The chairman of the U.S. Commodity Futures Trading Commission (CFTC) has defined why bitcoin futures have been accredited within the U.S. but bitcoin ETFs haven’t. He also shared his ideas on the way forward for cryptocurrencies and the way they will doubtlessly clear up currency-related issues in as a lot as two-thirds of the world’s international locations.

Bitcoin Futures vs Bitcoin ETFs

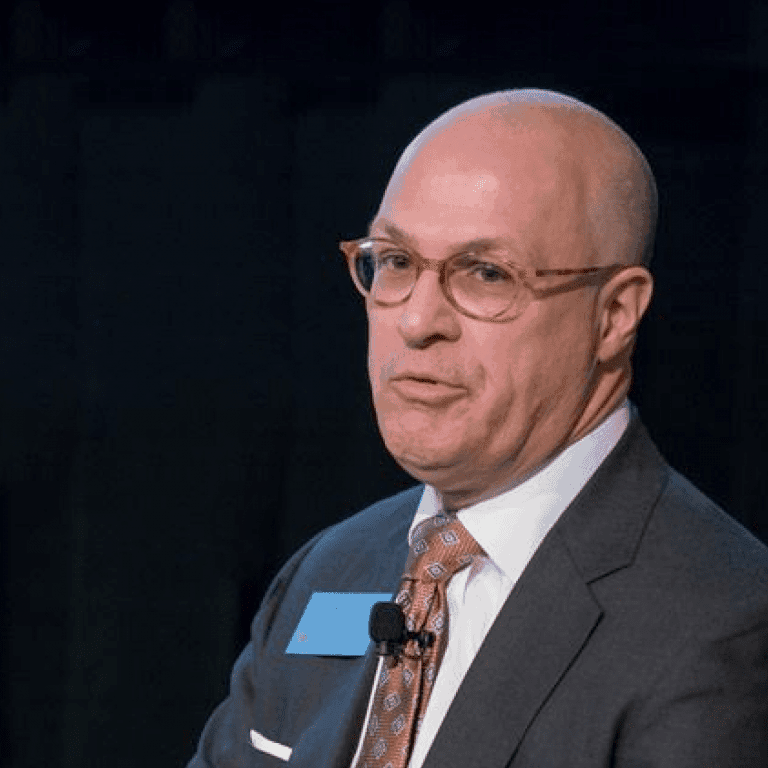

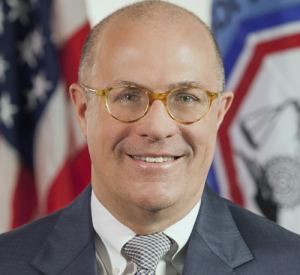

CFTC Chair Chris Giancarlo mentioned on Monday why there are bitcoin futures buying and selling on regulated exchanges within the U.S. but not bitcoin exchange-traded funds (ETFs). While bitcoin is a commodity, bitcoin ETFs are securities below the jurisdiction of the U.S. Securities and Exchange Commission (SEC). In an interview with CNBC, Giancarlo defined the disparity.

“We are old agencies, our statutes are written in the 1930s,” he started, including that the 2 businesses are attempting to work with statutes that had been written when there have been no improvements that exist right this moment. He then elaborated:

More broadly, the SEC, their oversight is over capital formation markets with a giant retail focus. Ours, on the CFTC, our focus is on danger switch markets and we’re at all times targeted on derivatives and loads of that’s institutional buying and selling. So we’re targeted on institutional investments, they’re targeted on retail.

He additional identified that the CFTC and the SEC have “different orientations, different histories, so we do come at these things from different perspectives.”

CFTC’s Regulatory Focus

Sharing the regulatory focus of his company, Giancarlo detailed, “We are very targeted on the fraud and manipulation features of cryptocurrency markets proper now.”

Sharing the regulatory focus of his company, Giancarlo detailed, “We are very targeted on the fraud and manipulation features of cryptocurrency markets proper now.”

He then referred to the latest landmark ruling involving My Big Coin. “Last week, we just won a big victory in the federal court in Boston, certifying our authority to prosecute fraud and manipulation in the crypto space,” he described, including that “We have been very active at it.”

Noting that his company is balancing between regulation and improvements, the chairman claimed:

It’s the United States that’s gone ahead with the very first bitcoin derivatives, with bitcoin futures buying and selling on the CME and also bitcoin choices and bitcoin clearing – we’re forward of the world in that. There is not any query that the United States is main in a lot of areas.

However, he also emphasised that there are different areas of innovation which he believes the US ought to “take slightly bit extra of a considerate and clever strategy [to], simply because the US Congress did 20 years in the past within the early days of the web.”

CFTC Chair Believes Crypto Is Here to Stay

In response to a query about the place he sees the way forward for cryptocurrencies two years from now, the chairman replied:

I personally assume that cryptocurrencies are right here to remain.

While acknowledging that “there is a future for them [cryptocurrencies],” he clarified, “I’m undecided they may ever come to rival the greenback or different laborious currencies but there’s a complete part of the world that actually is hungry for practical currencies that they will’t discover of their native currencies.”

While acknowledging that “there is a future for them [cryptocurrencies],” he clarified, “I’m undecided they may ever come to rival the greenback or different laborious currencies but there’s a complete part of the world that actually is hungry for practical currencies that they will’t discover of their native currencies.”

For the time horizon of about ten years, Giancarlo famous that “there are 140 countries in the world, every one of them has a currency. Probably two-thirds of them are not worth the polymer of the paper they are written on. Those parts of the world rely on hard currencies. Bitcoin may solve some of the problems, whether it’s bitcoin or another cryptocurrency.”

What do you consider Giancarlo’s remarks on crypto and his explanations? Let us know within the comments part below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.