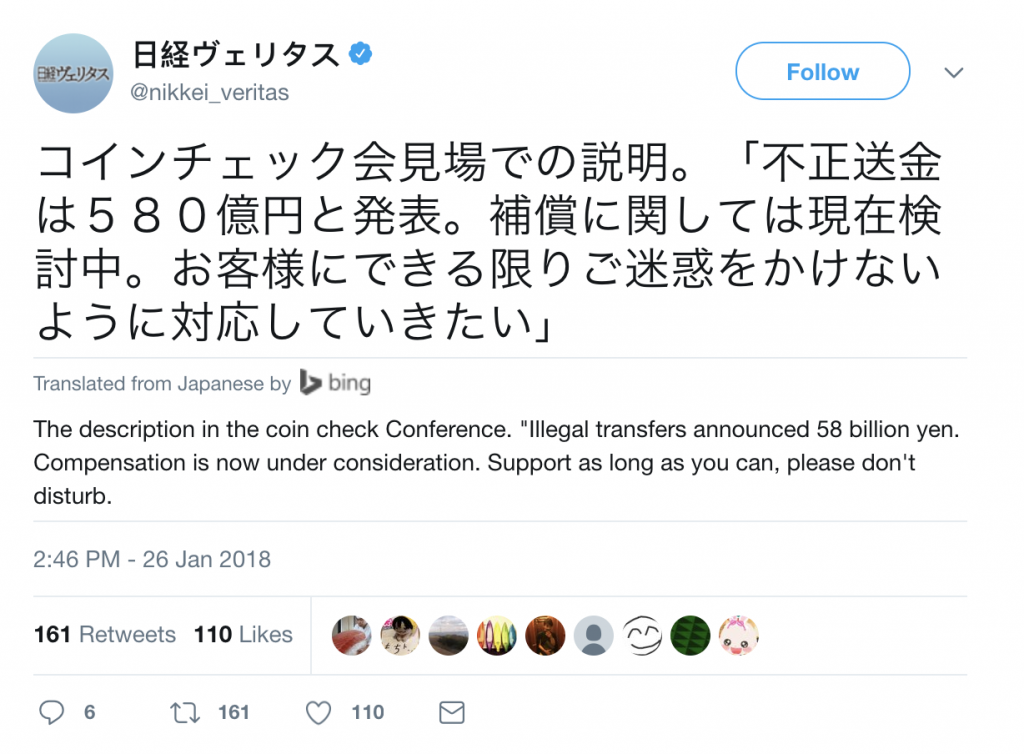

It was, by any reckoning, an enormous haul. Between $400 million and $534 million of NEM stolen, relying on whether or not you go on its worth at the time or as soon as the market had reacted to the information. At a press convention on Friday afternoon, the shocked Coincheck crew painted forlorn figures as they got here to phrases with being on the receiving finish of the best heist of all time. In the inevitable post-mortem, questions have been raised about the safety practices of the Japanese change.

Gox II: Goxxed Harder

Japan thought its days of being the focus for record-breaking cryptocurrency heists had been behind it. Less than 4 years on from the Mt Gox hack, which heralded the finish of Japan’s and the world’s largest change, the nation is again in the highlight. Over the previous few years, Japan has earned reward for its measured method to cryptocurrencies, having inspired their use in a regulated setting. Only this week, the Bank of Japan gave crypto a gentle endorsement. But on Friday January 26, the nation’s 127 million residents awoke to the information that one other seismic cryptocurrency hack had occurred on house soil. At round 3am native time, somebody withdrew all of the NEM held by the change in a single transaction.

Japan thought its days of being the focus for record-breaking cryptocurrency heists had been behind it. Less than 4 years on from the Mt Gox hack, which heralded the finish of Japan’s and the world’s largest change, the nation is again in the highlight. Over the previous few years, Japan has earned reward for its measured method to cryptocurrencies, having inspired their use in a regulated setting. Only this week, the Bank of Japan gave crypto a gentle endorsement. But on Friday January 26, the nation’s 127 million residents awoke to the information that one other seismic cryptocurrency hack had occurred on house soil. At round 3am native time, somebody withdrew all of the NEM held by the change in a single transaction.

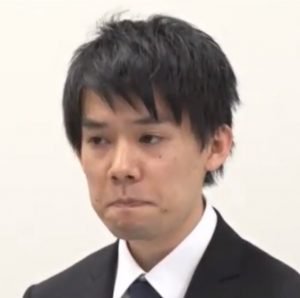

The identification and origin of the hacker is unknown at the moment, however what few particulars have emerged recommend severe flaws in Coincheck’s safety procedures. It seems that the 500 million NEM had been saved in a sizzling pockets with no multi-sig. If so, the change has realized nothing from current historical past, for it was the same setup that resulted in Mt Gox dropping round 850,000 bitcoins in 2014. At a press convention on Friday, when requested about Coincheck’s safety practices, there was an ungainly pause earlier than president Wakata Koichi Yoshihiro batted the query away, electing to concern an apology as an alternative.

The Coincheck Hack by Numbers

The magnitude of the Coincheck hack, a haul which exceeds another, could be seen by evaluating it alongside actual world record-breakers.

Securitas Depot Robbery, $83 million: Disguised in wigs and prosthetics, a gang did over a safety depot in Britain in 2006. They would have made off with extra, solely there was no extra space for money in the lorry. The Securitas theft was price one sixth of the NEM hack.

Knightsbridge Security Deposit Robbery, $97 million: A security depot raid in London in 1987 netted an enormous load of money and jewellery but it surely was nonetheless solely price a fifth of the NEM cryptocurrency hack.

Baghdad Bank Heist, $282 million: Iraq’s Dar Es Salaam financial institution was relieved of a whole bunch of hundreds of thousands of in 2007, with two guards alleged to be the instigators. The bumper theft was price round half the NEM stolen from Coincheck.

Baghdad Bank Heist, $282 million: Iraq’s Dar Es Salaam financial institution was relieved of a whole bunch of hundreds of thousands of in 2007, with two guards alleged to be the instigators. The bumper theft was price round half the NEM stolen from Coincheck.

Mt Gox, $450 million: The tranche of bitcoins stolen from the world’s largest cryptocurrency change in 2014 was price round $80 million lower than the worth of NEM that was taken.

An Irredeemable Fortune

In actuality, the thief could discover themselves struggling to shift their sizzling property. Within hours of the assault occurring, the NEM crew had contacted cryptocurrency exchanges looking for to have the pockets tackle blacklisted. One factor NEM received’t be doing is emulating Ethereum and hard-forking. If the blockchain had been to be rolled again and the stolen cash forked away, it might do Coincheck a favor, however would do little to reveal the immutability of blockchain ledgers.

Japan’s Financial Services Authority has confirmed it’s “looking into the facts” surrounding the matter. Meanwhile, Coincheck has promised that it’s looking for to compensate its prospects who had their NEM stolen. Despite its hefty greenback worth, the NEM hack is unlikely to place a discernible dent in the cryptocurrency markets. It raises severe questions although about Coincheck’s health to function a cryptocurrency change.

The firm had beforehand reported being authorised by the Financial Services Agency, but it surely’s emerged that Coincheck was not registered with the FSA. The solely approach for Coincheck to pay again its prospects could also be for it to be allowed to proceed buying and selling. Whether regulators will enable the beleaguered change to remain in enterprise – and whether or not prospects will belief it once more – is one other matter fully.

Do you suppose Coincheck ought to preserve buying and selling or wind up its operations? Let us know in the comments part below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.