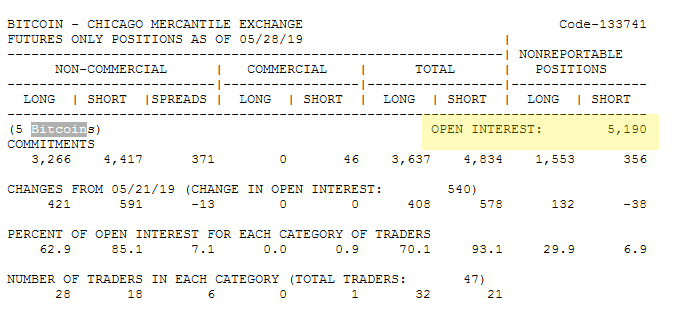

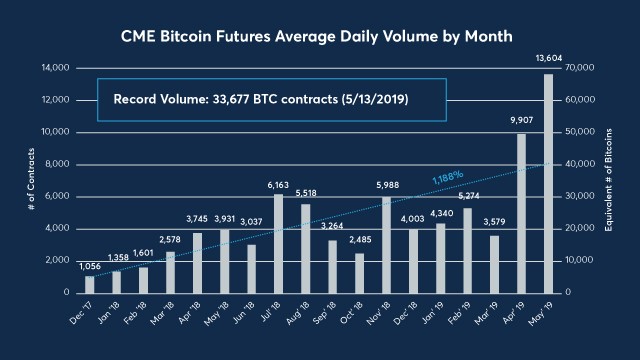

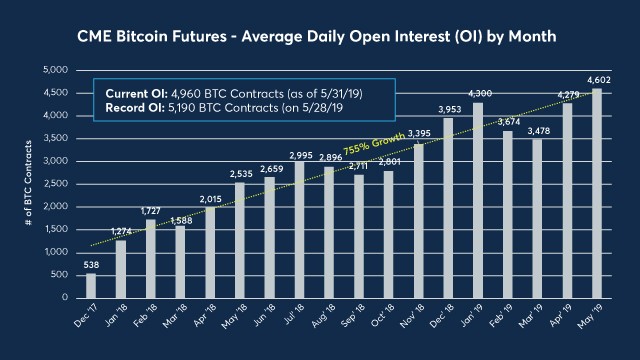

Ever because the Chicago Board Options Exchange (Cboe) revealed it was ending its bitcoin futures items back in March, the Chicago Mercantile Exchange (CME Group) has actually seen a substantial increase of bitcoin derivatives volumes. During the 2nd week of May, CME’s bitcoin futures touched a turning point when it exceeded 33,000 agreements ($1.3 billion notional worth) in one day. In another circumstances, CME’s open interest for its bitcoin derivatives positions smashed an all-time record high of 5,190 agreements on May 28.

Also Read: Our Value of Money Is Subjective But That Doesn’t Make It Meaningless

CME Group’s Bitcoin Futures Markets Break Records Throughout April and May

There’s been a great deal of action occurring with bitcoin futures items particularly coming from CME Group. Last March, Cboe chose to reveal completion of its bitcoin futures markets, specifying that the item saw low trade volumes. Although Cboe stated at the time that it would consider offering cryptocurrency derivatives items in the future. The last agreement for bitcoin futures on the CBOE exchange will be picked June 19th and according to an e-mail reaction from Cboe’s Suzanne Cosgrove, the exchange is still evaluating the scenario. “Cboe is evaluating its technique with regard to how it prepares to continue to provide digital property derivatives for trading,” Cosgrove mentioned on June 11. Cboe’s choice to end its bitcoin futures appears to have actually triggered much more need for CME Group’s crypto derivatives providing.

Last May ended up being a record month for CME Group’s bitcoin futures with near to 300,000 agreements settled. Moreover, June volumes are presently beginning to get therefore are agreements in July. News.Bitscoins.web reported on how CME Group’s bitcoin derivatives saw $1.3 billion notional worth (168K BTC) when 33,677 agreements were switched on May 13. The record day was up almost 50% from the last accomplishment of 22.5K agreements decided on April 4. When it pertains to open interest month to month, the typical day-to-day open interest by month increased 755%. Moreover, on May 28, CME information reveals that open interest leapt to 5,190 agreements. Throughout the months of April and May, bitcoin notional trading volume at CME Group exceeded the previous 6 months’ volume integrated.

In addition to the record numbers, CME Group released a new report on June 5 studying of the CME CF Bitcoin Reference Rate (BRR). The report describes how the BRR system works and how the bitcoin-based index prevents manipulative practices and offers a precise representation of cost. The paper addresses a number of points in order to develop how BRR is a “dependable reputable source for the cost of bitcoin and planned to help with the production of monetary items based upon bitcoin.” This consists of 8 unique tests of: Relevance, Manipulation resistance, Verifiability, Replicability, Timeliness, Stability, and Parsimony. “It is possible to conclude that the BRR is agent of the underlying bitcoin area market that it tracks, as by meaning it represents the real trades that have actually taken place within that market — By catching the notional worth of deals, the BRR offers a precise recommendation to the typical area cost over the duration,” CME Group’s most current bitcoin futures report notes. CME’s thorough analysis of BRR continues:

There is liquidity in the BRR, in the 1 year to March 2019, over USD 3 billion worth of bitcoin trades were performed, over 1.8 million trades were consisted of in the BRR based upon an overall of 607,000 bitcoins traded, this reveals trustworthiness in the calculation of the BRR.

Furthermore, the information aggregation web website Tradeblock released a report on June 7 explaining how bitcoin futures markets are collecting steam beside the currently developed area market environment. “CME’s [bitcoin futures] item has actually even started to surround trading volumes at United States available area exchanges — For the month of April, bitcoin futures notional trading volume exceeded the combined volume from the 6 biggest United States available area exchanges,” Tradeblock’s just recently released research study describes.

The Possibility of Institutional Players Hedging Their Bets

There’s also been a couple of visible spaces throughout May and the very first week of June that offer some speculators the impression that institutional traders remain in the video game. Traditionally spaces are filled when markets close at the end of the week and select back up once again on Monday, however there have actually been 4 spaces up until now in the last couple of weeks.

Up previously, there sanctuary’t been any unfilled spaces because CME Group released its bitcoin derivatives item in December 2017. This has actually led individuals to think huge gamers may be hedging their bets with BTC area market positions and benefiting throughout a new open for the following week. This, in turn, might trigger volatility with area market value and there’s been a great deal of turbulent action with BTC markets of late, coincidentally in parallel with growing open interest and volumes occurring on the CME exchange.

Over April and May, #bitcoin notional trading volume at the @CMEGroup was bigger than the volume for the previous 6 months integrated. pic.twitter.com/WHUIqkof0u

— TradeBlock (@TradeBlock) June 6, 2019

Cryptocurrency markets, in basic, have actually seen substantial gains this year as 2019 has actually eliminated a few of the bearishness blues from the year prior. Bitcoin-based futures trading wasn’t really active in 2018, however recently interest in bitcoin derivatives items has actually grown tremendously, specifically after Cboe revealed it was leaving. However, nobody understands how this action will impact BTC rates in the long run with interest in futures items getting considerably and the possibility of huge gamers leaping in between both area and derivatives markets in order to revenue.

What do you consider all the bitcoin futures action taking place on the CME exchange recently after Cboe called it stops? Let us understand what you consider this topic in the comments area below.

Image credits: Shutterstock, CME Group, Trading View, Twitter, and Pixabay.

Enjoy the simplest method to purchase Bitcoin online with us. Download your totally free Bitcoin wallet and head to our Purchase Bitcoin page where you can purchase BCH and BTC firmly.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.