The Chicago Mercantile Exchange (CME) has actually ended up being the second-largest derivatives market for bitcoin futures in regards to open interest. The popular exchange has actually seen an increase of need considering that the current Paypal statement and the Bitmex ordeal also.

- Data reveals that the Bitcoin Mercantile Exchange (Bitmex) open interest for bitcoin futures has actually taken a dive considering that it was charged with unlawfully running in the United States.

- CME Group’s rise in open interest started on Oct. 10, as Skew.com reported that the exchange included “almost 1,500 agreements on the October expiration.”

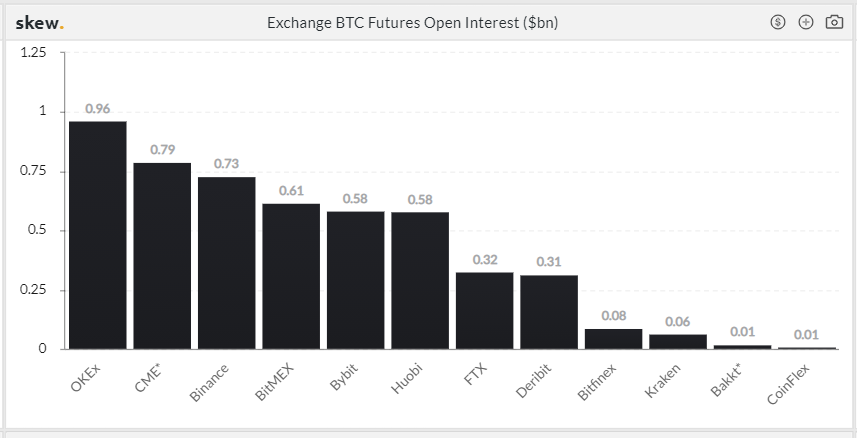

- Since introducing in 2017, it’s taken 3 years for CME Group to overtake the other bitcoin derivatives markets. CME is now the second-largest bitcoin futures market leader behind Okex in regards to open interest.

- Skew.com’s data reveal that CME Group represent close to $800 million worth of bitcoin futures agreements today.

- The near $800 million represents over 15.9% of the aggregate open interest among 12 derivatives exchanges.

- In regards to open interest, exchanges that follow Okex and CME consist of; Binance, Bitmex, Bybit, Huobi, FTX, Deribit, Bitfinex, Kraken, Bakkt, and Coinflex respectively.

- Bitcoin supporters and stars think CME’s open interest comes from banks and organizations starting to assistance cryptocurrencies.

- Chamath Palihapitiya, the CEO of Social Capital said: “After Paypal’s news, every significant bank is having a conference about how to assistance bitcoin. It’s no longer optional.”

- In regards to aggregate bitcoin futures volumes, CME Group is still behind 8 other derivatives exchanges. The leading 3 bitcoin futures trading platforms by volume today consist of Binance, Huobi, and Okex.

- The increased open interest toward CME Group’s bitcoin futures derivatives agreements accompanies bitcoin’s (BTC) 14.21% rate rise throughout the last 7 days.

- On Saturday, Skew.com tweeted about CME’s Commitment of Traders (COT) report. “Latest CME bitcoin futures COT report – leveraged funds net record brief and institutional web record long,” Skew tweeted. “With market rallying, basis trades are significantly appealing for hedge funds, presently yielding 10%+”

What do you consider CME Group’s bitcoin futures open interest outmatching Bitmex today? Let us understand what you believe in the comments area below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.