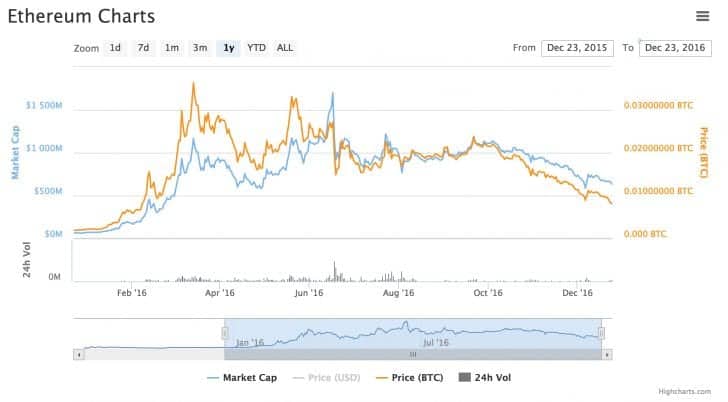

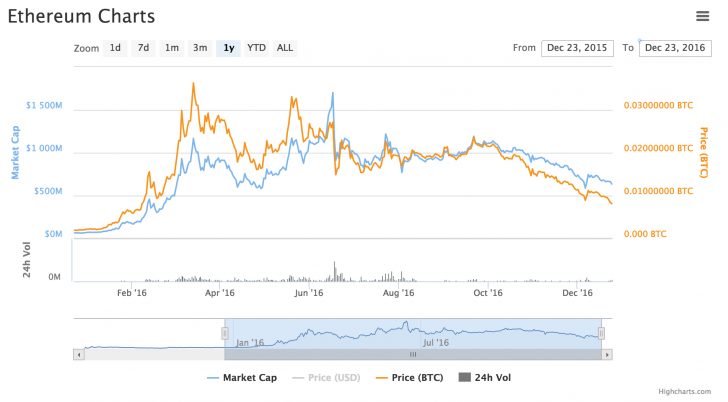

The previous 12 months marked a dynamic interval for the worth of ether (ETH), the cryptocurrency of the ethereum community.

Ether markets skilled sharp worth fluctuations over the course of 2016. The digital currency surged greater than 2,000% inside the first six months, rising from a gap worth of $zero.93 to roughly $21.50 by mid-June earlier than shedding a lot of those features throughout the latter a part of the 12 months.

At press time, ETH was buying and selling at $7.27, a determine which itself represents a greater than 700% year-to-date (YTD) enhance from January.

The digital currency skilled these notable features and losses as ethereum – a blockchain-based platform for the growth of decentralized purposes and good contracts – encountered quite a few twists and activates the growth entrance. Major moments included the launch of ethereum’s “Homestead” shopper, the collapse of the The DAO and the beginning of ethereum traditional.

The largest worth fluctuations occurred surrounding the rise and fall of The DAO, as ETH rose to an all-time excessive in mid-June and then proceeded to tank, falling greater than 50% inside 48 hours.

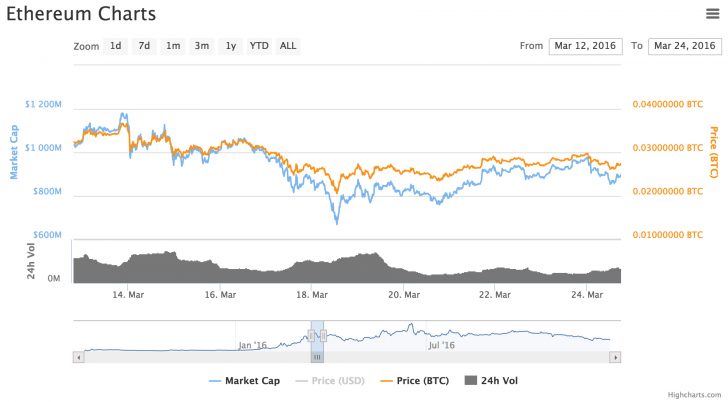

Homestead

Ethereum released Homestead, the first manufacturing model of its software program, on 14th March. This model adopted Frontier, which, as its title plies, was extra of a beta program that the builders used to discover the limits of the then-nascent community and uncover bugs.

While this replace helped drive growth progress, Homestead’s launch didn’t have a constructive affect on worth. ETH rose to as a lot as $15.22 on 13th March, however had declined to as little as $eight.52 on 18th March, CoinMarketCap figures reveal.

Homestead constituted a serious launch in the eyes of the market, in accordance to Petar Zivkovski, COO for leveraged bitcoin buying and selling platform Whaleclub.

“Homestead was probably the most anticipated update for ethereum as it provided both stability and legitimacy to the project,” he told CoinDesk. “It opened the doors to more mainstream developers making it easy for them to develop decentralized ‘unstoppable’ applications on the ETH blockchain.”

The DAO assault

For 2016 at the very least, nothing drew consideration to ethereum greater than the assault on The DAO.

The DAO, which is brief for “Distributed Autonomous Organization”, aimed to develop an ethereum-based car by means of which different tasks in the ecosystem may very well be funded by group consensus. The thought was that contributors may buy tokens and use them to vote for the tasks they needed to fund the most.

While this mission generated vital visibility and collected greater than $150m in ether, the state of affairs deteriorated considerably when The DAO was attacked on 17th June. The incident resulted in three.6m ethers (roughly $60m at then-current costs) being siphoned right into a “child DAO” resulting from an unexpected exploit in the good contract underlying the mission.

ETH costs reacted violently, falling from an all-time excessive of $21.52 on 17th June to $9.96 the following day, CoinMarketCap figures reveal.

The ethereum group shortly started debating whether or not to implement a tough fork, and some members took a extra proactive method by leveraging a white hat attack to take away a few of the remaining funds from The DAO and shield them from the continued motion of hackers.

Unfortunately, this method proved inadequate, and the ethereum group applied a tough fork on July 20th, returning the stolen ether from an account owned by an unknown attacker to a brand new tackle by primarily rolling again the community’s transaction historical past.

ETH costs, on the different hand, did not appear to undergo any headwinds due to this occasion, rising roughly 2% from $12.21 at roughly 14:30 UTC on 20th July (the time the laborious fork occurred) to $12.45 at 23:59 UTC, CoinMarketCap figures reveal. Transaction exercise additionally rose between these two occasions, with 24-hour buying and selling quantity rising from roughly $51.5m to $60.2m.

The digital currency’s worth pushed larger over the subsequent few days, rising to as a lot as $14.89 on 23rd July. At that time, 24-hour buying and selling quantity surpassed $78m.

Ethereum Classic

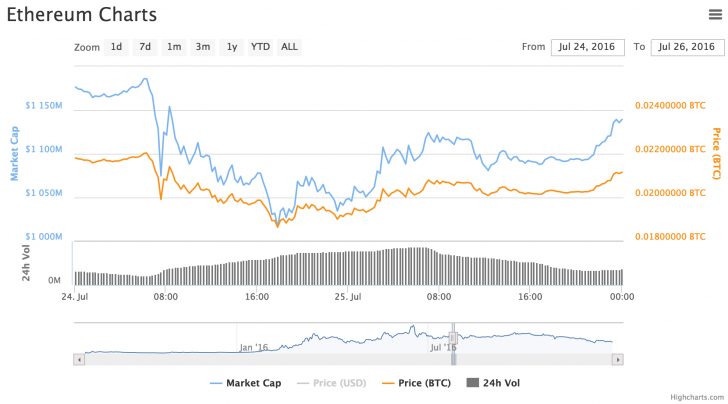

Perhaps simply as unpredictable was the emergence of one other ethereum.

While the laborious fork averted the dilemma of traders shedding thousands and thousands because of taking an opportunity on The DAO, the transfer got here with some unintended penalties. Some who opposed the transfer continued utilizing the pre-hard fork community, below the moniker of “ethereum classic“.

This separate blockchain, with its corresponding cryptocurrency ether traditional (ETC), shortly drew vital consideration. Its tokens began buying and selling at roughly 13:44 UTC for a worth of $zero.75 on 24th July, and in the end surged near 300% inside the first 72 hours, reaching $2.85 on 26th July.

ETH skilled modest volatility throughout ETC’s early buying and selling days, falling from $13.19 at 13:44 UTC on 24th July (when ETC started buying and selling) to $12.32 at 17:44 UTC. The digital currency shortly recovered to $13.10 by 20:14 that day, and rose to as a lot as $13.68 at 07:09 UTC on 25th July.

Supporters of the effort say it enshrines the authentic beliefs of the ethereum mission previous to the efforts to wind again the DAO collapse, whereas critics have mentioned the community serves as little greater than a car for hypothesis. Cryptocurrency fund dealer Jacob Eliosoff argued that ETC is susceptible to changing into a historic curiosity in the absence of deeper growth.

Eliosoff went on to acknowledge that “the DAO hack and the ensuing ETH/ETC schism undoubtedly damaged both the project and the price,” however emphasised that he sees a transparent path ahead for ethereum.

Hard forks

It was a 12 months of laborious forks for ethereum.

The community underwent a number of main modifications that required customers to improve their software program this 12 months in an effort to handle repeated assaults. Ethereum additionally skilled a very unintentional fork on Thanksgiving, in which Geth and Parity applied the logic of a tough fork executed November 22 otherwise, producing a consensus error.

This “Thanksgiving fork” was shortly flagged, and the occasion itself seemingly offered little in the means of headwinds for ETH costs, which rose from a gap worth of $9.23 to a day by day excessive of $9.66.

Some observers famous that the variety of laborious forks that ethereum has undergone over the final 12 months may be interpreted in multiple means. For instance, the easy proven fact that the community enacted all these modifications may be interpreted as a sign of its capability to maneuver and subsequently produce particular outcomes.

“ETH underwent several hard forks [in 2016]. While this does show flexibility, it also shows a certain lack of stability since a hard fork is essentially an entirely separate system in itself that has to be deployed and updated across all network nodes,” Zivkovkski argued. “It’ll have trouble establishing itself as a long-term currency and autonomous application blockchain if a hard fork is going to come into effect every few months.”

Images by way of CoinMarketCap, Shutterstock

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.