closed is at our discretion — we might shut all of your positions or solely sufficient to get your margin stage above 100%.”

Margin name tips for the alternate Bitfinex are as follows:

When a place is force-liquidated, the system locations a restrict order on the zero-equity value (slightly than merely executing a market order). We do that to forestall a liquidated place creating a destructive account stability for the person attributable to slippage throughout extremely unstable market durations.

There was a lot of complaining about margin merchants getting ‘burned’ the day many digital belongings reached new all-time highs. Take as an illustration this post on the Reddit discussion board /r/btc from a person who was liquidated for $200Okay price of funds on Bitfinex.

“Forgive me, but English is not my first language,” explains the post. “I see that Bitfinex has been having a lot of issues and I checked the website while bitcoin’s price was falling. As the page was loading in an instant, my account went from about $180,000 to minus -$20,000.”

I don’t know what to do — I attempted to contact assist, however nobody has responded to me and now I can’t even log into my account in any respect.

Who Is to Blame For Crypto-Flash Crashes?

Angriness has been the sentiment from margin merchants on Bitfinex and different exchanges this week. Traders usually are not too happy with the multitude of exchanges that had extreme operational points on November 29. Traders say they may not entry their accounts and cease liquidations earlier than it was too late. Looking at posts on /r/bitfinex and all throughout Twitter, it’s protected to say merchants misplaced a whole bunch of 1000’s of that day.

The query, nonetheless, is — Who is responsible for the losses if merchants didn’t set their stop-loss orders? Is it the buying and selling platform’s fault for not having the ability to keep constant operations? Whatever the case could also be margin merchants can ‘lose their shirt’ if they aren’t cautious with one of these buying and selling methodology.

What do you consider cryptocurrency margin buying and selling? Do you margin commerce on exchanges? Let us know your ideas within the comments below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.