The below is an excerpt from a current edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be amongst the very first to get these insights and other on-chain bitcoin market analysis directly to your inbox, subscribe now.

Last week, I put the enormous purchasing pressure concerning bitcoin in context, however there is another — possibly the biggest — source of possible demand going into the scene.

We currently understand the Bitcoin ETFs, MicroStrategy releasing more shares to purchase more bitcoin, Tether’s consistent purchasing, and the halving will all be significant sources of demand this cycle. For example, in the very first 2 weeks of trading alone, the “newborn 9” collected 125,000 BTC. That has, up until now, been balanced out by GBTC outflows, however it is not likely that all GBTC holders are captive sellers who will go out as soon as possible. This outflow needs to begin to subside in the coming weeks.

A rather unforeseen advancement is emerging in China of all locations. Readers of my material here and on bitcoinandmarkets.com won’t be complete strangers to what’s occurring in China over the previous number of years. They are experiencing the end-of-an-economic-model shift. The China we have actually grown to understand was developed on financial obligation, producing items for over-indebted foreign clients. They are greatly based on globalization and an extremely flexible financial environment. That period is concerning an end, and the crash of the Chinese realty market, and now their stock exchange, show up indications of completion of that paradigm.

On January 24, China Asset Management Company (China AMC), a massive fund supervisor and ETF service provider in China, stopped trading on their Nasdaq 100 and S&P 500 ETFs to stop the flood of cash out of other funds and into these US-connected funds. On Tuesday, other US-connected ETFs on Chinese markets opened limitation up, and had a 21% premium over NAV. The flight to security is also impacting Chinese-based Japanese ETFs. Tuesday saw the China AMC’s Nomura Nikkei 225 ETF increase over 6% to a 22% premium.

Chinese financiers remain in full-on panic mode, and the authorities are disallowing the door. It is just a matter of time till more Chinese financiers begin tapping bitcoin for its store-of-value and mobility. Many Chinese are currently acquainted with bitcoin. China utilized to be a dominant source of demand for bitcoin till the CCP prohibited it in 2021.

While bitcoin is still formally prohibited in Mainland China, financiers can still utilize exchanges like Binance and OKX. They can also purchase OTC, person-to-person, or by means of off-shore checking account. Last year, Hong Kong really openly opened back up to bitcoin. They have actually been following in lockstep behind United States regulators offering Bitcoin the main true blessing in Hong Kong. It is not likely that Hong Kong authorities would make such a public push for legislating bitcoin just to reverse the next year to prohibit it.

This early morning, a piece from Reuters prices quote a senior executive of a Hong Kong-based bitcoin exchange, who validates this capital flight story. “Investment on the mainland [is] risky, uncertain and disappointing, so people are looking to allocate assets offshore. […] Almost everyday, we see mainland investors coming into this market.”

The source included, “If you are a Chinese brokerage, facing a sluggish stock market, weak demand for IPOs, and shrinkage in other businesses, you need a growth story to tell your shareholders and the board.”

We have actually been speaking about Bitcoin supplying a parallel world of green shoots, and now it is being acknowledged all over.

The streams from China will be a huge source of demand in this cycle, and the approval of bitcoin area ETFs in the United States will produce an ideal synergy by means of permitting advanced foreign financiers to purchase bitcoin and US-based properties at the very same time.

We cannot ignore the failing European markets either. Europe is most likely currently in economic crisis. By December, EU factory activity had actually contracted for 18 straight months. Germany hardly prevented a technical economic crisis regardless of 2023 GDP being unfavorable at -0.2%. The relative beauty of bitcoin is really high in a world of capital flight and unfavorable development. Many bitcoiners are stressed over an economic downturn bringing a stock exchange crash, which would require selling of bitcoin like it performed in March 2020, however it may be the opposite this time around. As financiers understand that the old system is stagnant and rotting, Bitcoin’s distinct merging of homes as advanced tech, a repaired supply property, and financial development capacity will be where capital runs away into.

Bitcoin Price Update

Bitcoin’s rate efficiency has actually been frustrating because the ETF launch. However, in the context of FTX receivership offering $1 billion worth of GBTC and other big entities offering GBTC to turn into lower capital charges of the brand-new ETFs, rate has actually held up very well.

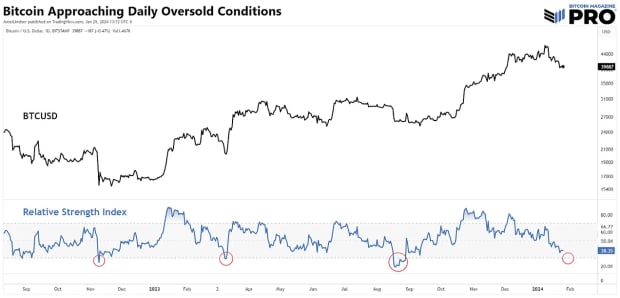

RSI is among the most utilized indications and, as such, has a Schelling point impact. People and bots are expecting the day-to-day RSI to strike oversold. Therefore, it is most likely we won’t see any considerable advantage in rate till 30 on the RSI is broken. That can be attained by another sell-off into assistance, because we are so near to 30 currently. A more not likely possibility is we might form a covert bullish divergence, where the rate makes somewhat greater lows, however the RSI makes lower lows. I do not anticipate any considerable disadvantage either with the confluence of demand explained above:we are at a momentary stalemate.

Staying on the day-to-day chart below however focusing, we see the 100 DMA is supplying assistance presently. I also am seeing the $37,877 level; an essential rate from back in November. Any dip that presses RSI to oversold may not close below that.

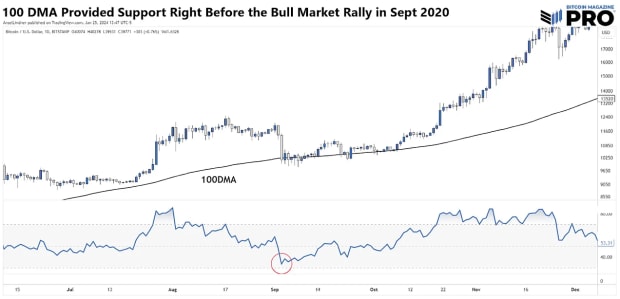

The 100-day generally does not supply much assistance in bitcoin, with the 50- and 200-day moving averages being the most prominent. However, below I reveal September 2020, right before the beast bull rally to end that year. The 100-day was the star at that time. It is possible to hold along the 100-day and after that rally with a time out in GBTC selling. Another fascinating note from that duration in 2020: the RSI stopped shy of oversold, capturing numerous off guard as it shot to the moon. That is not my base case, however it does have precedence.

Bottom line, we are seeing enormous and brand-new sources of demand for bitcoin from the ETFs and now China capital flight. The ETF launch characteristics have actually been made complex however rate has actually been reasonably stable all things thought about. It is just a matter of time till demand emerges in rate.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.