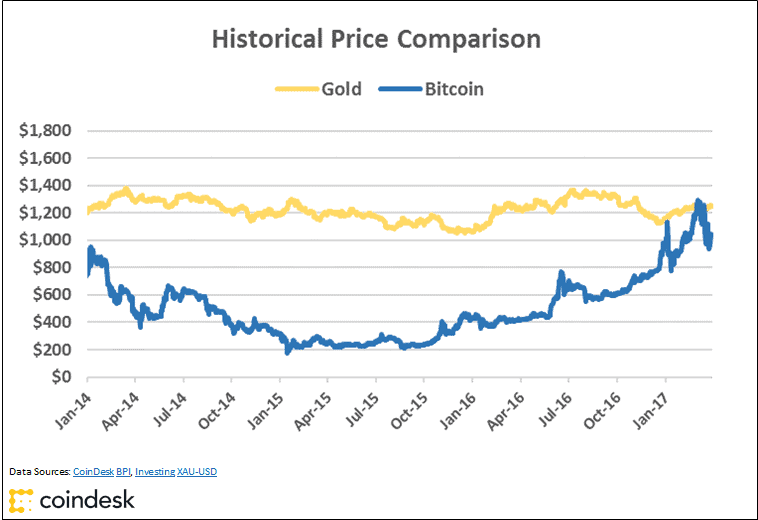

Bitcoin turned heads this month when its worth exceeded the worth of gold, however simply weeks later, the digital asset has fallen off the tempo.

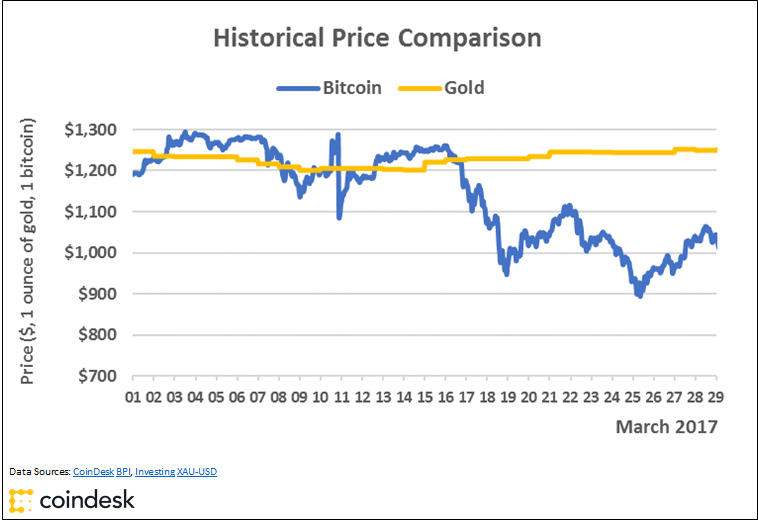

The digital currency surpassed the per-spot ounce worth of gold on 2nd March, when it traded for $1,238 and gold was listed at $1,237 on the XAU/USD spot trade charge offered by Bloomberg Markets.

The occasion marked the second time in historical past bitcoin was price greater than gold. This time spherical, bitcoin was buying and selling excessive amid optimism that the SEC might quickly approve a bitcoin ETF for retail traders.

Still, bitcoin did not take pleasure in this superior place for lengthy. According to the CoinDesk Bitcoin Price Index (BPI), costs have fallen sharply because the eventual rejection – a pattern that continued amid uncertainty about the way forward for its technical roadmap.

Days of glory

Overall, bitcoin’s worth managed to commerce increased than gold till seventh March, when costs fell beneath $1,200, BPI figures present. Gold costs, compared, closed at $1,215.86, in accordance to Bloomberg knowledge.

Bitcoin as soon as once more surpassed gold on 10th March, the day of the SEC choice, when its worth surged to an all-time excessive of greater than $1,300.

However, as the SEC rejected the proposed fund, bitcoin costs plunged, nearing $1,000. As a outcome, bitcoin as soon as once more traded south of gold, which closed the day at $1,204.64.

Bitcoin once more popped up to surpass the valuable metallic on 12th and 16th March. The digital currency did not keep north of gold for lengthy, and it fell beneath its valuable metallic counterpart in a while 16th March.

Watch this area

With the costs diverging, it could be that this ends the newest try for the digital currency to stay up to its often-used descriptor, ‘digital gold‘.

In reality, although, bitcoin and gold have incessantly proven little relationship by way of their worth actions.

While the 2 belongings have incessantly displayed a robust worth correlation throughout occasions of financial disaster, this relationship has typically deteriorated as soon as financial circumstances calmed down. (A previous evaluation of gold and bitcoin costs carried out by ARK Invest’s Chris Burniske failed to reveal a robust relationship between bitcoin and gold.)

Still, right now there are a number of retail merchandise that traders can use to commerce gold. Bitcoin, however, lacks such securities.

As a outcome, the bitcoin-gold worth relationship might change fairly a bit going ahead – and stays one to watch.

Gold bars picture through Shutterstock

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.